- Analytics

- Top Gainers / Losers

Top Gainers and Losers: the American dollar and the Japanese yen

Top Gainers - global market

Over the past 7 days, the US dollar index continued to rise for the 3rd week in a row. Investors do not rule out a further increase in the Fed rate by another 0.25% - up to 5% from the current level of 4.75%. According to CME FedWatch, the probability of this at the Fed meeting on March 22 reaches 82%. The strengthening of the Swedish krona contributed to good data on unemployment. It contracted in January and hit a multi-year low of 6.5%. In addition, the krone continued to win back positively in the form of an increase in the Sveriges Riksbank rate on February 9 to a multi-year high of 3%. Note that on the same day, the Bank of Mexico unexpectedly raised the rate to 11%. This caused the peso to appreciate. The weakening of the yen was supported by a sluggish advance in the preliminary Japan Gross Domestic Product for the 4th quarter of 2022, as well as a record Japan Trade Balance deficit in January. Investors are awaiting the appointment of a new Bank of Japan Governor in the next few days. Earlier, the Japanese government nominated Kazuo Ueda for this post.

1.Kobe Steel, Ltd., 26,2% – Japanese steel company

2. Bausch Health Companies Inc, 18,6% – Canadian manufacturer of medical equipment and drugs

Top Losers - global market

1. AMP Ltd – Australian financial corporation

2. Link Real Estate Investment Trust – Hong Kong real estate investment company.

Top Gainers - foreign exchange market (Forex)

1. USDZAR, EURZAR - the growth of these charts means the weakening of the South African rand against the US dollar and the euro.

2. USDJPY, CADJPY - the growth of these charts means the strengthening of the US and Canadian dollars against the Japanese yen.

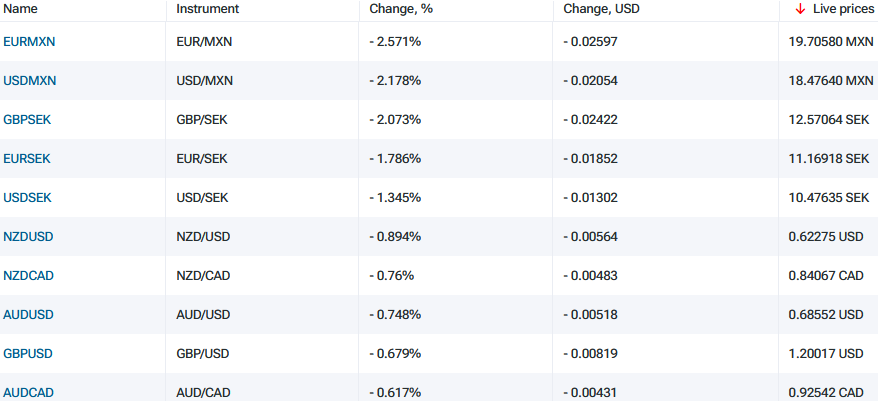

Top Losers - foreign exchange market (Forex)

1. GBPSEK, EURSEK - the decline of these charts means the weakening of the British pound and the euro against the Swedish krona.

2. EURMXN, USDMXN - the decline of these charts means the strengthening of the Mexican peso against the euro and the US dollar.

New Exclusive Analytical Tool

Any date range - from 1 day to 1 year

Any Trading Group - Forex, Stocks, Indices, etc.

Note:

This overview has an informative and tutorial character and is published for free. All the data, included in the overview, are received from public sources, recognized as more or less reliable. Moreover, there is no guarantee that the indicated information is full and precise. Overviews are not updated. The whole information in each overview, including opinion, indicators, charts and anything else, is provided only for familiarization purposes and is not financial advice or а recommendation. The whole text and its any part, as well as the charts cannot be considered as an offer to make a deal with any asset. IFC Markets and its employees under any circumstances are not liable for any action taken by someone else during or after reading the overview.

Previous Top Gainers & Losers

Over the past 7 days, the American dollar has remained almost unchanged. According to the CME FedWatch tool, there is an 89% probability of the U.S. Federal Reserve raising interest rates at the meeting on July 26th. The Swiss franc has strengthened due to positive economic indicators such as Credit...

Over the past 7 days, the US dollar index has declined. As expected, the Federal Reserve (Fed) maintained its interest rate at 5.25% during the meeting on June 14. Now, investors are monitoring economic statistics and trying to forecast the change in the Fed's rate at the next meeting on July 26. The...

Over the past 7 days, the US dollar index has remained largely unchanged. It has been trading in a narrow range of 103.2-104.4 points for the 4th week in a row. Investors are awaiting the outcome of the Federal Reserve meeting on June 14. Tesla shares have risen due to the opening of new gigafactories...