- Analytics

- Market Overview

Markets open after Christmas holiday - 27.12.2016

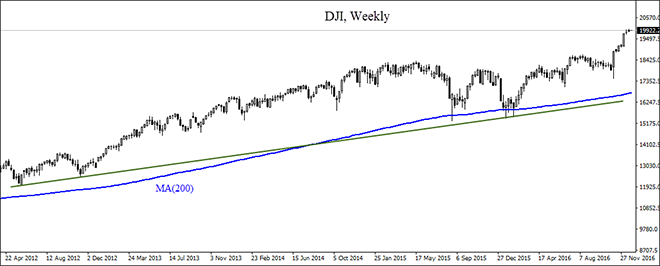

Dollar resumes rise

US stock market was closed on Monday for Christmas holiday. Stocks finished higher on Friday with the Dow Jones industrial average gaining over 14% for the year. The S&P 500 index ended below its closing record at 2263.79, up nearly 11% year to date. The dollar weakened: the live dollar index data show the ICE US Dollar index, a measure of the dollar’s strength against a basket of six rival currencies, slipped 0.09% to 102.942. The Nasdaq index rose 9% on week.

The dollar inched lower as investors were reluctant to continue buying the dollar after its recent rally on expectations of improved US growth following president-elect Trump’s proclaimed support for tax cuts and big infrastructure projects. Trading was thin with many investors away for public holidays. The dollar has resumed the rise after two day pause supported by expansionary policy expectations today. At 15:00 CET the S&P/Case-Shiller US Home Price Index will be released, the outlook is negative for dollar. At 16:00 CET the Conference Board will publish the December Consumer Confidence index, the outlook is positive..

ECB says Italian Banca Monte dei Paschi may need a €8.8 billion capital increase

European stock markets reopen today after Christmas holiday on Monday. The Stoxx Europe 600 index ended marginally lower for the week amid lower trading volume as investors prepared for the Christmas holiday. The euro inched higher against the dollar and the British Pound weakened on Monday in thin trading. The European Central Bank said yesterday Italian lender Banca Monte dei Paschi di Siena may need a capital increase of as much as $8.8 billion euros ($9.2 billion) based on results of a recent stress test. The world’s oldest lender said last Thursday it failed to raise €5 billion to recapitalize and the Italian government on Friday approved a €20 billion fund to aid the country’s banks and particularly rescue Banca Monte dei Paschi. The bank’s shares were suspended for trading on Friday by the Italian market regulator. No important economic data are expected today in euro-zone.

Japan’s consumer prices and spending slump in November

Asian stocks are mixed today in thin trading. Nikkei ended 0.03% higher at 19403.06 as yen edged lower against the dollar. Data indicated that core consumer prices fell 0.6% in December from a year earlier, the ninth straight month of annual declines and household spending slumped in November. Chinese stocks are edging lower with the Shanghai Composite Index down 0.2% and Hong Kong’s Hang Seng index lower 0.3% The mainland's industrial sector profit growth was stronger in November, suggesting the economy was improving, but growth was mainly due to a rebound in the prices for oil products and iron and steel. Australia’s All Ordinaries Index is 0.3% lower on a stronger Australian dollar.

Oil prices steady

Oil futures prices are steady today as traders are waiting to see how the major oil procures will fulfill their agreement on output cut. Oil markets were closed on Monday after Christmas at the weekend. On January 1 comes into force the agreement by the Organization of Petroleum Exporting Countries and non-OPEC members to lower production by almost 1.8 million barrels per day. Meanwhile Russia's Deputy Energy Minister said yesterday country’s oil exports would rise by almost 5% this year to 253.5 million tonnes and a "slight" increase was expected next year. Russia is among the non-OPEC countries who signed up to the production cut deal agreed with OPEC.

News

Crypto Liquidations Domino Effect

Crypto market just went through a sharp sell-off over the weekend Bitcoin briefly fell below key support level before bouncing...

Paramount Skydance is After CNN

Paramount Skydance is going after Warner Bros. Discovery. They’ve filed a lawsuit in Delaware and are getting ready to...

GM and Ford Are Pulling Back From EVs

General Motors and Ford are quietly stepping back from the aggressive EV plans they were pushing just a few years ago. This...

PayPal Partners with OpenAI and Applies to Become a Bank

PayPal has been under a lot of pressure for a while now: there was a rising doubt if paypal can even still compete with Apple...

The Road to Hell is Paved with Good Intentions: 10% Credit Card Interest Rate Cap

As of January 2026, there is a proposal to cap credit card interest rates at 10% nationwide. The idea is to help Americans...

Iran Currency Collapse and BRICS Stress Test

So, here is what we have; Iranian Rial basically collapsed in early 2026. And it’s happening because the currency is failing,...

Explore our

Trading Conditions

- Spreads from 0.0 pip

- 30,000+ Trading Instruments

- Stop Out Level - Only 10%

Ready to Trade?

Open AccountSee Also