- Analytics

- Market Overview

US futures slip - 7.2.2018

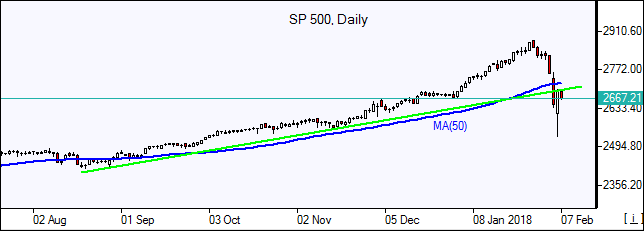

S&P 500 and Dow return into positive territory

US financial markets rebounded on Tuesday in a volatile session as buyers emerged after panic sell-off Monday. The S&P 500 recovered 1.7% to 2695.14 following 4.1% drop Monday. Dow Jones industrial average gained 2.3% to 24912.77, paring 4.6% loss the previous day. The Nasdaq composite index climbed 2.1% to 7115.88. The dollar added to previous day strength: the live dollar index data show the ICE US Dollar index, a measure of the dollar’s strength against a basket of six rival currencies, inched up 0.03% to 89.65. The recovery brought both S&P 500 and DJI back into positive territory for the year.

The selloff was triggered by better than expected January jobs report. It showed the increase in jobs was higher than expected, but more importantly it was accompanied by 2.9% increase in average hourly earnings year-over-year in January from 2.7% in December. Earlier the Bureau of Economic Analysis Monday report indicated US inflation is rising faster than expected: the core personal consumption expenditure index rose 0.2% on month in December from 0.1% the previous month. These reports fueled concerns the Federal Reserve could raise interest rates more quickly than currently anticipated. As buyers emerged after Monday’s slump Treasury yields resumed their climb following 10 year Treasury note yield decline to 2.71% from Monday peak 2.88%. Monday’s correction marked the biggest one day point drop ever for Dow Jones industrial average: the blue chip index lost 1175.21 points.

European stocks extend losses

European stocks continued the slump on Tuesday after global market sell-off Monday. The euro halted its retreat against the dollar while the British Pound continued weakening. The Stoxx Europe 600 dropped 2.4% Tuesday, seventh straight decline. The German DAX 30 fell 2.3% to 12392.66. France’s CAC 40 slumped 2.4% and UK’s FTSE 100 sank 2.6% to 7141.40. Markets opened 0.5%-0.8% higher today.

Asian stocks recover partially

Asian stock indices are mixed today after partial recovery following heavy losses in previous sessions. Nikkei rose 0.15% to 21636 as yen pared back most of previous session gains against the dollar. Chinese stocks are falling: the Shanghai Composite Index is down 1.8%% and Hong Kong’s Hang Seng Index is 0.5% lower. Australia’s All Ordinaries Index is up 0.75% with Australian dollar giving back Tuesday’s gains against the greenback.

Brent rises on US crude stocks drop report

Oil futures prices are rising today on the American Petroleum Institute late Tuesday report US crude inventories fell by 1.1 million barrels to 418.4 million barrels last week. Today at 16:30 CET the Energy Information Administration will release US Crude Oil Inventories.

See Also