- Education

- Introduction to Trading

- Short-Term Trading

Short-Term Trading - Short-Term Trading Tips

In the fast-paced world of finance, short-term trading has become a popular strategy for investors looking to capitalize on rapid price movements. Also known as day trading or swing trading, it involves buying and selling financial instruments within a short time frame, usually within a single trading day or a few days at most.

Unlike long-term investing that focuses on sustained growth over time, short-term trading aims to make quick profits by exploiting short-lived price fluctuations. Traders using this approach rely on technical analysis, market indicators, and real-time market data to make informed decisions. They constantly monitor market trends and execute trades swiftly.

Short-term trading offers the potential for swift and significant gains. Traders can profit from both rising and falling markets, taking advantage of volatility and intraday price swings. This dynamic strategy attracts various traders, including individuals, professional traders, hedge funds, and proprietary trading firms.

However, short-term trading comes with its challenges. It requires quick decision-making, constant position monitoring, and risk management in a volatile environment. Traders must have a good grasp of technical analysis techniques, chart patterns, and technical indicators to identify entry and exit points effectively.

Access to reliable market information and robust trading platforms is crucial for short-term trading. Online trading and real-time market data have made it easier for individual traders to engage in short-term trading.

In this article, we will delve into the core concept of short-term trading, examine effective strategies, and provide valuable trading tips. Additionally, we will explore the top indicators for short-term trading and compare it to long-term trading as a strategy. As a bonus, we will recommend a selection of stocks that are ideal for short-term trading.

Remember, short-term trading is a dynamic and speculative approach. Be thorough, conduct research, and continually educate yourself on market trends and trading techniques.

KEY TAKEAWAYS

- Short-term trading, also known as active trading, refers to a trading strategy in which financial instruments such as stocks, currencies, commodities, or derivatives are bought and sold within a relatively short time frame.

- Unlike long-term investing that focuses on sustained growth over time, short-term trading aims to make quick profits by exploiting short-lived price fluctuations.

- Scalping is a short-term trading strategy that aims to capture small, quick profits by taking advantage of intraday price fluctuations.

- Best Indicators for Short Term Trading: Moving Averages, Relative Strength Index, Bollinger Bands, Stochastic Oscillator, Volume, MACD.

What is Short Term Trading

Short-term trading, also known as active trading, refers to a trading strategy in which financial instruments such as stocks, currencies, commodities, or derivatives are bought and sold within a relatively short time frame.

Unlike long-term investing, which focuses on holding assets for an extended period to capture potential long-term growth, short-term trading aims to capitalize on short-lived price movements and exploit opportunities for quick profits.

Short-term traders actively monitor market conditions, analyzing technical indicators, chart patterns, and other relevant data to make rapid trading decisions. They seek to profit from short-term price fluctuations, often executing multiple trades within a single trading day or holding positions for a few days at most. The time frames for short-term trading can vary, ranging from seconds to weeks, depending on the trader's preferred style and the specific market being traded.

Short-term trading requires active involvement, discipline, and a keen understanding of technical analysis. Traders often utilize tools and techniques such as candlestick charts, moving averages, volume analysis, and oscillators to identify potential entry and exit points. Risk management is also crucial, as short-term trading involves quick decision-making and managing position sizes to control potential losses.

While short-term trading can offer the potential for quick profits, it also carries higher risks compared to long-term investing. The market can be volatile, and price movements can be influenced by various factors, including news events, economic data, and market sentiment. Traders must continually adapt to changing market conditions, adjust their strategies accordingly, and be prepared to exit positions if the market moves against their expectations.

It's important to note that short-term trading is a dynamic and demanding endeavor that requires knowledge, experience, and emotional discipline. Traders should educate themselves, practice with virtual trading platforms, and consider working with a reputable broker or financial advisor who can provide guidance and support. By carefully managing risks and developing a well-defined trading plan, individuals can potentially profit from short-term trading opportunities in the financial markets.

To engage in short-term trading effectively, it is recommended to download MetaTrader 4, a widely used and user-friendly trading platform that offers real-time market data, advanced charting tools, and efficient order execution. With MetaTrader 4, traders can access a wide range of financial instruments and indicators, empowering them to make informed trading decisions and capitalize on short-term market opportunities.

