- Analytics

- Market Overview

US dollar dropped - 24.4.2015

European stocks were mixed yesterday as weak business and industrial PMI for April were published. The data mark the decrease in France and Germany as well as in the EU at large. Today indices have been expanding due to positive reports by Electrolux, Renault and Banco Sabadell. The largest European Bank HSBC Holdings informed that it is going to move the headquarters from London to Hong Kong and its shares added 2.6%. To be mentioned, 16% of companies from STOXX 600 list have presented their reports so far. As much as 61% of them have met or outstripped their earnings forecasts. This is good news for investors, so they expect overall earnings to rise 2.8%. German IFO Business Climate Index in April has hit the high since last July, producing additional positive effect. It is worth mentioning that the euro has continued yesterday's surge. Most market participants believe that creditors will provide Greece with financial aid, reducing default risks in the country. No other important statistics are expected today in eurozone.

After 3 winning days Nikkei has slipped due to growing fuel prices that may increase costs for Japanese economy. We remind that Nikkei index rose yesterday to its 15-year strongest. The Japanese yen has been traded in a narrow range. Meanwhile, investors assume that Bank of Japan may reduce money emission, which may underpin the yen. We would like to point out, that US president Barack Obama will meet Japanese prime-minister Shinzo Abe to discuss a free trade treaty (TPP or Trans-Pacific Partnership).

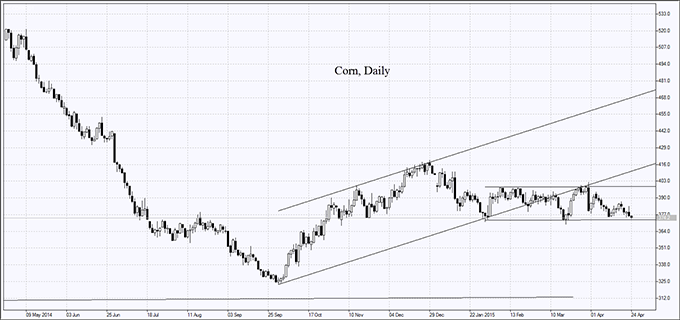

The weekly drop in corn prices may be the sharpest over 3 months. Market participants expect the demand to fall on the back of bird flu outbreak in the USA. More than that, due to good weather in the Middle West, agencies may raise their crops forecasts. Yesterday International Grains Council (IGC) increased the forecast for corn crops in the season 2015/2016 by 10 mln tons.

As far as wheat is concerned, according to IGC, the crops in 2015/2016 will contract 4 mln tons to 705 mln tons. At the same time wheat consumption is expected to grow to 711 mln tons. These two factors drive up wheat futures.

Soy futures have been edging higher for 2 weeks due to truck drivers' strike in Brazil. They blocked a number of roads in country's agricultural regions. Argentinian Ministry of Agriculture raised the soy crops forecast from 58 to 59 mln tons (53.4 mln tons were harvested last year). According to our analysts, soy prices may pull back, if USDA increases its own 57-mln-ton forecast.

See Also