- Analytics

- Market Overview

Global equities rebound on upbeat US reports - 17.10.2018

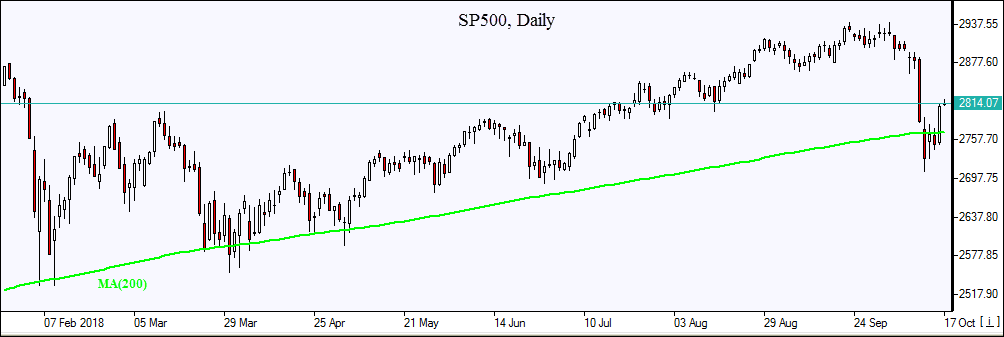

US stocks bounce back on upbeat quarterly reports

US stocks ended sharply higher on Tuesday on upbeat earnings and data as technology shares led the recovery. The S&P 500 rallied 2.2% to 2809.92. Dow Jones industrial average climbed 2.2% to 25798.42 led by Goldman Sachs and United Health which reported better than expected results for third quarter earnings. The Nasdaq composite index jumped 2.9% to 7645.49. The dollar strengthening resumed as the 0.3% rise in industrial production in September beat expectations of 0.2%: the live dollar index data show the ICE US Dollar index, a measure of the dollar’s strength against a basket of six rival currencies, edged up 0.04% to 95.065 and is higher currently. Futures on stock indices point to mixed openings today.

European indices open higher

European stocks extended gains on Tuesday despite mixed data. The EUR/USD turned lower as Italy’s government late Monday approved a draft budget law for 2019 which plans to raise budget deficit to 2.4% of gross domestic product or higher. The GBP/USD turned higher on report UK wage growth accelerated over the summer at the fastest pace in almost a decade. Both pairs are lower currently. The Stoxx Europe 600 rose 1.6%. The German DAX 30 advanced 1.4% to 11776.55. France’s CAC 40 jumped 1.5% and UK’s FTSE 100 gained 0.4% to 7059.40. Markets opened 0.3% - 0.4% higher today.

NIKKEI still best performer among Asian indices

Asian stock indices are advancing today as investors confidence was buoyed by rebound on Wall Street overnight. Nikkei ended 1.3% higher at 22841.12 with yen little changed against the dollar. Chinese stocks are higher: the Shanghai Composite Index is up 0.6% and Hong Kong’s Hang Seng index is 0.1% higher. Australia’s All Ordinaries Index extended gains 1.2% as Australian dollar continued slide against the greenback.

Brent up

Brent futures prices is rebounding today on expectations of a fall in US crude inventories. The American Petroleum Institute reported late Tuesday that US crude inventories fell by 2.1 million barrels last week. Prices advanced yesterday: December Brent rose 0.8% to $81.41 a barrel Tuesday. Today at 16:30 CET the Energy Information Administration will release US Crude Oil Inventories.

See Also