- Analytics

- Market Overview

Rising oil buoys global risk appetite - 16.5.2017

SP 500 and Nasdaq close at record highs

US stocks advanced on Monday led by energy stocks following higher oil prices. The dollar weakened: the live dollar index data show the ICE US Dollar index, a measure of the dollar’s strength against a basket of six rival currencies, fell 0.3% to 98.895. The Dow Jones average rose 0.4% to 20981.94, led by Cisco and Johnson & Johnson, up 2.3% and 2.7%respectively. S&P 500 gained 0.5% settling at 2402.32, a fresh record high. The Nasdaq composite index added 0.5% closing at record high 6149.67.

Stocks advanced despite a disappointing Empire State manufacturing report: the Empire State manufacturing index for May fell to negative 1, indicating contraction, from positive 5.2 in April. Treasury yields remained higher after the National Association for Home Builders reported the Housing Market Index hit 70, its second highest reading since 2008. A reading above 50 indicates growth. US broad market rebounded after Friday’s retreat following disappointing April retail sales and inflation. Today at 14:30 CET April Housing Starts and Building Permits will be released in US. The tentative outlook is positive for the dollar. At 15:15 CET April Industrial Production will be published, the outlook is negative.

Commodity stocks lead European equities higher

European stocks managed to extend gains on Monday led by commodity shares. Both the euro and British Pound strengthened against the dollar. The Stoxx Europe 600 index added 0.1% in a choppy trade. The DAX 30 rose 0.29% to close at 12807.04. France’s CAC 40 added 0.22% and UK’s FTSE 100 outperformed gaining 0.3% to record high 7454.37.

Energy shares led the advance, followed by basic materials and financial stocks. Tullow Oil gained 3.1%, and Statoil rose 2.1%. Mining majors Antofagasta and BHP both rose 2.3%. German utility RWE jumped 3.9%, lifting German stock index as the company announced it will pay a 50 cent dividend in 2017, first dividend payment since 2015. Today at 10:30 CET April inflation data will be released in UK, the tentative outlook is positive for British Pound. At 11:00 CET May ZEW survey results for Germany and euro-zone will come out. At the same time euro-zone first quarter preliminary GDP will be published. The outlook is positive for euro.

Asian markets advance on China’s pledge of 100 billion financing for “One Bent, One Road” program

Asian stock indices are rising today led by Chinese stocks as investor risk appetite was boosted after China’s President Xi Jinping announced more than $100 billion financing for China’s “One Bent, One Road” infrastructure program. Nikkei ended 0.25% higher at 19919.82 today with yen retreating against the dollar. Chinese stocks are higher as investors shrugged off weak data as growth in retail sales, industrial production and fixed asset investment slowed in April: the Shanghai Composite Index is up 0.75%, while Hong Kong’s Hang Seng Index is 0.2% lower with share valuations at historical highs in thin trading. Australia’s All Ordinaries Index is up 0.24% buoyed by commodity shares despite stronger Australian dollar against the greenback.

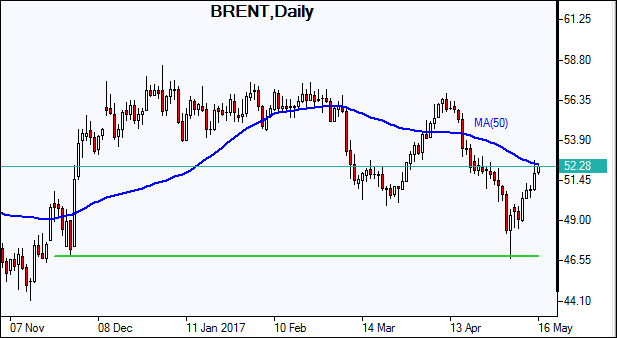

Oil prices rally on Saudi-Russia support of output cut extension

Oil futures prices are extending gains today after energy ministers from Saudi Arabia and Russia announced on Monday they support an extension of supply cuts until the end of March 2018. The Organization of the Petroleum Exporting Countries (OPEC) and major producers agreed last year to cut output by 1.8 million barrels per day (bpd) in the first half of 2017. The 12 remaining OPEC members and other producers participating in the cuts will meet on May 25 and an extension of output cuts will help balance the global oil market suffering from supply glut. Kuwait's oil minister said today that his country supported the Saudi-Russian initiative. US bank Goldman Sachs retained its average Brent price forecast for the third quarter of 2017 at $57 per barrel citing likely increases in output by OPEC members who were exempt from the cuts or producers who suffered supply disruptions like Libya and Nigeria. July Brent crude gained 1.9% to settle at $51.82 a barrel on Monday on London’s ICE Futures exchange.

See Also