- Analytics

- Market Overview

Chances for Fed rate hike over 90% - 13.3.2017

S&P 500 and Nasdaq indices continued advancing last week

US dollar index fell on Friday despite the positive labour market data in US for February.

The US Non-farm Payrolls surpassed the forecasts being 235 thousand. The benchmark was revised up from 227 thousand to 238 thousand. Due to the warm weather the payrolls in real estate showed an increase of 58 thousand which is the record monthly advance in recent 10 years. Investors believe that the US real estate market data will also come out positive. Amid this utilities and construction companies advanced. Strong economic data pushed US stock indices up on Friday. S&P 500 and Nasdaq were advancing for 6th straight week. The chances for the Fed rate hike on March 15, 2017 climbed from 85% to 93%. As a result, financials and banks soared. Nevertheless, US dollar index slumped. Several economic media reported that ECB plans to hike the rate even before the end of QE program. On this background euro rose more than 1% and US dollar weakened. No significant economic news will come out on Monday. US dollar index decline stalled awaiting the rate decision on Monday and Jellen’s speech.

Euro advanced on talks ECB may hike its rate

Euro soared on Friday. The pan-European Euro Stoxx 50 also advanced having hit its high since December 2015.

Commerzbank, Banco BPM and Banco Popular stocks were in highest demand having added about 5% each. Investors were very optimistic about the probable ECB rate hike, as several news agencies reported, but no official approval came out. The ECB meeting took place last Thursday where the regulator decided to undertake any measures to prolong the economic growth in EU. No significant economic data came out in Eurozone on Friday and Monday. Euro corrected down on Monday. Investors worry that it may fall against the US dollar after the Fed rate hike on Wednesday. Moreover, the Reuters polls had a negative impact on the single currency. Most investment banks do not expect the ECB rate to be raised till March 2018. The European QE program shall end in December 2017. European stock indices are on the rise on Monday. Energy and mining stocks become dearer given the slight increase in oil prices and nonferrous metals. The additional positive for the European stock market was the corporate M&A news.

Nikkei hits 15-month high

Nikkei advanced on Friday and Monday together with other world stock indices having hit a 15-month high. Yen got marginally stronger. No significant economic news came out in Japan. The stocks of exporters Toyota Motor, Panasonic and Tokyo Electron and financials Dai-ichi Life, MS&AD Insurance and Sumitomo Mitsui Financial were in demand on Friday. Toshiba Tec (+5,7%) and Toshiba (+3,7%) advanced on Monday on news that Toshiba Tec is sold. This week the Japanese manufacturing production data will come out on Wednesday morning which may weigh on Nikkei and yen

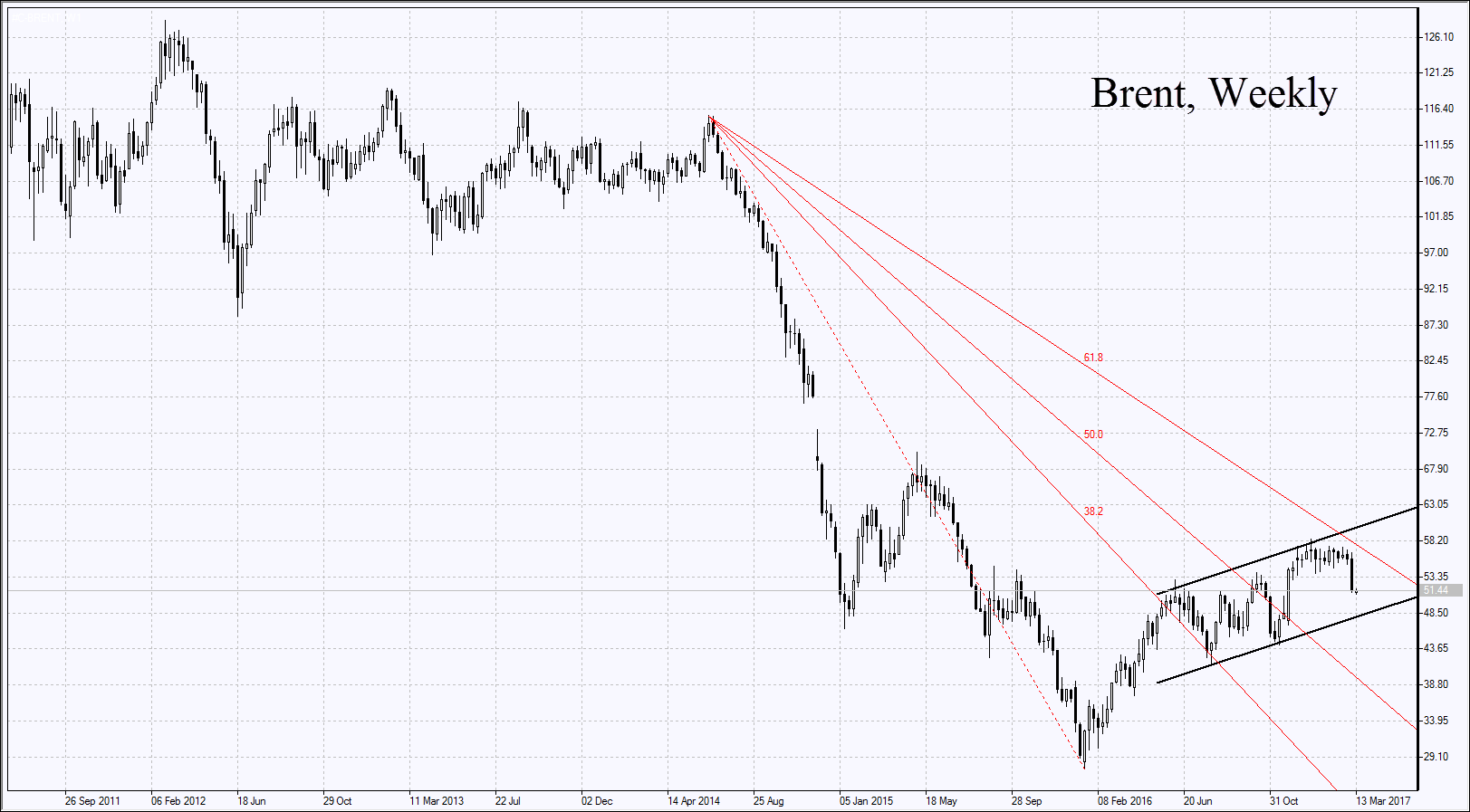

Oil slumped on higher US rig count

Oil hit a 4-month low on Monday as US active rig count increased to 617 from 386 in the same period last year. Meanwhile, according to the official EIA report, the US oil production in 2017 will reach just 300 thousand barrels a day compared to 2016 to 9.2mln barrels a day. The US rig count almost doubled since May 2016 while oil prices remain at about $50 a barrel. At the same time US oil production remained almost unchanged slightly above 8.9mln barrels a day.

See Also