Short Term Trading Strategies That Work

Short-term trading strategies are those that are designed to take advantage of the rapid price movements and volatility inherent in short-term trading. Some effective strategies include

- Scalping: involves making multiple trades within short time frames to capture small, quick profits

- Momentum trading: focuses on riding the wave of price momentum, entering positions when there is a strong price trend

- And breakout trading: involves identifying key levels of support or resistance and entering trades when the price breaks out of those levels

Scalping Strategy

Scalping is a short-term trading strategy that aims to capture small, quick profits by taking advantage of intraday price fluctuations. Traders using this strategy execute numerous trades within a short time frame, typically within seconds to minutes.

For example, a scalper may look for a highly liquid stock that has a tight bid-ask spread. They might enter a trade when the stock shows a temporary imbalance in supply and demand, quickly buying at the bid price and selling at the ask price for a small profit.

Momentum Trading Strategy

Momentum trading involves capitalizing on the continuation of strong price trends. Traders using Momentum strategy identify assets that exhibit significant upward or downward momentum and enter positions to ride the trend.

For instance, if a currency pair shows a strong upward momentum, a trader might enter a long position, expecting the trend to continue. They would set a target profit level and a stop-loss order to manage risk in case the momentum reverses.

Breakout Trading Strategy

Breakout trading aims to take advantage of significant price movements that occur when an asset breaks through a well-established level of support or resistance. Traders using this strategy monitor key price levels and wait for a breakout to occur.

For example, if a stock has been trading within a tight range and suddenly breaks above a resistance level, a trader might enter a long position, expecting the price to continue rising. They would set a stop-loss order below the breakout level to limit potential losses.

Range Trading Strategy

Range trading involves identifying and trading within specific price ranges where an asset is consolidating. Traders using this strategy buy near the support level and sell near the resistance level. For instance, if a currency pair has been trading between a support level of 1.1000 and a resistance level of 1.1200, a trader may initiate a long position near 1.1000 and close the trade near 1.1200. They would set stop-loss orders outside the range to manage risk.

News Trading Strategy

News trading focuses on taking advantage of significant price movements that occur after the release of important economic or financial news. Traders using this strategy closely monitor economic calendars and news announcements.

For example, if an economic report indicates better-than-expected job data, a trader might initiate a long position on a stock index, anticipating a positive market reaction. They would set appropriate stop-loss orders to mitigate potential losses if the market reacts differently than expected.

Remember, each strategy requires careful analysis, risk management, and adapting to changing market conditions. It is crucial to develop a deep understanding of the strategy, practice with virtual trading platforms, and continuously refine your approach to short-term trading.

Short Term Trading Tips

Here are some useful tips to consider for short-term trading:

- Develop a trading plan: Prior to commencing your trades, it's essential to create a well-defined plan that outlines your trading goals, risk tolerance, and the strategy you will employ.

- Utilize technical analysis: Technical analysis is a valuable tool for identifying short-term trading opportunities. By analyzing historical price data, you can recognize patterns that may help predict future price movements.

- Implement stop-loss orders: Use stop-loss orders as a risk management technique to limit potential losses. These orders automatically close your trade if the stock price reaches a specific predetermined level.

- Practice effective risk management: Managing risk is crucial in short-term trading. Ensure that you only risk a small portion of your capital on each trade, enabling you to protect your overall portfolio.

- Practice with a demo account: Before risking real money, consider practicing with a demo account. This allows you to familiarize yourself with the market, test different trading strategies, and gain valuable experience without any financial risk.

More additional helpful tips for short-term traders:

- Maintain emotional discipline: It's crucial to remain calm and objective while trading. Avoid letting your emotions dictate your decisions, as this can lead to poor outcomes.

- Avoid excessive trading: Although it may be tempting to trade frequently, it's not a sound strategy for short-term traders. Instead, focus on identifying high-quality trading opportunities and capitalizing on them.

- Practice patience: Short-term trading can sometimes be frustrating, with periods of both losing trades and limited opportunities. It's important to maintain patience and continue seeking good trading prospects.

By following these tips, you'll be well on your way to establishing yourself as a successful short-term trader.

Best Indicators for Short Term Trading

There are various indicators that traders use to assist their decision-making in short-term trading. While the effectiveness of indicators can vary based on individual trading styles and market conditions, here are some commonly used indicators for short-term trading:

1. Moving Averages

Moving averages (MAs) are used to smooth out price data and identify trends. Short-term traders often rely on shorter-term moving averages, such as the 20-period or 50-period moving averages, to determine the immediate price direction.

When the price is consistently above the moving average, it suggests an uptrend, while a price below the moving average indicates a downtrend. Traders may use moving average crossovers, where a shorter-term MA crosses above or below a longer-term MA, as potential entry or exit signals.

