- Education

- Forex Trading Strategies

- Strategies by Forex Analysis

- Technical Analysis Strategy

- Support and Resistance Trading Strategy

Support and Resistance Trading Strategy

Support and Resistance lines

Among the fundamental and most commonly used technical analysis tools, support and resistance (SR) levels have a special place. Moreover, strategies based on them are used not only by beginners, but also by quite experienced traders, who have many other tools at their disposal, as well as extensive trading experience. So why have these simple lines become so widely used by investors? Let's think about this together, but before that we may need to strengthen the knowledge of What is Forex trading and how does it work.

SR levels

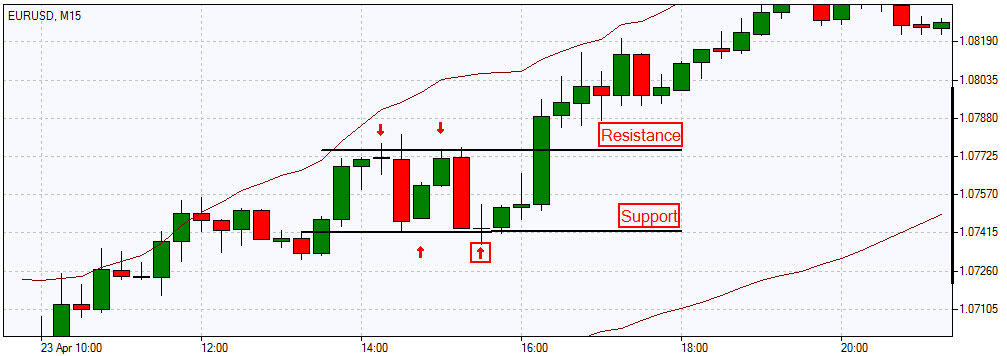

SR levels are conditional areas that each trader allocates individually by the price extremes - minimums and maximums, on a certain timeframe. These areas are often represented as lines, however, to calculate all the risks and correctly place orders, it is still better to depict the SR as areas on the chart.

It should be known that support and resistance lines on different timeframes will be drawn in completely different ways. It's worthy to note that SR lines on large timeframes, such as H1, H4, D1 and larger, are more reliable and less likely to be broken through, the same cannot be said for the SR lines drawn on M1, M5 or M15. There are no specific rules about whether to draw levels by candlestick bodies or by their shadows: experts have not yet agreed on this issue. Learn more about How to draw support and resistance.

Reasons for the formation of Support and Resistance Areas

To understand how Support & Resistance levels are formed and how to use them, we need to analyze the psychological component of this phenomenon. A market trend formation depends on the prevalence of one of three conditional groups in the market:

- Bears (open sell positions)

- Bulls (open buy positions)

- Undecideds (not yet on the market)

Imagine a situation with the price fluctuating in a consolidation area near the support line. Bears sell assets, bulls actively buy, and then the price begins to rise. In such a situation, the bears regret going short, and as soon as the price returns to the support line, they will close their orders to have a chance to break even.

The bulls are happy with this scenario, since their positions get profitable when the price rises, and at the very first correction of the price to the support line, they will go long again, as they believe the price will bounce off the support level one more time. Those traders who haven’t yet opened orders see that the sideways trend has turned upward and consider the moment of price correction and its rebound from the support level the most favorable for placing buy orders.

Thus, we see a clear BUY sentiment among traders at the very first, even slight price movement towards the support line. And when this happens, a huge number of market participants immediately go long, i.e. demand surges sharply, and supply does not keep pace with it, so the price rises as expected. The situation is reversed in the case of the resistance line, where supply rises steeply and demand slips downwards.

With such a common example, we can see a direct relationship between the Supply/Demand ratio and the Support/Resistance levels vector. This is why Support/Resistance lines are often called Supply/Demand levels.

How to trade using support and resistance levels?

We have sorted out the reasons how the S/R areas form. Now let's look at trading strategies based on support and resistance levels. When on the chart the price approaches the support or resistance line, it is expected to either bounce off that line or break it.

So, traders distinguish 3 types of trading based on the Support/Resistance levels: trading based on a rebound from levels (range trading), trading based on a level breakout, and a mixed type of trading (allows you to use both strategies alternately, depending on the current market situation). Let’s consider the two key strategies:

Range Trading

From the example above, it can be seen that with a significant accumulation of bullish potential, as the price approaches the support line, it is more likely that the price will reverse from the level. Then you can go long, placing the stop loss below the support level.

When the price moves towards the resistance line, and bearish sentiments prevail in the market, traders begin to actively open sell orders, as soon as the price reaches the Resistance level. As a result, the price bounces off the level and goes down.

In this case, the stop loss is usually placed above the resistance level. Using a take profit order and trailing stop mode also reduces the risk of losses and helps to fix profits in time. A rebound from levels occurs most often within consolidation (actually, the market is in this phase about 70% of the time), since the price alternately bounces from one level to another, so such trading is quite attractive for scalpers and short-term traders: insignificant profit per trade is compensated by the frequency of orders.

Breakout Trading

With large volumes in the market and a strong trend movement, the price may break through the support or resistance line, instead of reversing from it. Trend traders benefit the most from this price behavior.

- If the price breaks the resistance level from the bottom up, then returns to this level during correction, the price is not always able to punch it from the other side, so it bounces up from the level, forming an upward trend. Thus, after the breakout the resistance line turns into a support line.

- If the price breaks through the support line from top down, and upon returning to this line, the price isn’t always able to break it from the opposite side now, so it ricochets off the level and continues its downward movement, becoming a downtrend. In this case, the support line is transformed into a resistance line after the breakout.

- In some cases, after breaking through the support/resistance level once, the price crosses it back from the opposite side during the correction and returns to the previous price range. It's called a false breakout.

Key Takeaways of Support and Resistance Trading

- Trading based on support and resistance levels is suitable for all types of markets: currency, commodity, stock. Also, it is applicable to any timeframe.

- The principles of such trading are simple and straightforward.

- It is easy to identify support and resistance zones with the help of moving averages and trend lines on any timeframe. They often act as Support/Resistance levels themselves.

- Levels are a universal tool for technical analysis. They are unbiased, since most traders are guided by them.

- The more often a level is tested, the stronger it is considered. However, you need to be extremely careful in order to timely notice changes in the trend and its possible reversal.

- Several false breakouts indicate the stability and strength of the level.

- Fibonacci levels, moving averages of at least two large periods with round numeric values, the Lines algorithm, the PZ and IchimokuSuppRes indicators, Pivot Points, Bollinger Bands, Fractals and many others can help identify the S/R areas.

In conclusion, it’s worth noting that the concepts of Support and Resistance levels are not new in trading; many investors are guided by them and build their strategies accordingly.

However, there are also those who believe that the levels based on old data may be useful in analyzing the market development in the past, but not in predicting the future movements, since there are no guarantees that the market will behave in one way or another, because there are plenty of factors influencing the market, and the behavior of millions of market participants is unpredictable.