- Analytics

- Market Overview

US indices hit yearly highs; European and Asian indices still need progress - 27.8.2014

World stock markets continued to grow on Tuesday. The US indices renewed the yearly highs, but European and Asian indices have a long way to go to do it. Macroeconomic indicators of the American economy appeared to be very positive and outperformed significantly the forecasts. Durable Goods Orders in July upped 22.6%.

Boeing has signed contracts for construction of 324 aircrafts this month. Out of them 150 aircrafts are being constructed for Emirates airline from Dubai. Due to an increase in Durable Goods Orders, the bank Morgan Stanley raised its growth outlook for the US GDP in the third quarter by 0.5%, to 3.5% YoY, and the bank Barclays – by 0.3% to 2.7%. The Consumer Confidence Index in August reached the highest level since October 2007 and amounted to 92.4 points. This information has become a positive factor for investors. Meanwhile, in our opinion, the US stock market may look a bit “overheated” at the current performance levels. If the S&P 500 value is above 2000 points, the dividend yield is 2%. This is lower than the yield of 10-year US government bonds at 2.63%. Previously, most investors believed that this index would reach 2000 points only by the end of the year, when the financial statements of corporations are released not only for the second, but for the third quarter as well. Now they expect the S&P 500 could reach 2100 points by the end of the year, and it is only +5% to its current level. In this case, the total profit growth of corporations included in its list should reach at least 9.1% in order to justify such a high performance level of the index from a fundamental point of view. In our opinion, it will not be easy to achieve this level, since the average GDP growth forecast in the United States this year is considerably lower and makes up 2.9%. However, the complete annual data will be released only in the first quarter of 2015. In theory, a relatively low volume of trading amid the “rally” can be explained by the uncertainty of some investors. The volume of trading on the US stock exchanges was 4.25 billion stocks yesterday, which is 22% lower than the monthly average. The US significant macroeconomic data is not expected today.

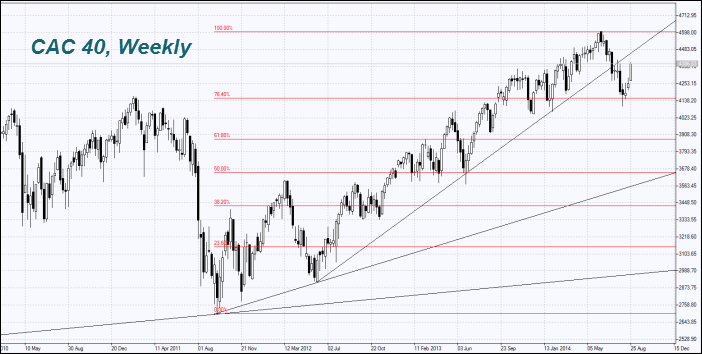

European stock indices have showed a slight downward correction today after the rapid 2-day growth, the highest since April. German Consumer Confidence Index for September has come out in the morning, which fell for the first time in half of the year. There was no economic data in the EU yesterday, and stock indices rose following the global trend. Nikkei is showing a slight retracement in the absence of significant macroeconomic or corporate information. We believe that market participants are not in a hurry to take risks, before the release of important data on inflation, unemployment, and other indicators, which will be released late Thursday night.

Coffee prices went on rising amid the expectations of the crop reduction in Brazil, as it was mentioned in the previous overview. National Coffee Council joined the German company Neumann, which lowered its production forecast of Brazilian coffee since 47.7 million to 45 million bags in 2015/2016.

Sugar prices boosted after the association Unica lowered the crop forecast of harvest sugar cane in Brazil to 546 million tons in 2014/2015, from 580 million, specified in the April overview. Due to this fact, the sugar production in the country can be reduced to 31.4 million tons, from 32.5 million tons. Note that according to International Sugar Organization, the global demand should outpace the sugar supply for at least 3-4 million tons in order to recover sugar prices. Now the excess only amounts to 1.3 million tons. Let us remind you that the sugar prices tumbled about 50% from its 30-year high in 2011. According to USDA, the world reserves have reached a record level of 45.5 million tons by the beginning of September. Therefore, the USDA does not expect a sharp rise in sugar prices. But in theory, it is possible in the future. The sugar imports into Indonesia this year is to be increased by 29%, to 3.6 million tons, according to Indonesian Sugar Refiners Association. In this case, the sugar consumption will reach 5.7 million tons and can grow up to 7 million tons in the next two or three years.

See Also