- Analytics

- Market Overview

Fed seen holding policy steady - 1.11.2017

Nasdaq closes at new record high

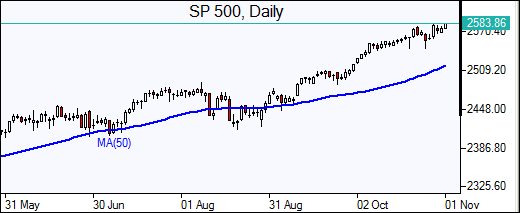

US stocks resumed advances on Tuesday on strong corporate reports. The dollar was little changed: the live dollar index data show the ICE US Dollar index, a measure of the dollar’s strength against a basket of six rival currencies, ended fractionally higher at 94.545. The S&P 500 added less than 0.1% to 2575.26 led by consumer stocks. The broad stock market index gained 2.2% for the month. Dow Jones industrial average rose 0.1% to 23377.24. The Nasdaq composite index rose 0.4% closing at record high 6727.67.

Investors will be watching closely the Federal Reserve interest rate statement today for central bank’s assessment of US economy and inflation scheduled at 14:30 CET. The Fed isn’t expected to change its monetary policy. While majority of policy makers have expressed support for third rate hike this year in December inflation has remained below the central bank’s target 2% level despite improving labor market. Positive economic data also underpinned market sentiment: the S&P/Case-Shiller 20-city home price index rose 0.5% during the three-month period ending in August and was up 5.9% compared with the same period a year ago, following the 5.8% annual gain in the period ending in July. The Chicago purchasing managers index rose to 66.2 in October, the best reading since March 2011.

European stocks rise as euro-zone growth accelerates

European stocks extended gains on Tuesday on reports euro-zone economy grew faster than expected in third quarter. The euro and British Pound added to gains against the dollar. The Stoxx Europe 600 rose 0.4%. German stock market was closed for a bank holiday. France’s CAC 40 closed 0.2% higher and UK’s FTSE 100 added 0.1% to 7493.08. Markets opened 0.1%-0.2% higher today.

Spanish stocks rallied after Catalonia's ousted president Carles Puigdemont agreed to a snap election on December 21 called by Spain's central government to end the crisis. Euro-zone’s statistics agency Eurostat reported euro-zone Q3 GDP grew 2.5% over year instead of expected 2.4% and unemployment fell from 9% to 8.9%, lowest in almost nine years.

Nikkei leads Asian stock indices higher

Asian stock indices are higher today as continuing global economic growth boosted investor risk appetite. Nikkei jumped 1.9% to 22420.08 on weaker yen against the dollar. Chinese stocks are higher: the Shanghai Composite Index is 0.1% higher and Hong Kong’s Hang Seng Index is up 1.0%. Australia’s All Ordinaries Index gained 0.5% despite stronger Australian dollar against the greenback.

Oil higher ahead of US crude stock report

Oil futures prices are rising today on reports OPEC has significantly improved compliance with its pledged supply cuts. Prices rose yesterday on Saudi Crown Prince Mohammed bin Salman’s commitment, made over the weekend, to extend the OPEC production cut agreement with Russia until the end of 2018. The American Petroleum Institute industry group said late Tuesday US crude stocks declined by 7.7 million barrels last week. December Brent crude rose 0.8% to $61.37 a barrel on Tuesday. Today at 16:30 CET the Energy Information Administration will release US Crude Oil Inventories.

See Also