- Analytics

- Top Gainers / Losers

Top Gainers and Losers: Wheat and Turkish Lira

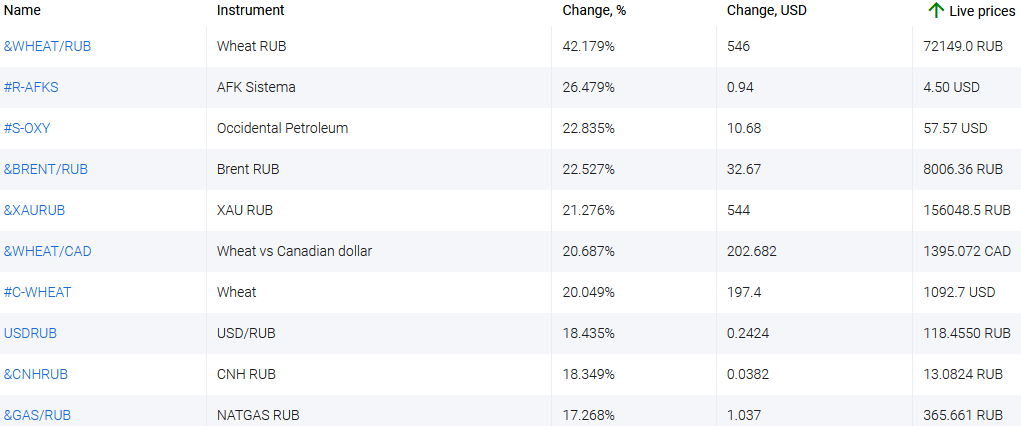

Top Gainers - global market

Top Gainers - global market

Over the past 7 days, the US dollar index has not changed much. Investors expect the Fed to raise rates at its March 16 meeting. At the same time, they are concerned about the continued growth of US inflation, which reached 7.9% y/y in February. The main world event continues to be the political crisis in Europe in connection with the war between Russia and Ukraine. Accordingly, shares of Russian companies and the ruble became the leaders of the fall again. The Turkish Lira has weakened due to the risks of a bad tourist season this year. A significant part of tourists at the seaside resorts of Turkey are citizens of Russia and European countries. The leaders of the strengthening are the currencies of commodity countries that are far from the European crisis: South Africa, Australia and New Zealand. Among the growth leaders, wheat can be noted. Russia will stop the export of grain and sugar until 31 August 2022.