Example: If a trader is using a 20-period moving average, they might observe that the price of a stock is consistently trading above the moving average. This indicates a potential uptrend, and the trader may consider entering a long position or holding an existing position until the price crosses below the moving average, signaling a potential trend reversal.

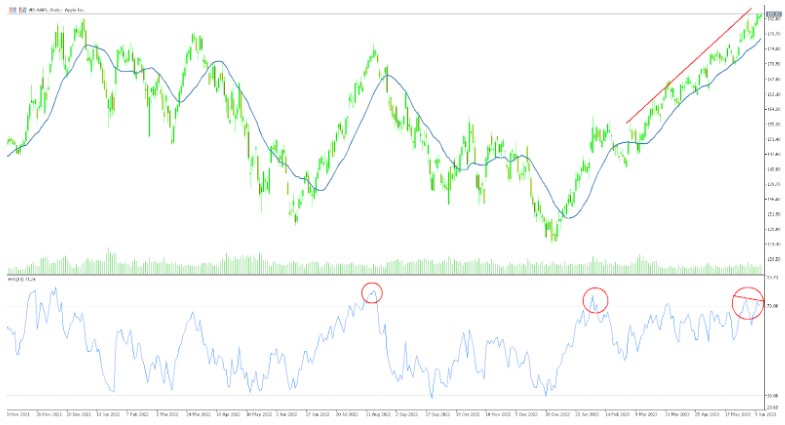

2. Relative Strength Index (RSI)

The RSI is a momentum oscillator that measures the speed and change of price movements. It helps identify overbought and oversold conditions in the market. The RSI ranges from 0 to 100, with readings above 70 suggesting overbought conditions and readings below 30 indicating oversold conditions.

Traders may look for potential reversals when the RSI reaches extreme levels or for divergences between the RSI and price, which can indicate a potential change in the prevailing trend.

Example: If the RSI of a stock reaches or exceeds 70, it suggests that the stock is overbought and may be due for a price correction. A short-term trader might consider selling or taking profits on a long position. Conversely, if the RSI drops below 30, it indicates oversold conditions, and a trader may consider buying or entering a long position as a potential reversal or bounce-back could occur.

3. Bollinger Bands

Bollinger Bands consist of a middle band (typically a moving average) and upper and lower bands that represent volatility levels. The bands expand and contract based on market volatility.

When the price is within the bands, it suggests a period of consolidation, and traders may anticipate a potential breakout when the price moves outside the bands. Bollinger Bands can also be used to identify potential support and resistance levels.

Example: If a stock's price has been trading within the Bollinger Bands and suddenly breaks out above the upper band, it may indicate a bullish signal for short-term traders. They might consider entering a long position, anticipating further price gains. Conversely, if the price breaks below the lower band, it could signal a bearish opportunity, prompting traders to consider short positions.

4. Stochastic Oscillator

The stochastic oscillator compares a security's closing price to its price range over a given period. It oscillates between 0 and 100 and helps identify potential turning points and overbought/oversold conditions.

A reading above 80 indicates overbought conditions, while a reading below 20 suggests oversold conditions. Traders often look for bullish or bearish divergences between the stochastic oscillator and price to signal potential reversals.

Example: If the stochastic oscillator shows a reading above 80, it suggests that the security is overbought and may be due for a pullback or price correction. A short-term trader might consider selling or taking profits on a long position. Conversely, if the stochastic oscillator drops below 20, it indicates oversold conditions, and a trader may consider buying or entering a long position as a potential reversal or bounce-back could occur.

5. Volume

Volume is the number of shares or contracts traded in a particular security during a given period. High volume often accompanies significant price movements and suggests strong market participation. Traders use volume to confirm the strength and sustainability of price movements.

Increasing volume during price breakouts or reversals can indicate the validity of a move, while decreasing volume during a price trend may signal potential weakness.

Example: If a stock experiences a significant price increase accompanied by above-average trading volume, it suggests strong buying interest and confirms the upward move. Traders may view this as a bullish signal and consider entering or holding a long position. Conversely, if the price rises on low volume, it may indicate a lack of market conviction and raise concerns about the sustainability of the upward move.

6. MACD (Moving Average Convergence Divergence)

MACD is a trend-following momentum indicator that shows the relationship between two moving averages. It consists of a MACD line (the difference between two exponential moving averages) and a signal line (a moving average of the MACD line).

When the MACD line crosses above the signal line, it generates a bullish signal, indicating a potential upward trend. Conversely, a cross below the signal line generates a bearish signal, suggesting a potential downward trend.

