- Analytics

- Market Overview

FED MEETING MINUTES HAVE NOT YET SUPPORTED THE DOLLAR - 1.2.2018

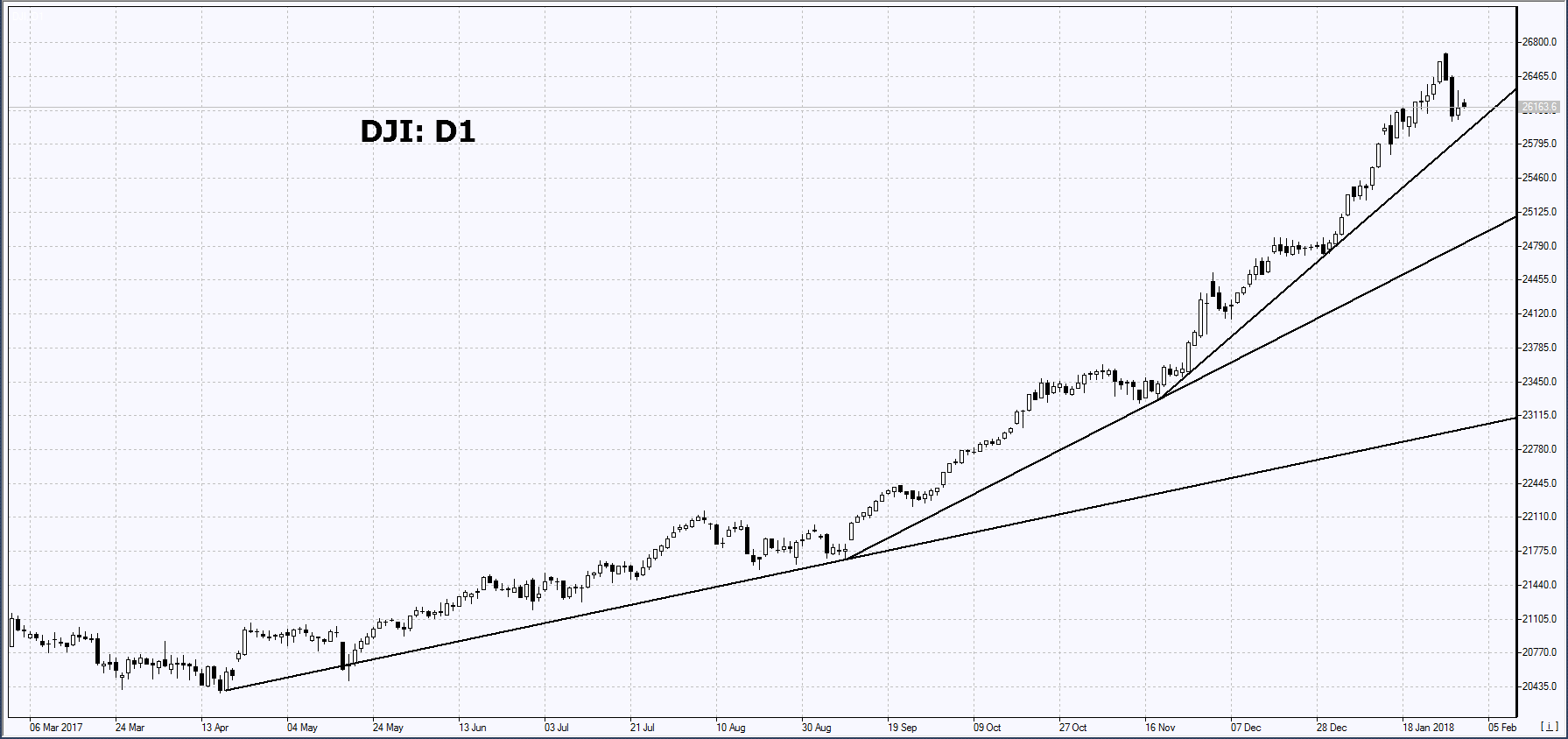

On Wednesday, US stock indices slightly rose

Investors reacted to the positive economic statistics and corporate reports

According to the ADP report, the number of jobs in the US increased more than expected in January 2018. The official US labor market data will come out on Friday and, are most likely to be positive. Boeing published a positive earnings report for the Q4 of the last year and a positive forecast for 2018. Its stocks have risen by almost 5% and contributed to the growth of the entire aerospace sector. Investment banks and brokerage companies raised the net profit forecast of the list of the companies in S&P 500 to 13.7% for the Q4. Before the start of the reporting season, the growth forecast was only 12%. About 190 companies in S&P 500 have already reported. The profit of 80% of them exceeded forecasts. Yesterday the Fed meeting took place. As expected, rates remained at the same level of 1.25-1.5%. According to the meeting minutes, there is a rate hike possibility in 2018. However, market participants do not expect the new Fed President Jerome Powell to rush in the tightening of the monetary policy. The US dollar index remained almost unchanged and is still close to its 3-year low. Investors expect a future increase in rates and the tightening of the monetary policy in the eurozone, Japan, Britain and other countries. On this background, the Fed actions should be more decisive, so that the dollar starts to noticeably strengthen. However, its dynamics may be affected by economic data. In particular, today the ISM Manufacturing PMI for January, as well as construction expenditure for December will be published in the US.

On Wednesday, European stocks slightly decreased

Ericsson quotes fell by almost 10% because of the weak earnings report and the forecasts of a decline in Chinese sales. However, the market was supported by low inflation in the eurozone.

According to preliminary estimates, inflation was 1.3% in January, which is much lower than the target level of 2%. The weak growth of consumer prices may contribute to preserving the monetary stimulus policy for the European economy. This is a positive factor, but the stock market dynamics was influenced by the weak earnings reports by the debt collection company Intrum Justitia (stocks fell by 8.9%), clothing chains’ stores H&M (-10.6%) and outsourcing company Capita (-47%). This morning, European stock indices were growing alongside with the US futures. Facebook raised its profit forecast. In addition, today the positive earnings reports of Nokia, Roche, Unilever and Dassault Systѐmes were published. Today no significant economic data in the eurozone are expected. Today the euro has been growing slightly amid the dollar weakening. However, it is below the psychological level of 1.25. In January, the euro rose by 3.5% and updated its 3-year high.

Today Nikkei has increased for the first time after a 6-day drop

This was mainly contributed by positive corporate information. The stocks of Fujifilm Holdings went up by 12% after the report that it is going to take over the US Xerox Corp in a $6.1 billion deal. Sumitomo Mitsui Financial Group and Mizuho Financial Group published positive quarterly earnings reports and their stocks gained 4.4% and 2, 2%, respectively. Hino Motors raised its earnings forecast and its quotes soared by 8%. In addition, the growth of the Japanese Manufacturing PMI for January had a positive impact. The yen advanced against the US dollar by 3.1% in January. However, today it has been weakening for the second consecutive day, which has a positive impact on the stocks of the Japanese exporters. The main reason for the weakening of the yen is the increase in the volume of the Bank of Japan buy-out of the mid-term Japanese government bonds. Today the Hong Kong index Hang Seng fell amid the negative dynamics of the Chinese stock market. Shanghai Composite has been down for the fourth consecutive day.

Brent rose on Wednesday after the data publication on the reserves.

According to the official data by the U.S. Energy Information Administration, the US oil reserves increased by 6.8 mln barrels after a 10-week continuous decline. This news was offset by an unexpected drop in gasoline reserves by 2 mln barrels. The US oil production rose in November and exceeded 10 mln barrels per day for the first time since 1970. At the same time, OPEC reduced its total production in January due to the economic problems in Venezuela. Today, oil continues to advance due to the statement by the Chinese company Sinopec Group that this year the consumption of petroleum products in China will increase by 3%.

Today the wheat and corn quotes continue to correct down. Market participants expect the weather to improve in the US and Argentina.

See Also