- Analytics

- Market Overview

Global equities advance buoyed by investor optimism - 21.12.2016

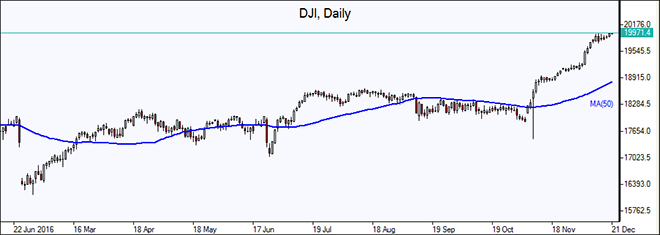

Dow Jones just below the 20000

Dow Jones industrial average closed at a new record high on Tuesday just below the psychologically important 20000 level. The dollar strengthened: the live dollar index data show the ICE US Dollar index, a measure of the dollar’s strength against a basket of six rival currencies, closed 0.14% higher at 103.283. The Dow Jones industrial average gained 0.5% to 19987.63, led by 1.7% advance in Goldman Sachs shares. The S&P 500 rose 0.4% settling at 2270.76 with financial and consumer-discretionary stocks leading the gains. Bank of America shares rose 1%. The Nasdaq index gained 0.5% to 5489.47.

Bank stocks led the broad market advance as investors expect the financial sector will benefit from the rising interest rates and the industry deregulation as part of a deregulation agenda proclaimed by president elect Trump. Trading volume was low with many traders out for holidays. Markets shrugged off attacks in Berlin and Ankara on Monday where twelve people were killed after a truck plowed into crowds at a Christmas market in Berlin, while in Ankara a gunman shot dead the Russian envoy to Turkey. In a third incident in Zurich three people were injured after a shooting at an Islamic center. Today at 13:00 CET Mortgage Applications will be released by the Mortgage Bankers’ Associations in US. At 16:00 CET November Existing Home Sales will be published, the outlook is negative.

Italian government announces bank rescue plan

European stocks closed higher on Tuesday helped by strong gains in bank shares on news Italy’s government is preparing a bailout program for its ailing sector. Both the euro and the British Pound weakened against the dollar with euro hitting nearly fourteen year low. The Stoxx Europe 600 ended 0.5% higher. Germany’s DAX 30 climbed 0.3% to 11464.74. France’s CAC 40 outperformed rising 0.6% and UK’s FTSE 100 index gained 0.4% closing at 7043.96.

The Italian government late Monday confirmed it is preparing for a potential €20 billion rescue package for the country’s struggling banks, including troubled Banca Monte dei Paschi di Siena SpA . Unione di Banche Italiane shares rallied 5.8%, Banco Popolare jumped 4.3% but Banca Monte dei Paschi di Siena ended 0.4% lower. Economic data were positive as the euro-zone’s current-account surplus in October widened to 32.8 billion from 32.2billion in September, and producer prices in Germany rose 0.1% in November year-over-year, instead of an expected 0.2% fall. Today at 10:30 CET Public Sector Net Borrowing for November will be published in UK, the outlook is negative for Pound. At 16:00 CET advanced Consumer Confidence for December will be published in euro-zone, the outlook is neutral for euro.

Asian markets follow Wall Street’s lead

Asian stocks are mostly up today with investor confidence buoyed by continued Wall Street rally. Nikkei ended 0.3% lower today at 19444.49 as traders booked gains after the index hit more than one-year highs earlier with yen advancing against the dollar. Chinese stocks are advancing with investors cautious about the impact of heavy capital outflows and traditional year-end cash deficit. The Shanghai Composite Index is 1.1% higher and Hong Kong’s Hang Seng index is up 0.7%. Australia’s All Ordinaries Index rose 0.4% with Australian dollar little changed against the dollar.

Oil prices rise on expectations of US crude draw

Oil futures prices are edging higher today as traders are waiting for the Energy Information Administration report on US crude oil inventories. Prices ended higher yesterday on expectations US inventories fell last week. The American Petroleum Institute reported late Tuesday a larger than expected drawdown of 4.2 million barrels in US crude oil supplies. February Brent crude, the global oil benchmark, rose 0.8% to $55.35 a barrel on London’s ICE Futures exchange yesterday. At 16:30 CET today Crude Oil Inventories will be released by the Energy Information Administration.

Gold outlook bearish

Gold prices are edging higher today after a decline on Tuesday as the ICE US dollar index continued to inch higher toward a fourteen year high following Federal Reserve’s decision to hike rates 0.25 percentage points last Wednesday. Despite the recent weakness gold is on track for first yearly gain since 2012, roughly 6%. However with the Federal Reserve indicating a faster than previously anticipated pace of further rate hikes in 2017, the outlook for gold is bearish. Among other precious metals, platinum is 0.14% lower at $919.10 an ounce after adding 0.55% the previous day. Silver is up 0.27% to $16.08 an ounce following 0.8% gain in the previous session.

News

Crypto Liquidations Domino Effect

Crypto market just went through a sharp sell-off over the weekend Bitcoin briefly fell below key support level before bouncing...

Paramount Skydance is After CNN

Paramount Skydance is going after Warner Bros. Discovery. They’ve filed a lawsuit in Delaware and are getting ready to...

GM and Ford Are Pulling Back From EVs

General Motors and Ford are quietly stepping back from the aggressive EV plans they were pushing just a few years ago. This...

PayPal Partners with OpenAI and Applies to Become a Bank

PayPal has been under a lot of pressure for a while now: there was a rising doubt if paypal can even still compete with Apple...

The Road to Hell is Paved with Good Intentions: 10% Credit Card Interest Rate Cap

As of January 2026, there is a proposal to cap credit card interest rates at 10% nationwide. The idea is to help Americans...

Iran Currency Collapse and BRICS Stress Test

So, here is what we have; Iranian Rial basically collapsed in early 2026. And it’s happening because the currency is failing,...

Explore our

Trading Conditions

- Spreads from 0.0 pip

- 30,000+ Trading Instruments

- Stop Out Level - Only 10%

Ready to Trade?

Open AccountSee Also