- Analytics

- Market Overview

Strengthening of the U.S. dollar continued on Tuesday in the absence of major macroeconomic news - 5.3.2014

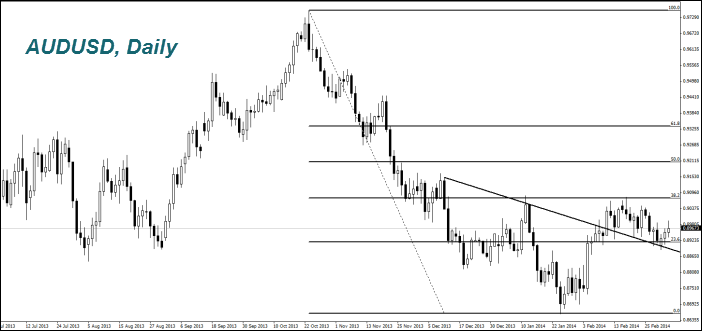

Australian Dollar strengthened (growth on the AUDUSD chart) after reports on the GDP growth in the fourth quarter by 2.8% on an annualized basis. This is more than expected. Australia is one of the few developed countries that successfully has been avoiding recession for 22 years. Recall that tomorrow night at 00-30 GMT Australia will announce the Retail Sales and the Trade Balance for January. The preliminary forecasts are negative, and this factor limits the strengthening of the Australian Dollar. The Canadian dollar is in the neutral trend before today's meeting of the Bank of Canada that is to be held at 15-00 GMT. According to forecasts, the discount rate will remain at the current level of 1%. Investors expect the Canadian Central Bank statements regarding the further economy and monetary policy development.

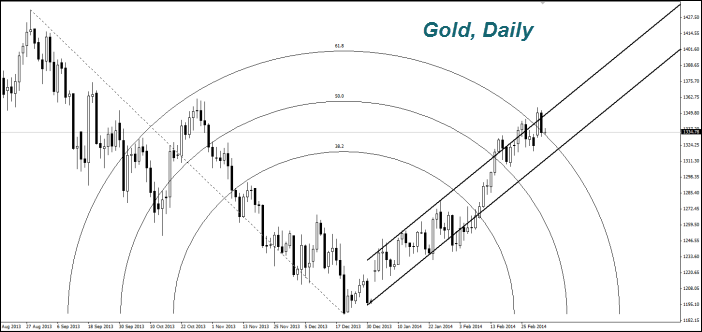

The Gold prices and prices for other commodity futures are correcting downwards due to the weakening of political tensions in Ukraine. Since the beginning of this year they have increased by 11%. Investors consider precious metals as safe heaven in case of any global economic and political problems. Meanwhile, the demand for gold in China is reduced now. Premium to its price in Shanghai compared to London, the Gold fell from $20 per ounce at the beginning of the year to its current level $1. However, the Gold demand increase is expected in India. The import duties over there have been increased by 10% for the last year. This led to the reduction in exports of Indian jewelry by 50% at the beginning of this year. Now the Ministry of Commerce is going to lower import duties on the Gold for India.

The Corn prices rose after reports that China may approve genetically-modified corn imports from North America. Earlier, China refused to purchase 887 tons of maize containing the MIR162 transgene. Negotiations on the grain supply have been conducted since 2010. The transgenic maize is mainly used as a food for poultry, pigs and other farm animals. Note that this news also boosted prices for soybeans (Soyb). Market participants believe that China may also approve the transgenic soya import, which is already bought by Japan and South Korea. An additional positive factor for soybeans are forecasts of reducing its harvest in Brazil due to bad weather. The price of the Coffee (Coffee) started correcting down after strong speculative rise on Monday. In previous reports we noted the possibility of reducing the Coffee prices due to improved weather in Brazil. Additional negative fact for the quotations was a message about the growth of the Coffee production in Colombia for February to the last 6 years, maximum 874 thousand standard bags, 60kg. each. This is 40% more than it was in February last year. Once the Coffee price rose from the beginning of 2014 by 70%, Brazil increased its exports from the last Coffee crop by 36% to 976 thousand bags per month.

See Also