- Analytics

- Market Overview

Senate budget committee passes tax bill - 29.11.2017

US three main indices log fresh records

US stocks ended at record highs on Tuesday as the Senate Budget Committee approved Republicans’ tax plan. The dollar strengthened as Federal Reserve Chair nomine Powell reassured at Senate hearing he would follow the current policy of gradual rate increases. The live dollar index data show the ICE US Dollar index, a measure of the dollar’s strength against a basket of six rival currencies, rose 0.3% to 93.207. The S&P 500 climbed 1% to record 2627.04. Dow Jones industrial average jumped 1.1% to all time high 23836.71 led by financial stocks. The Nasdaq composite index added 0.5% to fresh record high 6912.36.

The Senate Budget Committee voted 12-11 for the Republican tax bill with a full Senate vote planned later this week, possible as early as Thursday. Jerome Powell, President Donald Trump’s nominee to run the Federal Reserve, indicated he expects to stay on the course set by the current Fed chief Janet Yellen. Economic data were mostly positive, adding support to rising market sentiment: the Conference Board’s US consumer confidence index rose to 129.5 in October, its highest reading since 2000, and home prices, measured by the S&P/Case-Shiller national index of house prices, rose 6.2% over year in September, the fastest pace in more than three years. On the negative side the advanced US trade deficit in goods jumped 6.5% to $68.3 billion in October.

Energy stocks lead European markets recovery

European stocks advanced on Tuesday led by energy stocks. The euro extended losses against the dollar while British Pound rebounded. The Stoxx Europe 600 advanced for the first time in three sessions gaining 0.6%. German DAX 30 rose 0.5% closing at 13059.53. France’s CAC 40 ended 0.6% higher and UK’s FTSE 100 jumped 1% to 7460.65. Markets opened mixed today.

The Royal Dutch Shell led advancers after the company upgraded earnings outlook, saying it would cancel dividends paid in shares in lieu of cash payments from the fourth quarter of 2017 and plans to buy back 25 billion worth of shares between 2017 and 2020. Bank of England said Britain’s biggest banks passed its “disorderly” Brexit stress tests including scenarios of a severe recession with a collapse in housing prices, doubling of unemployment and a plunge in the pound.

Nikkei leads Asian indices higher

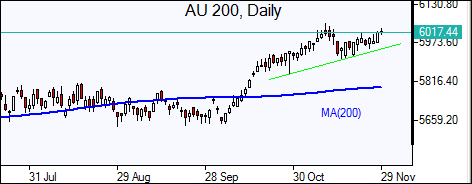

Asian stock indices are mostly higher today shrugging off the North Korean missile launch news. Nikkei rose 0.5% to 22597.20 despite a yen strengthening against the dollar. Chinese stocks are advancing: the Shanghai Composite Index is up 0.1% while Hong Kong’s Hang Seng Index is 0.3% lower. Australia’s All Ordinaries Index added 0.4% with Australian dollar extending losses against the greenback.

Oil lower on expected US crude build

Oil futures prices are extending losses today on doubts OPEC and Russia will agree on extending a crude production cuts deal on November 30. Prices fell yesterday weighed by the American Petroleum Institute industry group report US crude stocks rose by 1.8 million barrels last week. January Brent fell 0.4% to $63.61 a barrel Tuesday. Today at 16:30 CET the Energy Information Administration will release US Crude Oil Inventories.

See Also