- Analytics

- Market Overview

US stock market extends losses - 19.10.2018

Dollar strengthening slows

US stocks pullback deepened on Thursday as prospect of continued tightening weighed on market sentiment after hawkish Fed minutes. The S&P 500 dropped 1.4% to 2768.78. Dow Jones industrial average fell 1.3% to 25379.45. The Nasdaq composite lost 2.1% to 7485.14. The dollar strengthening slowed as initial jobless claims fell to 49-year lows while the Philadelphia Fed manufacturing index for October came in slightly below last month’s reading: the live dollar index data show the ICE US Dollar index, a measure of the dollar’s strength against a basket of six rival currencies, gained 0.3% to 95.919 but is lower currently. Futures on stock indices point to higher openings today.

European indices open mixed

European stocks extended losses on Thursday despite positive earnings reports. Both the EUR/USD and GBP/USD continued falling, with GBP/USD rising currently while EUR/USD still lower. The Stoxx Europe 600 index lost 0.5%. Germany’s DAX 30 dropped 1.1% to 11589.21. France’s CAC 40 slid 0.6% and UK’s FTSE 100 slipped 0.4% to 7026.99. Markets opened mixed today.

Chinese stocks rebound

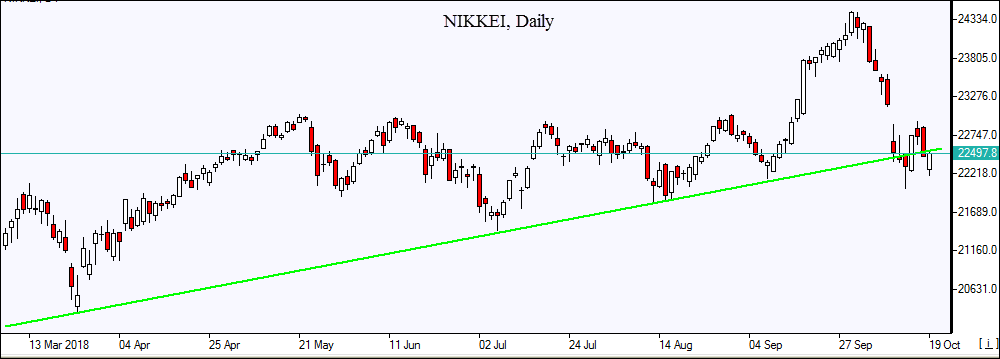

Asian stock indices are mixed today as Chinese stocks rallied paring earlier losses after lower than expected GDP growth. China’s gross domestic product grew 6.5% in the third quarter from the same quarter a year earlier when a 6.6% growth was expected: the Shanghai Composite Index is 2.6% higher and Hong Kong’s Hang Seng Index is up 0.5%. Nikkei however lost 0.6% to 22532.08 despite resumed yen weakness against the dollar. Australia’s All Ordinaries Index slipped 0.1% while Australian dollar turned higher against the greenback.

Brent advances

Brent futures prices are gaining today on expected rise in Chinese demand for crude as state-owned Chinese refiners return to service after maintenance. Prices ended lower yesterday after a report US domestic crude inventories rose sharply last week – 6.5 million barrels. Brent for December settlement closed 1% lower at $79.29 a barrel on Thursday.

See Also