- Analytics

- Market Overview

World stock indices rising on Thursday: still need progress to hit mid-July highs - 15.8.2014

World stock indices kept on rising on Thursday, but they still have a long way to go to renew their mid-July highs. The President of Russia Vladimir Putin gave a speech concerning the situation in Ukraine. It was regarded as pacific and reduced slightly the political tension, according to investors.

This contributed to the stock prices growth, despite the fact that weekly American economic data on labor market appeared to be weaker than expected. The US earnings season for the second quarter is coming to an end. The reports were submitted by 92% of the companies listed in S&P 500. The preliminary profit forecasts were outperformed by 67.7% of these companies. Some market participants are concerned about the fact that this index has been in uptrend for more than 1000 days without any significant retracement of at least 10%. Therefore, they refrain from buying as yet. In theory, it can explain a relatively low market activity. The volume of US trading yesterday was 13% lower than the 5-day average (5.4 billion) and made up 4.7 billion stocks. The Nordstrom Inc retailer published the negative earnings report, meanwhile JC Penney Co and Monster Beverage Corp – positive, after the trading being closed. Currently, futures on American stock indices are traded “in the black”. Quite a lot of US macroeconomic data is to be released today. Earlier this week, the majority of forecasts were negative, but now they are being revised upward, after the corporate reports were released. Producer Price Index and Empire State Index are to be announced at 12-30 CET. Industrial Production and Consumer Confidence by the University of Michigan are to be published at 13-15 CET.

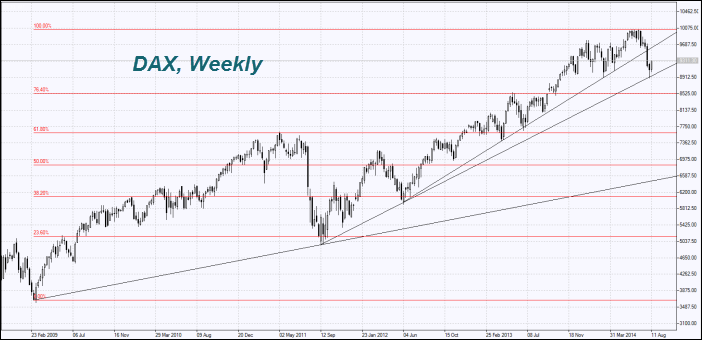

European stock indices are increasing today for the third day in a row. If this dynamics is maintained till the end of the day, they will show the weekly highest increase for the past six months. Investors do not pay attention to the poor performance of the EU economy. They reacted positively to the possibility of political situation stabilization in Ukraine after the statement of Vladimir Putin. We assume that there is certain consistency being observed: until the economy recovers, the ECB will continue to “pump up” the markets with liquidity. MSCI Germany P/E ratio is at the 10-year low and is equal to 12. This suggests a theoretical underestimate of German stocks. MSCI Europe P/E ratio amounts to 13.6 and S&P 500 – 15. There will be no significant EU macroeconomic data today.

Nikkei is climbing today, along with other world indices and can reach the highest weekly gain in 4 months. Despite that, the index is remained in the mid-term sideways trend. It is confirmed by the low trading activity. The trade turnover yesterday was 22% lower than the month average. Note that the Bank of Japan (BOJ) is considering lowering for the fourth time the GDP growth forecast for this year. Now it is equal to +1%, but can be reduced to +0.4%, due to the foreign trade poor performance and the negative impact of sales tax increase in Japan since April 1st. However, the economic growth forecast revision may linger to happen: at the BOJ meeting on October 31.

Sugar prices remain near the six-month low. India may increase the import duty from 15% to 40% to protect the local manufacturer, if they help the farmers with loan repayment. It can reduce the sugar procurement on the world market. It should be noted that a number of major Brazilian sugar producers such as Cosan SA and Sao Martinho decided to postpone the sell-off, hoping for a more favorable pricing environment in 2014/2015. If the sugar demand is not restored, then they can process a part of sugar cane into ethanol, which is used as a fuel. Thus, there are both negative and positive factors. Sugar prices will probably stay in the range for some time.

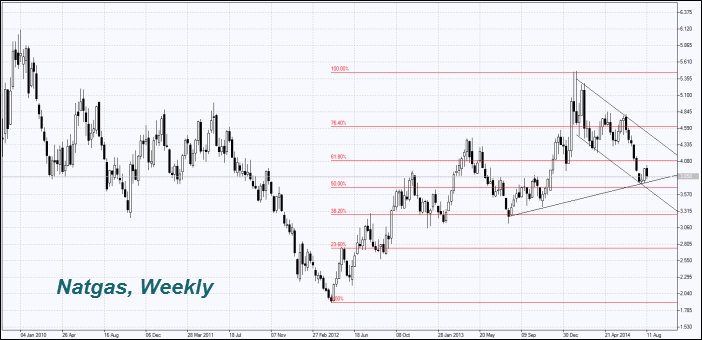

Natural gas prices ticked up yesterday, as the US gas reserves increased by 78 billion cubic feet (cf). It is considered to be lower than the expected 82 billion cf. We do not expect a drastic drop in gas prices. It becomes more attractive than coal for electricity generation at the price below $4 per mmBtu. Accordingly, the demand for natural gas can be increased. Besides, now the US gas reserves amount to 2.47 trillion cf. By the beginning of the heating season in late October, they should rise at least $1 trillion cf, that might prop up the demand.

See Also