- Education

- Introduction to Trading

- The Importance of Trading Psychology

The Importance of Trading Psychology

Trading psychology is important because emotions such as fear and greed can greatly affect the decision-making process, leading to impulsive and irrational decisions.

One of the most common emotional states that traders experience is fear. Fear can cause traders to panic and make decisions that are not based on facts or market analysis. It can also cause traders to hold on to losing positions for too long, hoping that the market will turn in their favor, resulting in significant losses.

On the other hand, greed can also be a major issue for traders. It can cause traders to take on too much risk or ignore warning signs, leading to poor decision-making and ultimately losses.

KEY TAKEAWAYS

- Although trading involves numerical analysis, graphs, and other mathematical considerations, it is fundamentally an emotional pursuit.

- Trading psychology is important because emotions such as fear and greed can greatly affect the decision-making process, leading to impulsive and irrational decisions.

- Novice traders mistakenly consider skills in fundamental and technical analysis as the most important element in trading.

- Psychology is considered the most important element, followed by money management and then strategy

What is Trading Psychology

Although trading involves numerical analysis, graphs, and other mathematical considerations, it is fundamentally an emotional pursuit. Traders seek to increase their profits by making decisions based on their assessment of the market's performance and potential.

However, making these decisions is not always straightforward.

To make sound trading decisions, traders must first master their trading psychology. Trading psychology encompasses various aspects of an individual's character and behavior that affect their trading decisions.

Trading psychology is a critical aspect of becoming a successful trader, as it is equally important as having market knowledge and experience. Possessing trading skills and knowledge alone is not enough, as uncontrolled emotions can result in misusing these attributes.

The key components of trading psychology are discipline and risk-taking, which are crucial for successful trading. A trader with a strong trading psychology can exercise the required discipline when necessary and take calculated risks when opportunities arise.

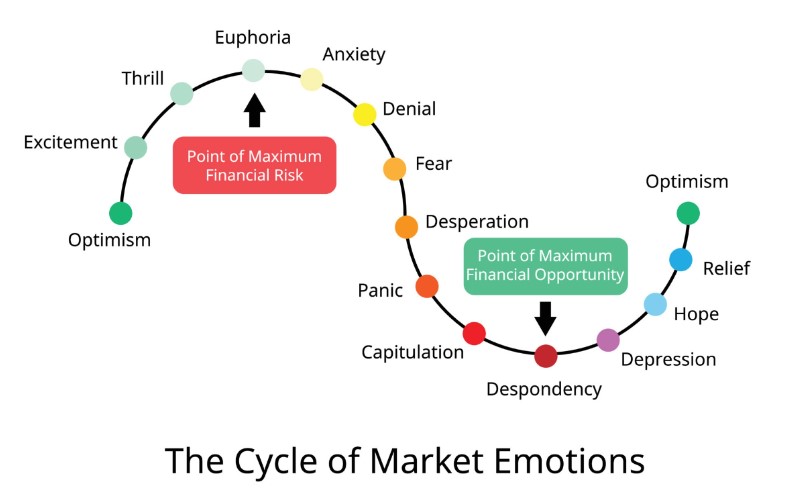

The moods and emotional state of a trader significantly impact their trading decisions. Emotions cause chemical changes in the brain and nervous system, leading to different moods. Fear, greed, hope, frustration, and boredom are some of the emotions that can influence a trader's decisions.

Fear and greed are two significant emotions that traders must control. While fear is essential to curb reckless trading, it is also crucial to be greedy when others are fearful, as stated by Warren Buffet. This rule is counterintuitive and challenging to master.

Buffet suggests that during significant market losses, most people become fearful and exit the market, but this presents an opportunity to be greedy and take risks. On the other hand, during market greed, it is prudent to be risk-averse and fearful.

Other emotions, such as hope, frustration, and boredom, also impact trading decisions. Being hopeful can lead to holding onto bad trades for longer than necessary, while boredom and frustration can prompt traders to make hasty decisions.

Emotional trading is a formidable challenge for traders as it involves making decisions based on feelings rather than logic. Despite having a well-defined trading plan, emotions such as fear and greed can cloud a trader's judgment and lead to impulsive actions.

A key element of successful trading is the development of a trading plan that outlines a clear course of action in different market conditions. This plan serves as a guide that helps a trader stay focused on their goals and objectives, rather than getting swayed by market sentiment or emotions.

For example, a trader may have a plan that recommends selling a particular asset because the market is likely to decline. However, if they succumb to emotions like greed or fear, they may hesitate to execute the trade, even as the asset's price continues to rise. This can result in greater losses when the market eventually turns against them.

The struggle between emotions and rational thinking can be a significant obstacle for even the most experienced and skilled traders. It requires a deep understanding of how emotions affect trading psychology and constant self-awareness to overcome them.

Understanding emotions like regret and fear of missing out is crucial in the psychology of trading. These emotions often arise after emotional trading and can affect a trader's mental state, leading to poor decisions in future trades. Regret can occur when a trader feels guilty for being too greedy, while fear of missing out arises from potential profits by not taking enough risks during times of greed.

Experiencing these emotions can influence a trader's behavior in subsequent trades. For instance, if a trader regrets trading recklessly, they may become overly cautious when faced with similar opportunities to be greedy. On the other hand, if a trader experiences fear of missing out, they may become too greedy in future trades.

How to Control Emotions in Trading

To avoid the influence of emotions in trading, you need to develop discipline that allows you to evaluate what is happening as objectively as possible. Here are some ways to achieve this:

1. Trade with a tried and tested strategy

You are much more likely to remain calm under pressure if you are confident in your trading strategy. If the strategy has not been tested well enough, it can lead to doubts, which can allow fear to take hold.

2. Trade on a demo account

Testing and further development of the strategy should be done on a demo account before moving on to trading with real money. Using real money creates additional pressure, which can amplify the negative emotions experienced during trading and lead to further losses.

3. Accepting risk

There is no strategy in which you win 100% of trades. You must be prepared for losses. It is perfectly normal to hope that every trade will be profitable, but inexperienced traders often experience stronger emotions when they suffer losses. On the other hand, a profitable trader can accept losses as part of the trading strategy and move on to the next trade, not allowing greed or fear to influence further decisions.

Bottom Line on The Importance of Trading Psychology

These are a few important points, especially beginner traders, should take away with them from this article.

- Novice traders mistakenly consider skills in technical and fundamental analysis as the most important element in trading;

- Emotional control is actually the most important skill that a trader should focus on;

- The trading process into three categories that affect traders: strategy, money management, and psychology;

- Psychology is considered the most important element, followed by money management and then strategy. This emphasizes that regardless of the profitability of the strategy, psychology can prevent a trader from making money;

- Fear of loss can lead a trader to close trades earlier than necessary, which can result in further losses;

- Greed can cause a trader to allow a trade to continue and not close it at the profit level dictated by their strategy, resulting in less profit if the market turns against them;

- Ego is the inability to acknowledge mistakes and can cause a trader to either not close trades when their strategy requires it or continue trading in the same direction after a trade has been closed;

- Trading as revenge occurs when a trader tries to pursue money lost on trades completely detached from their strategy.

- Confidence in your trading strategy and trading on a demo account ultimately help you learn to control your emotions;

- A strategy with 100% winning trades is impossible, and you need to learn to take risks with each trade.