- Analytics

- Market Overview

US markets slip after Fed minutes - 18.10.2018

Dollar boosted after Fed minutes

US stocks pulled back on Wednesday after the release of minutes from the Federal Reserve’s September meeting. The S&P 500 slipped 0.03% to 2809.21. The Dow Jones industrial average lost 0.4% to 25706.68. Nasdaq composite index edged 0.04% lower to 7642.70. The dollar strengthening accelerated as minutes revealed policy makers supported gradual rate increases despite President Trump’s criticism of Fed’s rate hikes policy: the live dollar index data show the ICE US Dollar index, a measure of the dollar’s strength against a basket of six rival currencies, rose 0.6% to 95.621 and is higher currently. Futures on stock indices indicate mixed openings today.

The dollar gained and Treasury yields ticked higher despite data showing housing starts fell in September compared with the same period a year ago while permits for construction rose.

No Brexit breakthrough weighs on European indices

European stocks resumed the slide on Wednesday ahead of Brussels European Union summit on Brexit in the evening. The GBP/USD joined EUR/USD’s slide as UK inflation slowed more than expected in September. Both pairs are lower currently. The Stoxx Europe 600 lost 0.4%. Germany’s DAX 30 fell 0.5% to 11715.03. France’s CAC 40 slid 0.5% and UK’s FTSE 100 slipped 0.1% to 7054.60. British Prime Minister Theresa May urged her European Union counterparts to get creative in resolving disagreements on customs arrangements on border between Northern Ireland and the Republic of Ireland after Brexit. Markets opened mixed today.

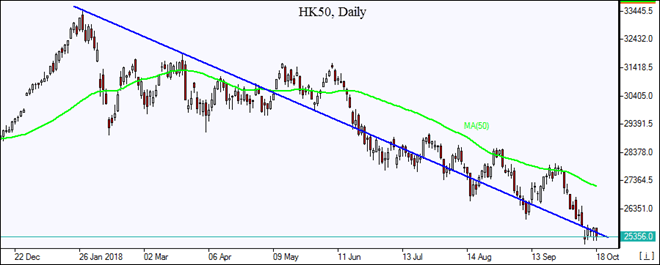

Chinese stocks lead Asian indices losses

Asian stock indices are mostly in red as uncertainties about US-China trade dispute weighed. Nikkei fell 0.8% to 22658 as Japan’s exports drop in September for the first time in nearly 2 year and yen turned higher against the dollar. China’s stocks are falling despite US government refraining to name China as a currency manipulator : the Shanghai Composite Index is down 3% and Hong Kong’s Hang Seng Index is 0.6% lower. Australia’s All Ordinaries Index however added still 0.1% as Australia's unemployment fell sharply while the Australian dollar turned higher against the greenback.

Brent lower on US inventories build

Brent futures prices are extending losses today while supported by supply tightening concerns as Iranian oil exports have been falling more steeply. Prices fell yesterday after the Energy Information Administration report that US crude stockpile rose 6.5 million barrels last week, the fourth straight weekly build. Yesterday the American Petroleum Institute reported that US crude supplies fell 2.1million barrels last week. Prices fell: December Brent crude lost 1.7% to $80.05 a barrel on Wednesday.

See Also