- Analytics

- Market Overview

World stock indices fall on Friday - 28.7.2014

World stock indices showed a downward correction on Friday. Macroeconomic data was positive on Friday, but market participants did not pay any attention to this fact, focusing on the earnings reports. Trade turnover on the U.S. exchanges was 11% lower than the monthly average and amounted to 4.95 billion stocks.

Apart from the weak quarterly report of the American company Amazon.com, there was a negative report of Visa. Their stocks dropped 9.6% and 3.6%, respectively. Moreover, the trade turnover of Amazon.com was five times more than the two-month average. Let us remind you about the earlier published weak reports of two significant industrial companies Boeing and Caterpillar. As a result, the Dow Jones industrial average (Dow) slipped 0.8% last week. S&P 500 has hardly changed. NASDAQ added 0.4%. Let us note the continued strengthening of the dollar against the euro and other currencies for the second week in a row. This happened due to the good economic data on inflation and the labor market, increasing the possibility of the Fed rate hike. According to the quarterly investment research of the investment bank Goldman Sachs, the recommendation on global market stocks is lowered to "neutral"; mentioning that the MSCI All-World Index has already rose 5% since the beginning of the year, and hit its historical high in early July. According to the bank data, on the regional level, the stock markets of Europe and Japan are overrated, and the American one is underestimated. Today the American business activity indices prepared by Markit, such as PMI composite and Service PMI for June will be released at 13-45 CET, and Pending Home Sales for July at 14-00 CET. We assume that the forecasts are moderately positive.

European stocks fell last Friday, due to reduced German business confidence index Ifo in July, that fell to the lowest point in the last nine months, weak reporting of the luxury goods manufacturer Moet Hennessy Louis Vuitton (LVMH) and negative earnings reporting from the United States. Today, the European indices are rising due to the good financial performance of the airline Ryanair for the current year. Futures on American stock indices are also “in the black”. Important supplementary positive data for the markets was the income increase of industrial enterprises in China in June that amounted to 17.9% YoY, while the forecast was +8.9%. This has been the largest increase since September. The information related to this fact came out yesterday. No significant economic data is expected today in the European Union.

Nikkei rose along with the European markets today, also due to the positive macroeconomic data in neighboring China. Note that unlike the U.S. indices it is still 4.7% below the level of this year beginning. While its ratio of "total capitalization/total net assets" (P/B) amounts to 1.3. It is almost twice lower than the S&P 500 (2.7). Nikkei rose 57% in 2013. This week and the following one most Japanese companies will release their reports for the second quarter, and that may have an impact on their quotes. At 23-30 CET the important data on unemployment and retail sales for June will be released today in Japan. Forecasts are promising to be neutral. A remarkable data divergence from investor expectations can contribute to changing the yen and Nikkei rates.

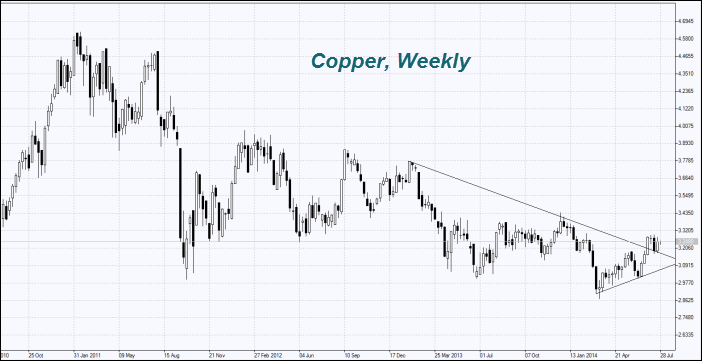

Copper prices declined slightly after the announcement of the American company Freeport-McMoran on resumption of exports from Indonesia. In the first half year it was banned. The country's authorities demanded an increase in duties. In the second half of the year the company is going to export 756 tons of copper. Second American copper producer in Indonesia Newmont Mining announced that it is also going to make an agreement with the government relating to duties.

According to National Coffee Council, coffee crop in Brazil in 2015 could be the lowest since 2009 because of the drought: less than 40 million bags. The Ministry of Agriculture gives higher figures: 44.6 million bags.

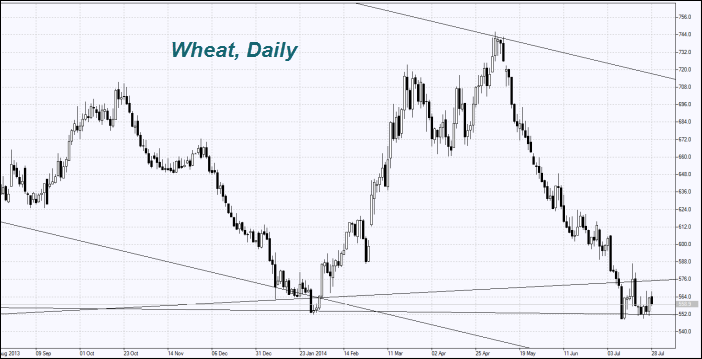

Wheat prices jumped due to its lowered crop forecast in 2014/2015 from 24.8 million tons to 24.6 million tons, according to Australian Bureau of Agricultural and Resource Economics and Sciences. This is less than last year's level of 27 million tons. The reduction in output is attributed to the drought caused by the negative impact of El Niño hurricane. Corn and soybean have also risen in price. Among other things, market participants expect an increase in demand from China after the recent decline in grain prices.

See Also