- Analytics

- Market Overview

Currency market dynamics turn out in line with our expectations - 6.1.2014

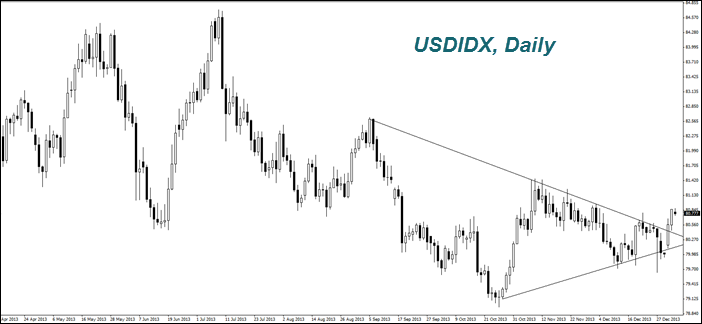

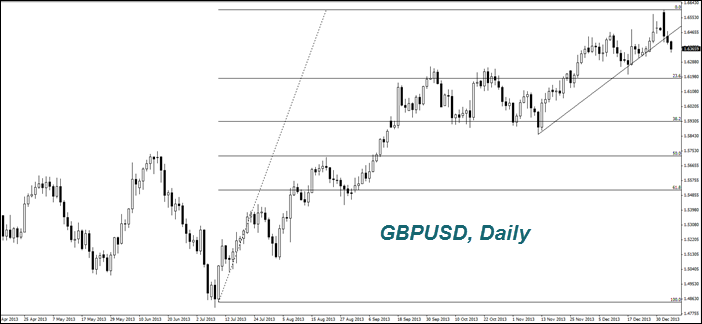

Today, we expect a lot of important statistics. You can read more about this on our website in the "Economic Calendar" section. However, we note the most important events. Services PMI for the UK will be announced at 9-30 GMT ( 0). Eurozone inflation data for December comes out at 13-00 GMT ( 0). In our opinion, the preliminary forecasts for both the pound (GBPUSD) and Euro (EURUSD) are negative, but GBP can be stronger. The USA services PMI for December and industrial orders for November will be found out at 15-00 GMT (0). Both indicators are expected to be positive. We do not exclude increased volatility in the forex market. The fact is that this week, the ECB and the Bank of England meeting will be held on Thursday. Attention of investors will be stuck to results of those meetings. Now most of the market participants believe that the interest rates will remain unchanged. The FOMC Minutes are expected on Wednesday. It is less important event, as it is not supposed to change key parameters. Australian Dollar (AUDUSD) strengthened on expectations that economic data will come out positive. According to forecasts, the trade deficit in November will be reduced to A $ 300 million and retail sales will grow by 0.4% compared to October. Australian data will be released on Thursday.

See Also