- Education

- Forex Technical Analysis

- Chart Patterns

Forex Chart Patterns

Traders often use chart patterns when conducting technical analysis. The behavior of the Forex market shows patterns, and since chart patterns usually appear during trend reversals or when trends begin to form, traders often follow them when trading. To strengthen your trading knowledge, you can read our other article about "What is Forex trading and how does it work".

There are known patterns like head and shoulder patterns, triangles patterns, engulfing patterns, and more. Let us introduce to you some of them, it will help you identify the trend of the market and trade accordingly.

KEY TAKEAWAYS

- Technical analysts use price patterns to study current price movements in order to predict future market movements.

- Traders often use chart patterns as a Forex strategy.

- Technical analysts try to identify patterns as a way to anticipate the future direction of a security’s price.

Technical Analysis Chart Patterns

Trend Continuation Patterns

If you look at the chart with a strongly pronounced trend you can see places where the price has consolidated during its movements forming the same type of figures. These formations are trend continuation patterns which are often used by traders for making decisions. Trend continuation patterns are formed during the pause in the current market trends, and mark rather the movement continuation than its reversal.

By contrast with the model of trend reversal, the figures are often formed at shorter time intervals.

Trend Reversal Patterns

Trend Reversal Patterns represent geometric models on the charts of currency rates which are formed after the price level has reached its maximum value in the current trend. These patterns serve to indicate that the ongoing trend is about to change the course and their recognition helps to identify the end of the trend and the beginning of a new movement. A notable feature of the recognition of these models is that the trader is informed not only about the imminent change in the trend, but also the possible value of price movement.

Technical Analysis Patterns

Technical analysts use price patterns to study current price movements in order to predict future market movements. As you can see they play a big role in making a profit.

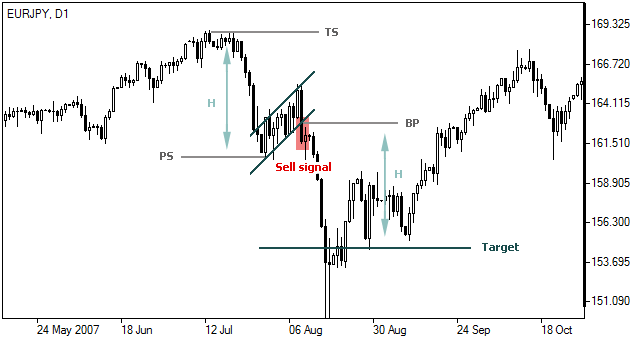

Head and Shoulders Pattern

Head and Shoulders pattern is quite popular and easy-to-spot in technical analysis. Pattern shows a baseline with three peaks where the middle peak is the highest, slightly smaller peaks on either side of it. Traders use head and shoulders patterns to predict a bullish and bearish movement.

Head and shoulders shaping is distinctive, chart pattern provides important and easily visible levels - Left shoulder, Head, Right shoulder.

Triangle Chart Pattern

Triangles fall under continuation patterns category, there are three different types them:

- Ascending triangle - The ascending triangle pattern in an uptrend, easy to recognize but is also quite an easy entry or exit signal.

- Descending triangle - The Descending triangle is notable for its downtrends and is often thought of as a bearish signal.

- Symmetrical triangle - Symmetrical triangles, as continuation patterns developed in markets, are aimless in direction. The market seems apathetic in its direction. The supply and demand, therefore, seem to be one and the same.

At the start of its formation, the triangle is at its widest point, as the market continues to trade, the range of trading narrows and the point of the triangle is formed. Because the triangle narrows it means that both buy and sell sides interest is decreasing - the supply line diminishes to meet the demand.

Chart Patterns in Trading

Chart patterns are widely used in trading while conducting technical analysis. Studying these patterns will be useful for building or using as a trading strategy.

Cup and Handle Pattern

A cup and handle is a technical chart pattern that resembles a cup and handle where the cup is in the shape of a "u" and the handle has a slight downward drift. Looks like this:

It is worth paying attention to the following when detecting cup and handle patterns:

- Length: Generally, cups with longer and more "U" shaped bottoms provide a stronger signal. Avoid cups with sharp "V" bottoms.

- Depth: Ideally, the cup should not be overly deep. Avoid handles that are overly deep also, as handles should form in the top half of the cup pattern.

- Volume: Volume should decrease as prices decline and remain lower than average in the base of the bowl; it should then increase when the stock begins to make its move higher, back up to test the previous high.

