- Analytics

- Market Overview

Global stock indices generally rose on Friday - 30.6.2014

Global stock indices generally rose on Friday. The U.S. consumer confidence index from the University of Michigan coincided with a positive outlook. The Russell Agency has revised its composition of indices. Because of this, investment funds rebalanced their "portfolios" and the trading volume on the U.S. exchanges on Friday soared to 8.9 billion shares. This is much higher than the average monthly level of 5.6 billion.

The biggest loser on the list of the Dow and S&P 500 is DuPont (DD), having its shares fallen by 3.5%. It lowered the operating profit forecast for entire 2014 from $4.1 to $4 per share. Recall that we will see the corporate reports in the United States for the Q2. This will affect the stock market growth. To justify the S&P500 growth by 6.1% the corporate return is required. Otherwise, we will see the downward correction. The current current earnings per share (P/E) reached the pre-crisis peak of 2008 that is 15.9 for the S&P500 as an average. According to Reuters, most American analysts are very optimistic and they expect the growth of the total corporate income of the companies out of S&P500 by 9.1% for this year. According to them, the index should reach 2000 points and the Dow has to be at 17275 points. The growth forecast for the next year is 2053 and 18000, respectively. We believe that the increase in the indexes will depend on the financial corporative performance. Their targets are set taking the expected S&P500 dividend yield equal to 2% into account. This is below the ten-year U.S. government bonds yield at 2.62%. Accordingly, the difference and risk should be compensated with the price growth. The government bonds in the U.S. are considered as a risk-free asset. Today we will see pretty much important economic data in the U.S.: Chicago PMI (PMI) for June at 13-45 in CET and unfinished estate transactions for May at 14-00 CET. The forecast for the second indicator is positive. We do not exclude that now it can be more than the PMI and may support the quotes.

European stock indexes are rising in anticipation of the inflation data from the EZ for June at 9-00 CET. It is expected to remain at a relatively high level for May. This will reduce the deflation risk. Note that there were in the negative retail sales coming out in Germany in the morning, but investors have ignored them.

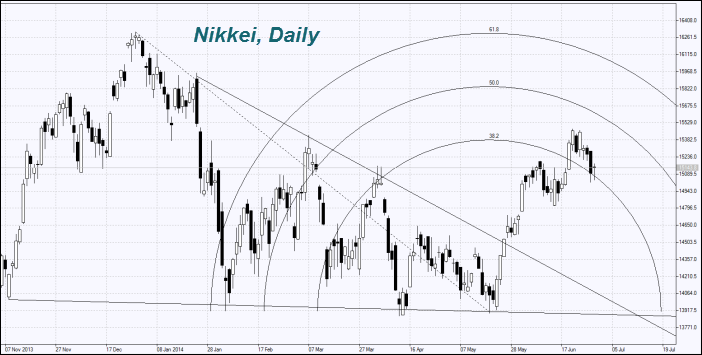

The Nikkei rose slightly after significant decline on Friday. The Industrial Production in Japan for May rose by 0.5% after falling by 2.8% in April due the sales tax increase. A significant price fall was prevented by the contraction of new buildings on the real estate market in May. At night time, we will see a bunch of economic indicators (Tankan) at 23-50. At 1-35 CET, it will be declared about the final PMI Manufacturing for June. We believe that the predictions of these indicators are broadly neutral.

Today, we will see the USDA quarterly crop report in the U.S. at 16-00 CET. The Q2 Wheat spot price had fallen to the maximum 3-years by 16.4%. The Wheat stocks are expected to melt down to a minimum of six years - 598 million bushels. Investors believe that it will be compensated by a large harvest in other countries. The USDA also predicts a drop in soybean stocks to a minimum for the past 37 years - 378 million bushels. The maize stocks, in contrast, can grow up to the 4-year high of 3.72 billion bushels. Recall forecast data on June 1st from the USDA for wheat, corn and soybeans: 0.718 million bushels, 2.766 billion and 0.435 million, respectively. As we can see, the forecast for the U.S. corn stocks increased and on other crops are reduced. Most likely, the quotes will heavily depend on the harvest and weather for other countries.

The Cocoa price updated the maximum of 32 months. The International Cocoa Organisation expects that the global deficit will be at 1,415 million in 2012/2013 despite the production increase in beans in Côte d'Ivoire in the season 2013/2014 to 1.7 million tons, the global deficit will still be 75 tons. Previously, it was projected in the amount of 115 thousand tons. The reduction is planned, but not as significant as the crop growth. This testifies to the high chocolate demand. The forecast of world cocoa production increased by 58 tons to 4.16 million tons.

News

Will Gold Keep Rising

Since 2020 gold price climbed more than 230% at the same time central banks started one of the biggest buying waves in decades....

TikTok is Being Gutted for AI Data and Advertisers

TikTok is no longer the company it once was. From a creator centric social hub it turned into a data collecting and selling...

S&P 500 Outlook: Valuations, Real Yields, and the AI Hype

S&P 500, as we all have been saying too many times, is moving mostly because of a small group of very large tech companies...

Crypto Liquidations Domino Effect

Crypto market just went through a sharp sell-off over the weekend Bitcoin briefly fell below key support level before bouncing...

Paramount Skydance is After CNN

Paramount Skydance is going after Warner Bros. Discovery. They’ve filed a lawsuit in Delaware and are getting ready to...

GM and Ford Are Pulling Back From EVs

General Motors and Ford are quietly stepping back from the aggressive EV plans they were pushing just a few years ago. This...

Explore our

Trading Conditions

- Spreads from 0.0 pip

- 30,000+ Trading Instruments

- Stop Out Level - Only 10%

Ready to Trade?

Open AccountSee Also