- Analytics

- Market Overview

Global stock indices up on Thursday after several days down - 30.1.2015

Global stocks rose on Thursday after several days of losses. Initial jobless claims in the United States marked its strongest decrease this week since November 2012, as the very number of claims plunged to a 15-year low (265 thousand). Stocks were bolstered by good Q4 earnings of Apple, Boeing and Visa Inc. American stocks turnover was 10% above the weekly average amounting to 7.7 billion stocks. Futures on US indices have tumbled this morning. The American IT company, Qualcomm, and Chinese e-commerce enterprise, Alibaba Group, reported falling earnings and their shares lost 10.3% and 8.8% respectively. Today the US will issue important indicators: Q4 GDP (13:30 CET), Chicago PMI index (14:45 CET) and Michigan Consumer Confidence Index (15:00 СЕТ). The tentative outlook is neutral, however, if it is not confirmed, market will react sharply.

Today European stocks slightly pull back after yesterday's gains. Deflation in eurozone, which may continue for 2 consecutive months, is among investors' concerns. Eurozone CPI data will be released at 10:00 CET together with Unemployment Rate. The forecast for the latter is neutral. In general, the 8% increase of European Stoxx 600 in January may hit its record high over the last 20 years. Investors welcomed the start of euro printing. Note that originally the euro lost 20% against the US dollar. At the moment, the euro is trying to rebound as the dollar index is sliding back, driven by potential timeout in Fed rate hike. Some economists believe the rate increase to be unreasonable while global oil prices are low and rein in inflation.

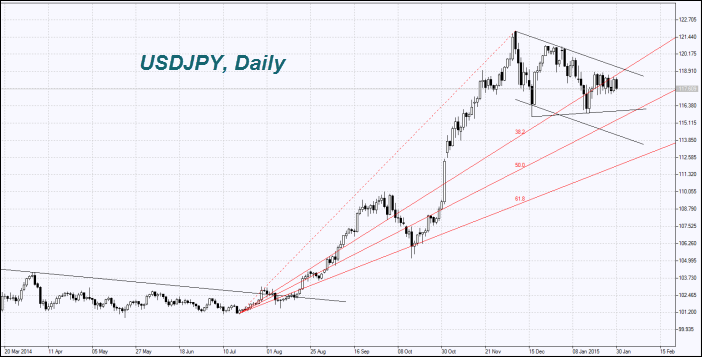

Nikkei dipped today with other global indices, but advanced, regarding weekly results, pinched by good economic data. This also stabilized yen within a narrow neutral corridor. Japan marked another core inflation growth slowdown in January that lasts for 5 consecutive months and now makes up 2.5%. Disregarding sales tax raise in April 2014, it amounted to 0.5%. Investors consider it positive, because the core inflation is still moving towards the BOJ target level of 2%. Unemployment rate fell to 3.4% (the lowest since 1997). Monday morning Markit/JMMA will announce Japanese Manufacturing PMI and no other important economic data are expected till Friday.

Gold gained 6% in January, hitting its monthly high since the beginning of the year: demand for precious metals was driven up by euro issuing and Fed waiting stance. Meanwhile, in China the demand plunged by 1/3 in 2014 to 866 and registered the 4-year low. On the contrary, India showed the demand for gold up by 14% to 690 tons.

Copper plunged to its 5.5-year low, decreasing 7 straight weeks for the first time since July 2008. A probable rebound may be taken into consideration. The Chinese Manufacturing PMI for January will be issued on February, 1. The majority of investors suppose it to surpass the December figures that were the worst over a 1.5-year period. In case of upbeat China's macroeconomic reports, copper may get up. Please note, that Cochilco, Chilean state copper commission, expects copper to bridge current price in 2015 and advance to $2.85 per pound. It will be accommodated with a 275-thousand ton oversupply this year, i.e. significant price surge is unlikely.

See Also