- Analytics

- Market Overview

Decline in euro was followed by growth - 26.1.2015

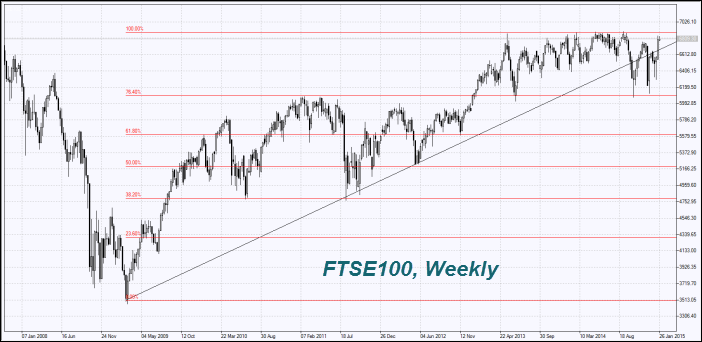

European stocks witness an increase today after a slight pullback on Friday. German IFO indices for January outperformed forecasts. As a result of parliamentary elections in Greece, Syriza party took 149 seats out of 300. The party is known for its anti-austerity movement and pro-refunding of the external debt. Initial plunge of euro was followed by upsurge. Investors believe that Greece will keep cooperating with eurozone and is unlikely to quit the EU. Amid euro emission last week, Stoxx Europe 600 Index added 5.1% hitting the 3-year record high. No important statistics is expected in the EU today.

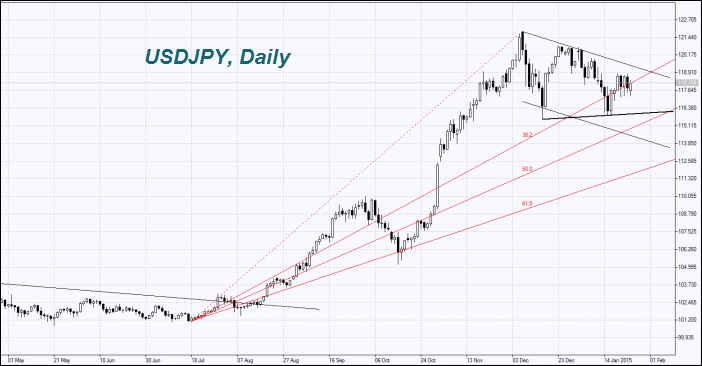

Nikkei opened with a negative gap on Monday and has been expanding all day long, driven by December positive data on foreign trade in Japan. Our analysts suppose that a more active increase of Nikkei is hampered by a mid-term yen strengthening trend. As seen from our previous overviews, a strong yen also encouraged the surge of the Australian dollar last week. The Japanese macroeconomic data are expected on Wednesday night.

Predictably, crude oil prices didn’t show positive dynamics after the power shift in Saudi Arabia. According to the U.S. Commodity Futures Trading Commission (CFTC), the volume of short positions for WTI attained a highest level since September 2010, while the volume of long positions shrinking for first time in 3 weeks. The net long position for oil dropped respectively by 3.3%. The US is eager to retain the maximum oil production since 1986, despite the number of operating oil wells decreasing 7 weeks in a row, reaching the 2-year low, as reported by Baker Hughes. At the moment the figure amounts to 1317 oil wells. The production of the remaining oil pumps is supposed to be increased, thanks to hydraulic fracturing method and horizontal drilling technologies. We deem that the scenario is hardly probable and the future slump in oil prices is restrained.

Gold continued the downward movement from the “psychological” limit of $1300 per ounce with the volume of long positions growing 4 consecutive weeks, as reported by CFTC.

Cacao slumped last week; in the meantime International Cocoa Organization reviewed its forecast for global cacao reserves for the end of 2013/2014 season. Experts anticipate a 19-thousand ton deficit instead of a 53-thousand ton surplus. Cacao exports by Cote d’Ivoire from October, 1 to January, 25 (the current 2014/2015 season) declined from 1067 million tons to 1045 million tons compared to the same period of the previous season.

See Also