- Analytics

- Market Overview

The decline in world stock markets continued in the absence of major economic indicators - 9.7.2014

Yesterday the decline in world stock markets continued in the absence of major economic indicators from the United States. Market participants probably did not like the Fed statement. In particular, Narayana Kocherlakota of Minneapolis said that the U.S. labor market is still on a long way to achieve the Fed employment targets.

Recall that the U.S. unemployment rate fell from 10% at the peak of the recession to 6.1% in June. Kocherlakota believes that this is not enough, it should be at just a little higher than 5%. Another Fed representative- the head of a regional bank in Richmond, Jeffrey Lacker expressed concerns over the inflation increase in the United States. According to him, the GDP growth in the second half of 2014 should be not less than 2,25-2,5%, rise in consumer prices may prevent it. Shares of Delta Air Lines and Boeing aircraft manufacturers, which we wrote about in previous reviews, noting the negative, updated the local lows. The biggest losses were suffered by the shares of Internet companies such as: Twitter, Facebook, Pandora Media, TripAdvisor and others traded with very high earnings per share (P/E). The trading volume on the U.S. exchanges on Tuesday was 6.2 billion shares, which is 7% higher than the monthly average. The Alcoa aluminum producer announced good financial results for the second quarter after the trading session was closed and its shares rose slightly. Now the U.S. futures are traded slightly positive. Today we will see the June meeting minutes at 18-00 CET released in the U.S., the Fed is able to influence the prices. Significant corporate reports are not expected.

Shares of European companies today have slightly increased after three days of declines. Perhaps this is due to the closing of short positions. Important macroeconomic data in the EU is not coming out today.

Nikkei continues fluctuating in the neutral trend. Yesterday it dropped together with global stock indices and it has grown today due to increased orders for industrial machinery. Tonight at 23-50 CET, we will see another statistics portion from Japan, which could affect the quotes if it differs markedly from neutral forecasts. At 5-00 CET, it will be announced on Japanese consumer confidence index for June.

Reducing inflation and PPI in China exceeded forecasts. We believe that this can contribute to the growth in commodity futures prices in the future. Today investors are likely to be looking forward to see tomorrow data on Chinese foreign trade in June. In our opinion, they are more important for the markets. The information will be released at 00-00 CET.

Palladium rose yesterday already for the thirteenth consecutive time on the demand for automakers and fears of reducing its production in South Africa. Its quotes are at the peak since February 2001. Gold also continues to rise. The SPDR Gold Trust reserve fund is still increasing. It has already reached 800.28 tons. It got in the black in comparison to the level of the beginning of this year. While the fund holdings were at the minimum in May since December 2008. Since the beginning of this year, rise in the Gold prices was 10% and surpassed all other assets. So the Bloomberg Commodity Index, which includes 22 kinds of different materials, grew by only 5.3% since the beginning of the year. The MSCI All-Country World rose by 5% and the Bloomberg Treasury Bond increased by 3%. Note that the major Western banks such as Goldman Sachs and Societe Generale still believe in a drop in Gold prices around the level of $1050 per ounce within 12 months. According to them, the likely rate increase in the U.S. and the U.K. and the subsequent increase in bond yields will reduce the demand for precious metals.

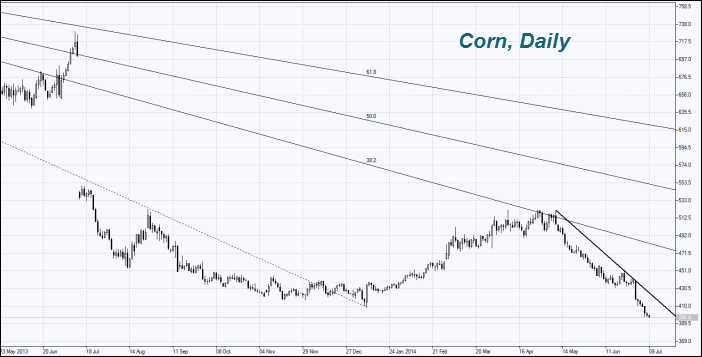

The Corn price had fallen to the 4-year low. The non stop drop in the Soyb prices was the longest since 2009. It happens amid-off take of Chinese government reserves, as well as on expectations of a record harvest in the United States. This is what we wrote many times in previous reviews. Now we want to note that the new USDA report will be released the next day on July 11. Market participants expect the world corn reserve forecast increase to 184.5 million tons in 2015. In the previous review the USDA expected them to make 182.65 million tons. Investors expect the USDA forecasts to increase for other grains, so the actual report can significantly affect the quotes. Note also that the Bureau of Meteorology MDA Weather Services stated that the decrease in humidity and temperature can damage the grain harvest in the Midwest. While this did not affect the market, as investors will wait for the USDA report.

See Also