- Analytics

- Technical Analysis

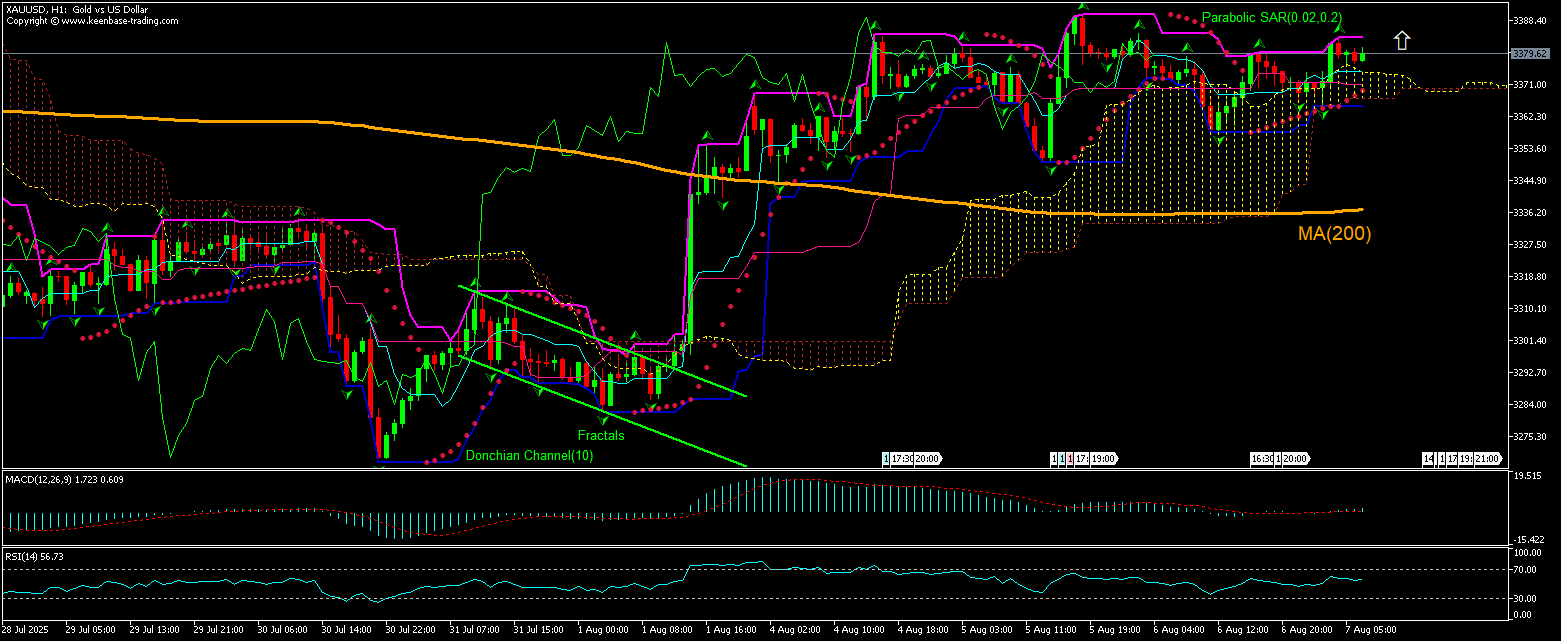

XAU/USD Technical Analysis - XAU/USD Trading: 2025-08-07

Gold Technical Analysis Summary

Above 3383.91

Buy Stop

Below 3365.23

Stop Loss

| Indicator | Signal |

| RSI | Neutral |

| MACD | Buy |

| Donchian Channel | Neutral |

| MA(200) | Buy |

| Fractals | Neutral |

| Parabolic SAR | Buy |

| Ichimoku Kinko Hyo | Buy |

Gold Chart Analysis

Gold Technical Analysis

The technical analysis of XAUUSD price on the 1-hour timeframe shows XAUUSD,H1 is rebounding to upper bound of trading range above the 200-period moving average MA(200) which is tilted upward. We believe the bullish momentum will continue after the price breaches above the upper Donchian boundary at 3383.91. This level can be used as an entry point for placing a pending order to buy. The stop loss can be placed below 3365.23. After placing the pending order the stop loss is to be moved every day to the next fractal low indicator, following Parabolic signals. Thus, we are changing the expected profit/loss ratio to the breakeven point. If the price meets the stop-loss level (3365.23) without reaching the order (3383.91) we recommend cancelling the order: the market sustains internal changes which were not taken into account.

Fundamental Analysis of Precious Metals - Gold

African banks are increasing their gold purchases. Will the XAUUSD rebound continue?

Central banks in sub-Saharan Africa are accelerating their gold purchases against the background of rising geopolitical risks around the world. Ghana, which has launched its domestic gold purchasing program, is leading the trend. Both the volume and the value of the West African country’s gold reserves have surged, according to BMI, a unit of Fitch Group. Ghana's total gold holdings have risen 255% from 8.7 tonnes to over 31 tonnes between the second quarter of 2022 and the first quarter of 2025. And earlier this year, Ghana signed an agreement with nine mining companies to directly purchase 20% of their gold output at a 1% discount to the London Bullion Market Association (LBMA) price. Burkina Faso government has nationalized gold mines and established a National Gold Reserve with the goal of stockpiling a minimum of 5% of annual domestic production. Nigeria launched its own national gold purchase program last year, while Zimbabwe recently relaunched a gold-backed currency, the Zimbabwe Gold, in an effort to stabilize the country’s financial system. Rising demand for gold under high geopolitical uncertainty is bullish for XAUUSD.

Explore our

Trading Conditions

- Spreads from 0.0 pip

- 30,000+ Trading Instruments

- Stop Out Level - Only 10%

Ready to Trade?

Open Account Note:

This overview has an informative and tutorial character and is published for free. All the data, included in the overview, are received from public sources, recognized as more or less reliable. Moreover, there is no guarantee that the indicated information is full and precise. Overviews are not updated. The whole information in each overview, including opinion, indicators, charts and anything else, is provided only for familiarization purposes and is not financial advice or а recommendation. The whole text and its any part, as well as the charts cannot be considered as an offer to make a deal with any asset. IFC Markets and its employees under any circumstances are not liable for any action taken by someone else during or after reading the overview.