- Analytics

- Market Overview

Positive manufacturing data lift markets - 4.1.2017

ISM Manufacturing index hits highest level in two years

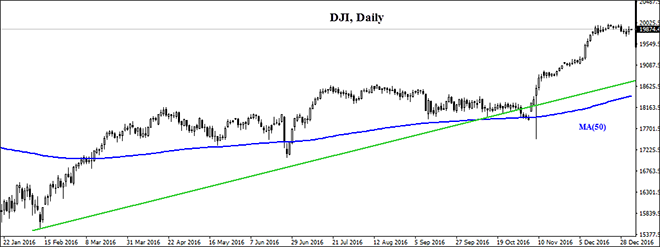

US stock market closed up on Tuesday in the first trading session of 2017 while oil prices dropped. The dollar strengthened on stronger than expected manufacturing data: the live dollar index data show the ICE US Dollar index, a measure of the dollar’s strength against a basket of six rival currencies, closed 0.4% higher at 103.229. The Dow Jones industrial average gained 0.6% closing at 19881.76 with Nike and Verizon shares the biggest gainers in the blue chip index. The S&P 500 rose 0.9% settling at 2257.83 led by telecom and health care stocks. The Nasdaq index gained 0.9% to 5429.08.

Stocks rose on positive economic data resuming the uptrend which stalled last week as the S&P 500 pulled back 1.1%. The Institute for Supply Management reported the Manufacturing PMI climbed to the highest level in two years at 54.7% in December from 53.2% the previous month. Meanwhile, construction spending was also above expectations rising 0.9% in November and the sixth increase in the past seven months. Today at 13:00 CET Mortgage Applications will be released by the Mortgage Bankers’ Associations in US. And at 20:00 CET Federal Reserve releases minutes from December 13-14 FOMC interest rate meeting.

Positive Chinese and US data boost European markets

European stocks extended gains on Tuesday as market sentiment was bolstered by positive Chinese and US manufacturing data. The euro fell against the dollar touching the lowest level in nearly 14 years while the British Pound strengthened after the UK Manufacturing PMI for December jumped to a 30-month high. The Stoxx Europe 600 climbed 0.7% as mining and energy shares advanced on report China’s Caixin Manufacturing PMI in rose to 51.9 in December from 50.9 in November, indicating economic growth in the world’s second largest economy and a major user of natural resources continues. Germany’s DAX 30 underperformed slipping 0.1% to 11584.24. France’s CAC 40 index gained 0.4% and UK’s FTSE 100 index rose 0.5% to 7177.89 a fresh record high.

Shares of Tullow Oil jumped 5.6%, and miner Glencore advanced 2.9%. Bank stocks extended gains as global banking regulators failed to agree on the minimum amount of capital banks must hold and postponed the approval of rules which would tighten regulatory environment. Shares of Credit Suisse and Bank of Ireland were also among top STOXX gainers rallying 6.4% and 6.8% respectively. In other economic news German jobless claims dropped by 17000 in December and the unemployment rate remained at a record low. Today at 10:30 CET Construction PMI for December and November Loans for House Purchases by British Bankers' Association will be published in UK, the outlook is negative for Pound. At 11:00 CET advance Consumer Price Index for December will be released in euro-zone, the outlook is positive for euro.

Nikkei outperforms Asian indexes

Asian stocks are advancing today with investor confidence buoyed by positive data from US, China and Europe. Nikkei jumped 2.5% to its highest level since December 2015 at 19594.16 with weaker yen lifting exporter stocks. A higher than expected Manufacturing PMI indicating expansion in Japanese manufacturing sector also supported the market sentiment as the index rose to 52.4 in December from 51.3 in November, the highest reading since December 2015. A reading above 50 indicates expansion. China's insurance regulator launched new rules on Wednesday to tighten insurers' compliance management systems. Chinese stocks are mixed with the Shanghai Composite Index up 0.8% while Hong Kong’s Hang Seng index is 0.2% lower. Australia’s All Ordinaries Index gained 0.1% helped by higher commodities with Australian dollar strengthening against the dollar.

Oil prices steady

Oil futures prices prices are steady today as Saudi Arabia is expected to raise official selling price for all its crude grades to Asia in February. Prices ended sharply lower on Tuesday on reports Libya, which is a member of Organization of the Petroleum Exporting Countries but was exempt from the cartel’s deal to cut output, has been ramping up output. Stronger dollar also weighed on oil prices making it more expensive for users of other currencies. March Brent on the ICE Futures exchange in London dropped 2.4% to $55.47 a barrel on Tuesday.

News

Why China Wins When Oil Prices Spike

Key Takeaways The Paradox - China's import dependence doesn't translate to vulnerability The Stockpile Advantage - the 1.13-2M...

Will Gold Keep Rising

Since 2020 gold price climbed more than 230% at the same time central banks started one of the biggest buying waves in decades....

TikTok is Being Gutted for AI Data and Advertisers

TikTok is no longer the company it once was. From a creator centric social hub it turned into a data collecting and selling...

S&P 500 Outlook: Valuations, Real Yields, and the AI Hype

S&P 500, as we all have been saying too many times, is moving mostly because of a small group of very large tech companies...

Crypto Liquidations Domino Effect

Crypto market just went through a sharp sell-off over the weekend Bitcoin briefly fell below key support level before bouncing...

Paramount Skydance is After CNN

Paramount Skydance is going after Warner Bros. Discovery. They’ve filed a lawsuit in Delaware and are getting ready to...

Explore our

Trading Conditions

- Spreads from 0.0 pip

- 30,000+ Trading Instruments

- Stop Out Level - Only 10%

Ready to Trade?

Open AccountSee Also