Flag Pattern

Flag is a price pattern that moves in a shorter time frame against the prevailing price trend observed in a longer time frame on a price chart. Reminds the trader of the flag, hence the name.

Flag patterns can be upward trending (bullish flag) or downward trending (bearish flag).

Note: Flag may seem similar to a wedge pattern or a triangle pattern, it is important to note that wedges are narrower than pennants or triangles.

Flag patterns have five main characteristics:

- The preceding trend

- The consolidation channel

- The volume pattern

- A breakout

- A confirmation where price moves in the same direction as the breakout

Wedge Pattern

Wedges form as an asset’s price movements tighten between two sloping trend lines. There are two types of wedge: rising and falling.

Wedge patterns are usually characterized by converging trend lines over 10 to 50 trading periods, which ensures a good track record for forecasting price reversals. A wedge pattern can signal bullish or bearish price reversals. In either case, this pattern holds three common characteristics:

- The converging trend lines;

- Pattern of declining volume as the price progresses through the pattern;

- Breakout from one of the trend lines.

The two forms of the wedge pattern are a rising wedge, which signals a bearish reversal or a falling wedge, which signals a bullish reversal.

Rounding Bottom Pattern

Rounding bottom Chart pattern is identified by a series of price movements that graphically form the shape of a "U". Rounding bottoms are found at the end of long downward trends and signify a reversal in long-term price movements.

It could take from several weeks to several months and it happens quite rarely.

Double Top Pattern

Double top is a bearish technical reversal pattern. Traders use double top to highlight trend reversals. Typically, an asset’s price will experience a peak, before retracing back to a level of support. It will then climb up once more before reversing back more permanently against the prevailing trend.

Double Bottom Pattern

Double bottom patterns are the opposite of double top patterns. Double top patterns if identified correctly are highly effective. However, if they are interpreted incorrectly. Therefore, one must be extremely careful before jumping to conclusions.

Bottom Line on Forex Chart Patterns

Chart patterns are the most common formations in forex trading and while they aren't enough for trading, in combination with technical analysis like trendlines, they are quite helpful for finding opportunities. Knowing market insights allow traders constract trading plans with less exposure to the risk of losing money.

Without experience in Forex trading there is little you can do or understand. It's better to start with a demo try using in practice for example recognizing chart patterns, identify right entry exit points. Experiment with knowledge you've learned until you feel comfortable opening a real account.

Forex Indicators FAQ

What is a Forex Indicator?

Forex technical analysis indicators are regularly used by traders to predict price movements in the Foreign Exchange market and thus increase the likelihood of making money in the Forex market. Forex indicators actually take into account the price and volume of a particular trading instrument for further market forecasting.

What are the Best Technical Indicators?

Technical analysis, which is often included in various trading strategies, cannot be considered separately from technical indicators. Some indicators are rarely used, while others are almost irreplaceable for many traders. We highlighted 5 the most popular technical analysis indicators: Moving average (MA), Exponential moving average (EMA), Stochastic oscillator, Bollinger bands, Moving average convergence divergence (MACD).

How to Use Technical Indicators?

Trading strategies usually require multiple technical analysis indicators to increase forecast accuracy. Lagging technical indicators show past trends, while leading indicators predict upcoming moves. When selecting trading indicators, also consider different types of charting tools, such as volume, momentum, volatility and trend indicators.

Do Indicators Work in Forex?

There are 2 types of indicators: lagging and leading. Lagging indicators base on past movements and market reversals, and are more effective when markets are trending strongly. Leading indicators try to predict the price moves and reversals in the future, they are used commonly in range trading, and since they produce many false signals, they are not suitable for trend trading.

Trend Continuation Patterns

If you look at the chart with a strongly pronounced trend you can see places where the price has consolidated during its movements forming the same type of figures. These formations are trend continuation patterns which are often used by traders for making decisions. Trend continuation patterns are formed during the pause in the current market trends, and mark rather the movement continuation than its reversal.

By contrast with the model of trend reversal, the figures are often formed at shorter time intervals.

Trend Reversal Patterns

Trend Reversal Patterns represent geometric models on the charts of currency rates which are formed after the price level has reached its maximum value in the current trend. These patterns serve to indicate that the ongoing trend is about to change the course and their recognition helps to identify the end of the trend and the beginning of a new movement. A notable feature of the recognition of these models is that the trader is informed not only about the imminent change in the trend, but also the possible value of price movement.

Not sure about your Forex skills level?

Take a Test and We Will Help You With The Rest