The US dollar started the week on negative way following US stocks negative close as well as on weaker than expected releases on Friday concerning personal income and spending, nonetheless Chicago PMI was at 58.7 for May, beating estimates of 50.3. The S&P 500 lost by 1.43% to 1630.74 and

Dow Jones closed lower by 1.36% losing more than 200 points on Friday. The US dollar index retraced on Friday to resistance at 83.57 but then dropped weighed by weaker than estimated economic news.

During the weekend China released it Manufacturing PMI at 50.8, above 50 mark and better than projected at 49.9. The latter underpinned the Aussie against the US dollar pair to open higher on Monday and advance further away from more than a year low at 0.9527, currently is trading around 0.9633. Chinese better than expected PMI somewhat calms down concerns about the biggest export partner of Australia coupled by Gold’s attempt to recover from recent low at 1385.03 towards 1400. However the Non-Manufacturing May PMI for China was at 54.3, lower than previous at 54.4 limiting recently established upside momentum.

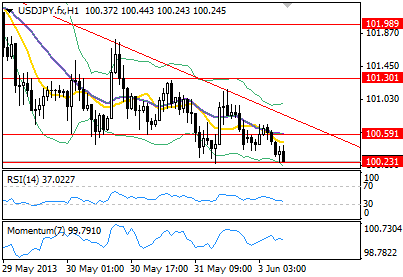

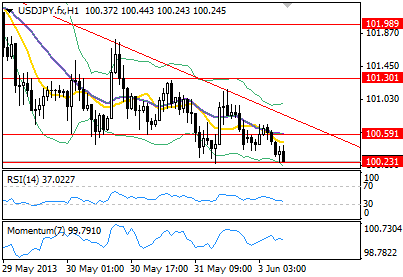

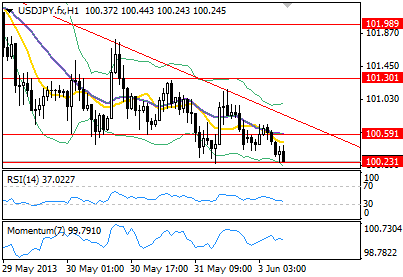

In Asia equities trading session indices were heavier following US stocks trading on Friday with NIKKEI 225 opening lower and closing even lower, losing by 3.72% to 13261.82. NIKKEI was likely affected by weaker CNY Non-Manufacturing PMI, at the same time Hang Seng dropped by 0.15% and Shanghai Composite was also in red light. The greenback against the Japanese Yen is in a downtrend maintaining correlation with NIKKEI and at the time being is approaching near psychological support at 100, it was lastly seen at 100.24.

Looking ahead, highly expected news for this week are US Unemployment Claims due to be released on Friday together with Unemployment Rate and could influence FED decision on path to follow for QA. In addition RBA on Tuesday ahead of ECB and BOE on Thursday monetary policies are highly watched.