Example: If the MACD line crosses above the signal line, it generates a bullish signal for short-term traders. This indicates a potential upward price movement, and traders may consider entering a long position. Conversely, if the MACD line crosses below the signal line, it generates a bearish signal, suggesting a potential downward price movement. Traders may consider selling or taking short positions in response to this signal.

It's important to note that no indicator is 100% accurate, and traders should use indicators as part of a comprehensive trading strategy, considering other factors such as price patterns, fundamental analysis, and risk management techniques. We would recommend practicing with DEMO, backtest strategies, and adapt indicators to individual trading styles and market conditions for the most effective use.

Short-term vs Long-term Trading

When it comes to trading in the financial markets, investors have the option to pursue different approaches based on their time horizons and investment goals. Two commonly used trading approaches are short-term trading and long-term trading. While both strategies aim to generate profits from market movements, they differ in terms of timeframes, trading styles, and objectives.

Short-term Trading vs. Long-term Trading:

| Aspect | Short-term Trading | Long-term Trading |

|---|---|---|

| Time frame | Involves buying and selling within a short time frame, often within a day or a few days. | Involves holding positions for an extended period, ranging from months to years. |

| Trading Style | Focuses on capturing quick price movements and exploiting short-term market fluctuations. | Emphasizes sustained growth and capital appreciation over a longer time horizon. |

| Objective | Aims to generate immediate profits from short-term price volatility. | Aims to capitalize on long-term trends and fundamental factors for significant gains over time. |

| Decision-making | Relies heavily on technical analysis, market indicators, and short-term price patterns. | Incorporates fundamental analysis, macroeconomic factors, and company-specific information. |

| Frequency of Trades | Involves frequent buying and selling, executing multiple trades within a short period. | Involves fewer trades, with longer holding periods between buying and selling. |

| Monitoring | Often subject to higher volatility and short-term market fluctuations, resulting in increased risk. | Generally experiences lower volatility and reduced exposure to short-term market swings. |

| Risk and Volatility | Often subject to higher volatility and short-term market fluctuations, resulting in increased risk. | Generally experiences lower volatility and reduced exposure to short-term market swings. |

| Examples | Scalping, day trading, swing trading. | Buy-and-hold investing, position trading. |

Example:

Let's consider an example to illustrate the difference between short-term and long-term trading strategies. Suppose Company ABC releases its quarterly earnings report, exceeding market expectations and indicating strong growth prospects.

- A short-term trader might react to this news by analyzing the immediate market reaction and short-term price patterns. They may decide to enter a long position, aiming to capture the expected positive momentum over the next few trading sessions. Their goal is to profit from the short-term price movement resulting from the earnings announcement.

- On the other hand, a long-term investor would approach this news from a broader perspective. They would analyze the company's fundamentals, growth prospects, and industry trends. If they believe Company ABC has a promising future, they may decide to hold the stock in their portfolio for an extended period, possibly years, with the expectation of significant capital appreciation over time.

In this example, the short-term trader focuses on immediate market reactions and exploits short-lived price movements, while the long-term investor considers the company's long-term potential and aims to benefit from sustained growth.

It's important to note that the choice between short-term and long-term trading depends on individual preferences, risk tolerance, and investment goals. Traders and investors should carefully assess their time availability, market knowledge, and desired returns when deciding which approach best aligns with their needs.

Best Stocks for Short Term Trading

Here are some factors to consider when identifying the best stocks for short-term trading:

- Technical analysis: Use technical analysis tools to identify stocks that are oversold or overbought. These stocks are more likely to experience a reversal in price, which can provide an opportunity for short-term traders to profit.

- Price momentum: Stocks that are trending upwards are more likely to continue to rise in the short term. You can identify these stocks by looking at their price charts and using technical indicators such as moving averages and relative strength index (RSI).

- Volatility: Stocks that are more volatile tend to experience larger price swings, which can give you the opportunity to make more profits in a short period of time. However, volatility also increases the risk of losses, so it's important to use stop-loss orders to limit your losses.

- Liquidity: Stocks that are highly liquid are easy to buy and sell, which is important for short-term traders who want to get in and out of positions quickly. You can check a stock's liquidity by looking at its average daily trading volume.

- Fundamentals: While technical analysis can be helpful for identifying short-term trading opportunities, it's also important to consider the underlying fundamentals of a company. This includes factors such as the company's financial performance, its competitive landscape, and its growth prospects.

It's important to remember that short-term trading is a risky proposition, and there is no guarantee of success. However, by following these factors, you can increase your chances of identifying the best stocks to trade in the short term.

