- Analytics

- Market Overview

Some of the market participants must be taking profit ahead of a long weekend - 28.8.2014

The growth of world market indexes stopped on Wednesday due to absence of substantial macroeconomic information on Europe and USA. Some of the market participants must be taking profit ahead of a long weekend. The American exchanges will be closed on Monday for the Labor Day national holiday. The investor activity has stayed low. Yesterday 4.05 billion stocks changed hands, which is 25% lower than the average monthly number.

At 12:30 CET today important economic data has to be released: the second estimate for second-quarter U.S. Gross Domestic Product and weekly Unemployment Claims. In our opinion, the preliminary forecasts are neutral. Therefore a noticeable market reaction is possible if the indicators turn out to be significantly different from expectations. At 14:00 CET an index that measures how many U.S. homes are ready to be sold for July will become available. The forecast for the index is moderately positive. Currently, the US index futures are being traded in a “deep negative” zone, the dollar has also slipped. We believe this is the result of the worsened global political situation. Unconfirmed rumors of Russian army servicemen sittings at Ukraine borders have appeared. The NATO Chief Fogh Rasmussen announced plans for stationing rapid reaction forces along the Russian borders for the first time since the end of the “cold war”. The issue will be on the agenda of the alliance summit of September4-5. Furthermore, the United States declared that Russian hackers may have participated in a cyber assault on five American banks.

The European indexes have dropped for about one percent. The investors are mostly focused on economic news and not on politics. Yesterday the ECB announced it will be taking into account the Friday data on Euro zone inflation for August in discussing the parameters of the monetary policy easing with the aim of preventing deflation. Today at 12:00 CET the consumer price index for Germany will be reported, which may lead to a considerable forecast revision. The index is expected to be neutral, but things happen. The corresponding index for Spain fell to a five-year record low. At 9:00 CET a series of EU business optimism indicators will be released, which are expected to be negative.

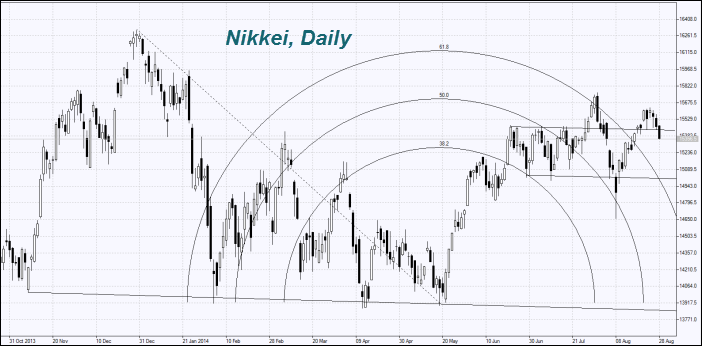

Japan’s Nikkei slid together with other world indexes. The investors don’t want to take any chances before the release of important economic data, which will be reported at 23:30 and 23:50 CET. In our opinion, the initial forecasts are negative, especially in view of weak second quarter GDP data for Japan, reported two weeks ago. As a reminder, the GDP in Japan contracted at 6.8% annual rate. It is the biggest drop since March 2011, when the accident at Fukushima nuclear power plant occurred. It should be noted that today the minimum volume of trades in the last two weeks was recorded at Tokyo stock exchange.

Regarding commodity futures, gold and silver futures advanced considerably due to worsened political situation in Ukraine. The advance was accompanied by an increase in the volume of trade which exceeded the average for the last three months.

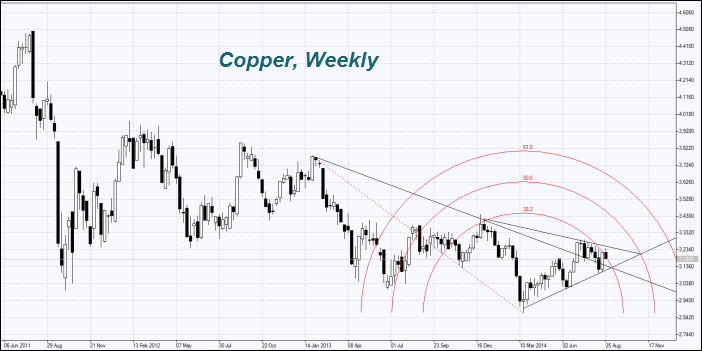

Copper has fallen after news of falling profit growth rates of Chinese manufacturing enterprises to 13.5% in July compared with 17.9% in June. Nevertheless, prices have not fallen yet significantly after Botswana stooped its copper deliveries to ports of Congo due to Ebola epidemic. Before that Zambia and Congo experienced problems with their copper exports. It should be noted that the Ebola epidemic may disrupt cocoa deliveries from Cot d Ivory – the leading world producer which accounts for 37% of world output. Yesterday the cocoa price breached the three year maximum but declined later. Wheat and coffee rose due to drought in Australia and Brasil. The armed conflict in Ukraine also plays a role in the rise of wheat.

News

Iran Secret Overture to the CIA

A day after US and Israeli strikes began raining down on Iranian territory, operatives from Iran Ministry of Intelligence...

Why China Wins When Oil Prices Spike

Key Takeaways The Paradox - China's import dependence doesn't translate to vulnerability The Stockpile Advantage - the 1.13-2M...

Will Gold Keep Rising

Since 2020 gold price climbed more than 230% at the same time central banks started one of the biggest buying waves in decades....

TikTok is Being Gutted for AI Data and Advertisers

TikTok is no longer the company it once was. From a creator centric social hub it turned into a data collecting and selling...

S&P 500 Outlook: Valuations, Real Yields, and the AI Hype

S&P 500, as we all have been saying too many times, is moving mostly because of a small group of very large tech companies...

Crypto Liquidations Domino Effect

Crypto market just went through a sharp sell-off over the weekend Bitcoin briefly fell below key support level before bouncing...

Explore our

Trading Conditions

- Spreads from 0.0 pip

- 30,000+ Trading Instruments

- Stop Out Level - Only 10%

Ready to Trade?

Open AccountSee Also