- Analytics

- Top Gainers / Losers

Top Gainers and Losers: US dollar and Australian dollar

Top Gainers - global market

Over the past 7 days, the US dollar index continued its growth for the 4th week in a row, the increase was provoked after the Fed raised the rate by 0.25% to 4.75% on February 1. Investors do not rule out a further increase in the rate to 5.5% by the end of 2023. The Mexican peso strengthened on strong performance of the Mexico Gross Domestic Product and Current Account, which were better than expected. In addition, in the first half of February, inflation slowed down a little in Mexico. The weakening of the Australian dollar contributed to the materials of the February meeting of the Reserve Bank of Australia (RBA). He considered raising the rate by 0.5% but ended up increasing it by 0.25% to the current level of 3.35%. Investors do not rule out a pause in the tightening of the monetary policy of the RBA at the next meeting on March 7. Recall that inflation in Australia in the 4th quarter of 2022 reached 7.8% y/y. This is much more than the RBA rate.

1. Orora Ltd, +19% – Australian manufacturer of bottles and cans for soft drinks.

2. Rolls-Royce Group, +17.2% – British manufacturer of aircraft and marine engines and equipment, as well as turbines for power generation

Top Losers - global market

1. AMP Ltd – Australian finance company

2. Intel Corporation – computer processor and equipment manufacturer.

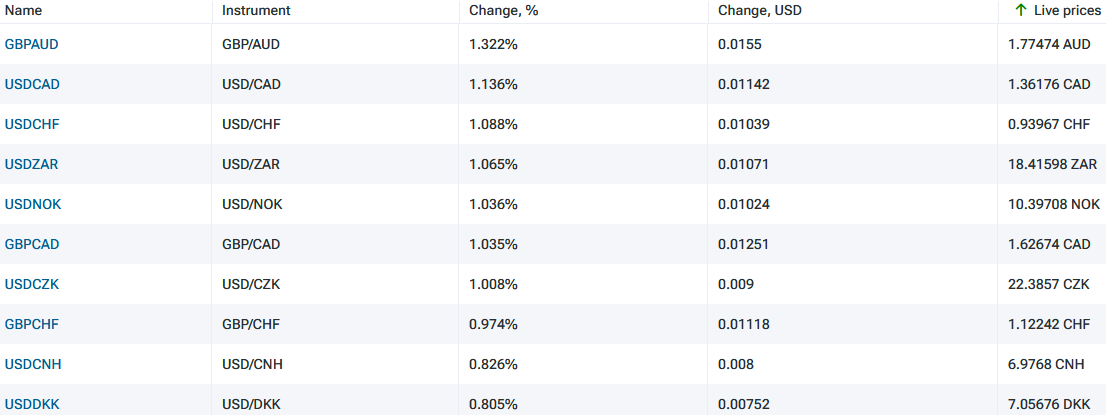

Top Gainers - foreign exchange market (Forex)

1. GBPAUD, USDCAD - the increase in these charts means the strengthening of the US dollar against the Canadian dollar and the British pound against the Australian dollar.

2. USDCHF, USDZAR - the increase in these charts means the weakening of the Swiss franc and the South African rand against the US dollar.

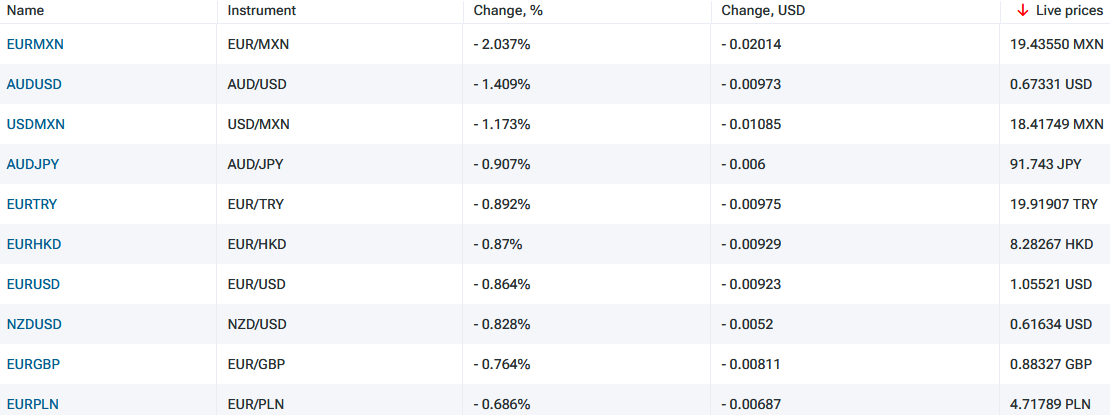

Top Losers - foreign exchange market (Forex)

1. EURMXN, USDMXN - the decrease in these charts means the weakening of the euro and the US dollar against the Mexican peso.

2. AUDUSD, AUDJPY - the decrease in these charts means the strengthening of the US dollar and the Japanese yen against the Australian dollar.

New Exclusive Analytical Tool

Any date range - from 1 day to 1 year

Any Trading Group - Forex, Stocks, Indices, etc.

Note:

This overview has an informative and tutorial character and is published for free. All the data, included in the overview, are received from public sources, recognized as more or less reliable. Moreover, there is no guarantee that the indicated information is full and precise. Overviews are not updated. The whole information in each overview, including opinion, indicators, charts and anything else, is provided only for familiarization purposes and is not financial advice or а recommendation. The whole text and its any part, as well as the charts cannot be considered as an offer to make a deal with any asset. IFC Markets and its employees under any circumstances are not liable for any action taken by someone else during or after reading the overview.

Previous Top Gainers & Losers

Over the past 7 days, the American dollar has remained almost unchanged. According to the CME FedWatch tool, there is an 89% probability of the U.S. Federal Reserve raising interest rates at the meeting on July 26th. The Swiss franc has strengthened due to positive economic indicators such as Credit...

Over the past 7 days, the US dollar index has declined. As expected, the Federal Reserve (Fed) maintained its interest rate at 5.25% during the meeting on June 14. Now, investors are monitoring economic statistics and trying to forecast the change in the Fed's rate at the next meeting on July 26. The...

Over the past 7 days, the US dollar index has remained largely unchanged. It has been trading in a narrow range of 103.2-104.4 points for the 4th week in a row. Investors are awaiting the outcome of the Federal Reserve meeting on June 14. Tesla shares have risen due to the opening of new gigafactories...