Here are some of the best stocks for short-term trading in June 2023, based on the factors mentioned above:

- Tesla (TSLA): Tesla is a leading electric vehicle manufacturer that has been on a tear in recent years. The stock is up over 500% in the past year and is still trading at a high valuation. However, Tesla's strong fundamentals and continued growth potential make it a good candidate for short-term traders.

- Meta Platforms (META): Meta Platforms is the parent company of Facebook and Instagram. The company has been under pressure in recent months due to slowing user growth and increased competition from TikTok. However, Meta is still a dominant player in the social media space and has a large user base. This makes it a good candidate for short-term traders who are looking to capitalize on a potential rebound in the stock price.

- Amazon (AMZN): Amazon is one of the largest retailers in the world and has been a consistent outperformer in the stock market. The company is facing some challenges in the e-commerce space, but it is still a dominant player and has a strong track record of innovation. This makes it a good candidate for short-term traders who are looking to take advantage of a potential pullback in the stock price.

- Apple (AAPL): Apple is one of the largest and most popular technology companies in the world. The company has a strong track record of innovation and has been a consistent outperformer in the stock market. Apple is also a dividend-paying stock, which can provide some income for short-term traders.

These are just a few examples of stocks that could be good candidates for short-term trading in June 2023. You should always do your own research before making any investment decisions.

How to Short Term Trade

If you're ready to dive into short-term trading and start using this strategy, here are the steps you need to follow:

1. Get Clear on Your Goals

Figure out what you want to achieve with short-term trading. Decide how much time and money you can dedicate to it and set realistic profit targets and risk levels.

2. Learn the Ropes

Dive into learning about different financial instruments, trading strategies, and technical analysis tools. Familiarize yourself with indicators, charts, and all the trading lingo.

3. Craft a Trading Plan

Create a cool trading plan that outlines when to enter and exit trades, how much to risk per trade, and how to manage your overall risk. Think of it as your trading roadmap.

4. Pick Your Style

Choose a trading style that suits your personality. Do you want to scalp quick profits, trade within a day (day trading), or catch bigger moves over a few days (swing trading)?

5. Master Technical Analysis

Use technical analysis tools to analyze price patterns and find potential entry and exit points. Look at charts, spot trends, and use indicators like moving averages or funky oscillators.

6. Keep Tabs on the Market

Stay in the loop with market news, economic data, and company updates that can shake things up. Keep an eye on real-time market data to spot opportunities.

7. Be a Risk Manager

Protect your hard-earned cash by managing risk. Set stop-loss orders to limit losses and decide when to take profits. Size your positions based on how much you're willing to risk.

8. Nail the Trade Execution

Choose a user-friendly trading platform that gets the job done. Make sure you're comfortable placing different types of orders, like market, limit, or stop orders.

9. Monitor and Review

Keep an eye on your trades and adjust your stop-loss and profit targets when needed. Regularly review your trades to see what's working and what needs tweaking.

10. Stay Chill and Disciplined

Emotions can mess with your trading decisions, so try to stay calm and stick to your plan. Don't let FOMO (fear of missing out) or FUD (fear, uncertainty, and doubt) mess with your head.

Keep learning, adapt to market changes, and practice with virtual trading or paper trading before going all-in with your real money. Have fun and may the trading gods be with you!

Bottom Line on Short-Term Trading

Short-term trading is a world of endless possibilities, where various methods and tools are used to seize profitable opportunities. However, the key to success lies in educating yourself and mastering the application of these tools. As you delve deeper into the realm of short-term trading, you'll naturally gravitate towards specific strategies that align with your personal tendencies and risk tolerance.

Ultimately, the aim of any trading strategy, including short-term trading, is to minimize losses while maximizing profits.

To thrive in short-term trading, it's crucial to equip yourself with knowledge, skills, and a solid understanding of market dynamics. Explore different strategies, experiment with techniques, and fine-tune your approach to find the perfect blend that suits your style. With a well-crafted strategy, you'll be able to navigate the markets with confidence, capitalizing on fleeting opportunities for maximum gains.

However, it's important to remember that successful short-term trading is not a guaranteed path to instant riches. It requires discipline, continuous learning, and the ability to adapt to ever-changing market conditions. You must approach each trade with a calculated mindset, carefully managing risk and setting realistic expectations.

As you gain experience and refine your skills, you'll become better equipped to make informed decisions, swiftly seize profitable opportunities, and limit potential losses. Keep your focus on preserving capital and maximizing returns, maintaining a disciplined approach throughout your short-term trading journey.

Remember, there is no one-size-fits-all strategy in short-term trading. Your success lies in finding the right mix of techniques and tools that work best for you.