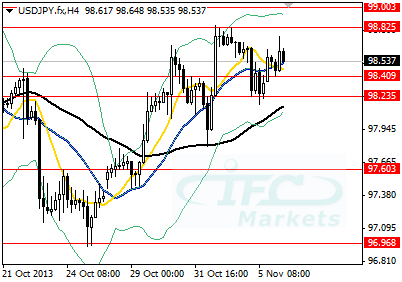

During overnight the

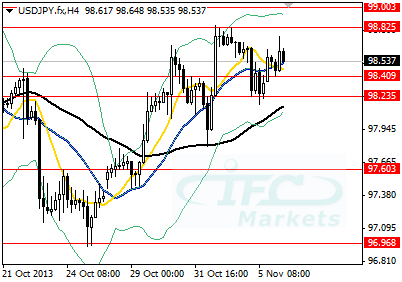

US dollar against the Japanese Yen jumped from 98.40 to 98.74 backed by

NIKKEI 225 rise of 0.79%. Bank of Japan meeting minutes release last night showed that the central bank is concerned about Fed policy on asset purchases, a decision to start asset tapering would cause capital outflows from emerging markets and that in turn would hurt Japan in terms of exports. Therefore, investors consider that as an indication of more dovish attitude by BoJ. In our opinion breaching resistance at 99.00 could strengthen upside bias.

USDJPY

The Euro pushed higher to 1.3521 from support at 1.3447 against the greenback after Japan’s developments increased investors’ confidence. In addition the common currency versus the Japanese Yen recovered from 132.38 to 133.44 as improvement in risk sentiment underpinned the currency pair ahead of ECB. Investors demand on Euro is however limited due to caution on ECB possible monetary stance shift, towards more dove.

October CPI dropped to 0.7% in annual terms in an announcement the previous week spreading concerns that ECB could cut deposit rate to below zero levels. Although the majority of market participants are not expecting any rate cut there is some expectation that ECB would signal further monetary easing at its meeting in December. We would expect the

EURUSD to continue its fluctuation in 1.3521/1.3447 recently created range.

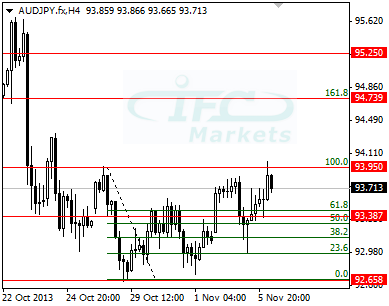

Elsewhere, the Aussie was underpinned earlier today contra US dollar by improving trade data but was contained by upside hurdle at 0.9521. At the same time the

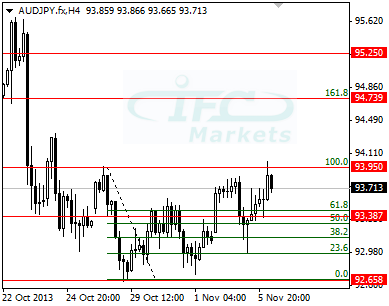

AUDJPY formed a reverse

Head & Shoulders trading pattern and for a moment edged above the neckline at 93.95. We would closely monitor the pair and follow another break out of 93.95 with initial target at 94.73.

AUDJPY

On the data front, we are monitoring today UK Manufacturing and Industrial Production, EZ Retail Sales, later on Canadian Building Permits and lastly, concerning equities, Toyota Motor would release its Q2 EPS estimated at $2.15.