1.&WHEAT/RUB, +42,2% - personal composite instrument: wheat versus Russian ruble

2. AFK Sistema (GDR), +26,5% - global depository receipts of the Russian multi-profile holding AFK Sistema

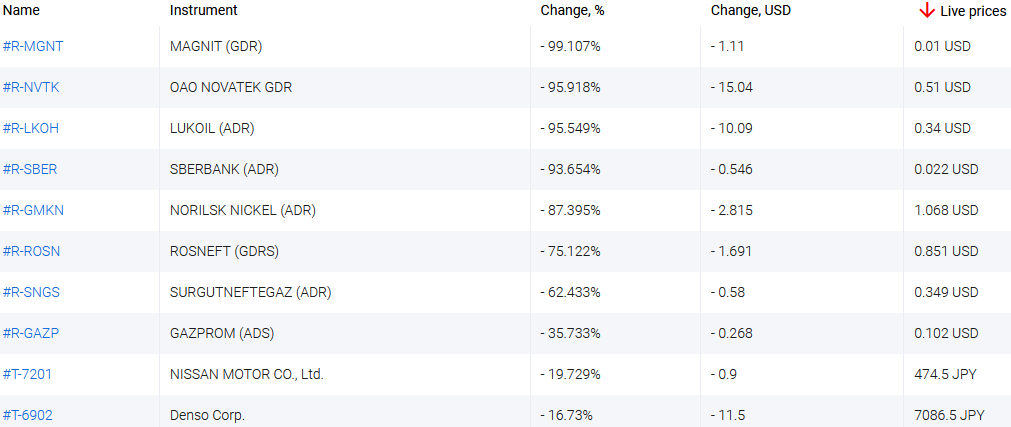

Top Losers - global market

Top Losers - global market

1. MAGNIT (GDR) – global depository receipts of the Russian retail chain MAGNIT

2. NOVATEK (GDR) – global depository receipts of Russian gas company Novatek

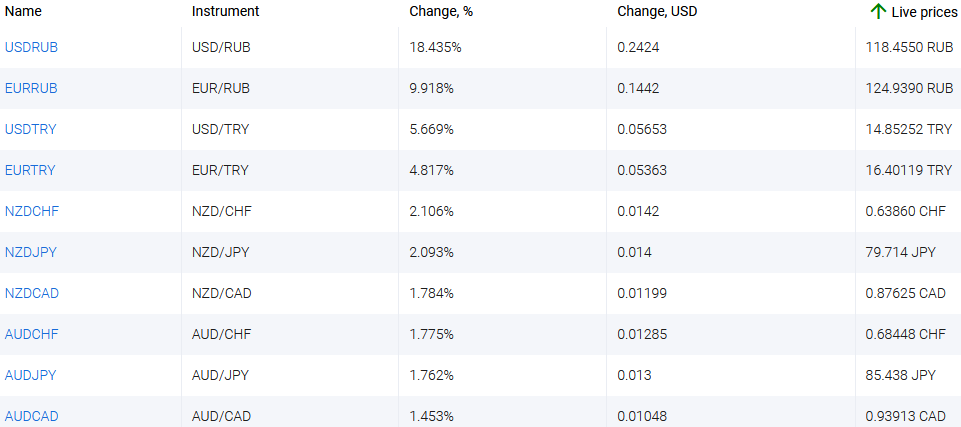

Top Gainers - foreign exchange market (Forex)

Top Gainers - foreign exchange market (Forex)

1. USDRUB, EURRUB - the increase in these charts means the strengthening of the US dollar and the euro against the Russian ruble.

2. USDTRY, EURTRY - the increase in these charts means the weakening of the Turkish lira against the US dollar and the euro.

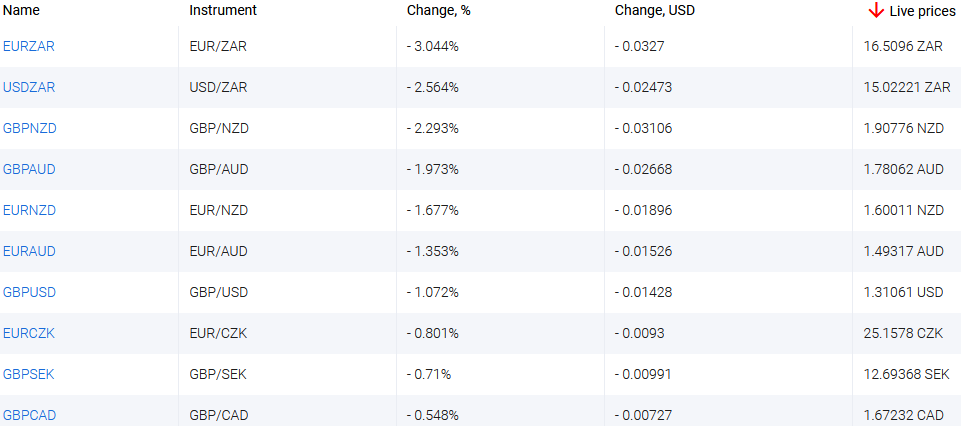

Top Losers - foreign exchange market (Forex)

Top Losers - foreign exchange market (Forex)

1. EURZAR, USDZAR - the decline in these charts means the weakening of the euro and the US dollar against the South African rand.

2. GBPAUD, GBPNZD - the decline in these charts means the strengthening of the Australian and New Zealand dollars against the British pound.

New Exclusive Analytical Tool

Any date range - from 1 day to 1 year

Any Trading Group - Forex, Stocks, Indices, etc.

Note:

This overview has an informative and tutorial character and is published for free. All the data, included in the overview, are received from public sources, recognized as more or less reliable. Moreover, there is no guarantee that the indicated information is full and precise. Overviews are not updated. The whole information in each overview, including opinion, indicators, charts and anything else, is provided only for familiarization purposes and is not financial advice or а recommendation. The whole text and its any part, as well as the charts cannot be considered as an offer to make a deal with any asset. IFC Markets and its employees under any circumstances are not liable for any action taken by someone else during or after reading the overview.

Previous Top Gainers & Losers

Over the past 7 days, the American dollar has remained almost unchanged. According to the CME FedWatch tool, there is an 89% probability of the U.S. Federal Reserve raising interest rates at the meeting on July 26th. The Swiss franc has strengthened due to positive economic indicators such as Credit...

Over the past 7 days, the US dollar index has declined. As expected, the Federal Reserve (Fed) maintained its interest rate at 5.25% during the meeting on June 14. Now, investors are monitoring economic statistics and trying to forecast the change in the Fed's rate at the next meeting on July 26. The...

Over the past 7 days, the US dollar index has remained largely unchanged. It has been trading in a narrow range of 103.2-104.4 points for the 4th week in a row. Investors are awaiting the outcome of the Federal Reserve meeting on June 14. Tesla shares have risen due to the opening of new gigafactories...