- Education

- About Forex

- What is Forex Trading and How does it Work

Forex Market Definition

It’s easy isn’t it? Forex Market offers traders huge opportunities to benefit from fluctuations in the currency markets. The size of the market is really big, but the way the FX Market functions, unlike other financial markets, is quite simple.

So, what is Forex market? Let’s take a closer look at it.

Foreign Exchange Market

Forex market is the largest market in the world with an average trading value over $5 trillion per day.

Forex beginners are often wondering - Where Forex Market is located? The question is - Forex has no centralized marketplace where transactions are conducted. Forex trading is carried out electronically over-the-counter (OTC), meaning that all trading transactions are performed via computer by traders and other market participants over the world.

With no centralized location of trades, the forex market is open 24 hours a day, five and a half days a week, and currencies are traded worldwide across almost every time zone.

Forex Market is the most liquid market and its high liquidity means that prices can change rapidly in response to news and short-term events, creating multiple trading opportunities.

How to Trade on Forex Market

Now, after answering the question "What is Forex Market?", let's see exactly how Forex Market works.

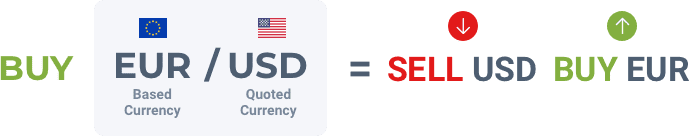

The trade that takes place in Foreign exchange market involves simultaneously the buying of one currency and the selling of another. This is because the value of one currency is relative to the other currency and is determined by their comparison. From a retail trader’s perspective Forex trading is the speculation on the value of one currency relative to another.

Here’s how it goes:

Each currency pair can be thought of a single unit consisting of a “base currency” (the first currency) and a “counter (or quoted) currency” (the second currency) which can be bought or sold. It shows how much of the counter currency is needed to buy one unit of the base currency. So, in the EUR/USD currency pair EUR is the base currency and USD is the counter currency. If you expect the price of Euro to increase against the price of the U.S. dollar you can buy the EUR/USD currency pair. While buying a currency pair (going long) the base currency (EUR) is being bought, whereas the counter currency (USD) is being sold. Thus, you buy the EUR/USD currency pair at a lower price to later sell it at a higher price and as a result make a profit. If you expect the opposite situation, you can sell the currency pair (go short), meaning sell Euro and buy the U.S. dollar.

However, the risk is always there. If you buy Euro against the U.S. dollar, expecting that Euro is going to rise in price, but instead the U.S. dollar strengthens, you will then suffer losses. So, besides the benefit that you can make from forex trading, you should always consider the risk involved in it.

As you could see the foreign exchange market is not so complex to understand and not so dangerous to enter. You can become one of the participants of the market in a few minutes and start earning money more than easily.

What’s stopping you? ... Just give it a go

How to learn Forex trading and specifically how to use the online trading platform are thoroughly presented on our website. You can read our educational materials and trading e-books which will help you understand the essence of Forex trading, discover its benefits, learn how to trade effectively and how to manage your risk.

History of Forex Market

The history of Forex market is marked by two particular events which put a deep stamp on its formation and development. These two historical events are the creation of Gold Standard System and Bretton Woods System.

Gold Standard and Bretton Woods Systems

Gold Standard System was formed in 1875. The main idea behind it was that governments guaranteed that a currency would be backed by gold. All the major economic countries defined an amount of currency to an ounce of gold as the value of their currencies in terms of gold and the ratios for these amounts became the exchange rates for these currencies. This marked the first standardized means of currency exchange in history. However, World War I caused a breakdown of the gold standard system as countries sought to pursue economic policies which would not be constrained by the fixed exchange rate system of the Gold Standard.

In July 1944 more than 700 representatives from the Allied nations brought forward the importance of a monetary system which would fill the gap left behind the gold standard. They arranged a meeting at Bretton Woods, New Hampshire, to set up a system that would be called the Bretton Woods system of international monetary management. The creation of Bretton Woods System led to the formation of fixed exchange rates as the United States defined the value of US dollar in terms of gold equal to $ 35 for one ounce and other countries pegged their currencies to the dollar. The US dollar became the main reserve currency and the only currency that was backed by gold. However, in 1970 the U.S. gold reserves were so depleted that it was impossible for the U.S. treasury to cover all the reserves held by foreign central banks.

In August 1971 the U.S. announced it would no longer exchange gold for the U.S. dollars that foreign central banks had in reserve .This was the end of Bretton Woods System and the beginning of Forex Trading System.

Forex Market Hours

The currency exchange market never sleeps, and the quotes constantly change. This is the only market open around the clock five days a week. Large volumes of currencies are traded on the international interbank market in Zurich, Hong Kong, New York, Tokyo, Frankfurt, London, Sydney, Paris and other global financial centers. This means that the interbank market is always open - when the working day ends in one part of the world, banks in the other hemisphere have already opened their doors and the trade goes on.

No time frames - a very important condition for traders with a busy working schedule. They do not need to worry about opening and closing hours of trading sessions on the interbank market and are free to arrange their trade anytime they want, since it

does not matter for Forex traders which bank provides liquidity for their transactions.

But the Forex market liquidity can change during the day, depending on which time zone banks are operating at the moment (when liquidity falls,

spreads grow and the speed of price changes slows down). For example, the pairs with the Japanese yen will be the most liquid during the working time of Japanese banks.

Below you can find the opening and closing hours of trading sessions on the interbank market (i.e. periods of high liquidity), determined by the opening hours of the largest banks in each time zone.

Sydney

Tokyo

London

New York

- Sydney 7:00 PM - 4:00 PM (CET)

- Tokyo 7:00 PM - 4:00 PM (CET)

- London 3:00 AM - 12:00 PM (CET)

- New York 8:00 AM - 5:00 PM (CET)

Participants of Foreign Exchange Market

Foreign exchange market is composed of different participants, also called Forex market players, who trade on the market for quite various reasons. This means that participating in Forex market transactions does not take place simply for speculative purpose. Each of the participants plays its own role in the market providing the latter’s wholeness and stability.

The main players of the market are

- Governments and Central Banks

- Commercial banks and companies

- Hedge funds

- Brokerage companies

- Investors

- Retail Forex traders

- Speculators

Was this article helpful?

You can study CFD trading more thoroughly and see CFD trading examples in the section How To Trade CFDs Visit Educational Center

You can study CFD trading more thoroughly and see CFD trading examples in the section How To Trade CFDs Visit Educational Center