- Analytics

- Market Overview

The U.S. Dollar Index rose due to good macroeconomic data - 22.4.2014

On Monday, the U.S. Dollar Index (USDIDX) rose due to good macroeconomic data in the U.S.. The Leading indicator for March rose by 0.8%. This is more than the preliminary forecasts. Technically the U.S. Dollar Index has been closing positively for seven consecutive days. Meanwhile, according to the Commission Commodity Futures Trading (CFTC), the net short on the USD has been formed last week for the first time since October. Today at 14-00 CET, we will see the Real Estate market data from the United States for March, as well as the manufacturing index from the Federal Reserve Bank of Richmond in April. The overall prognosis is positive in our opinion.

At 15-00 CET, we will see the EZ Consumer Confidence index for April. According to forecasts, it may have the highest value of the last six years. It is difficult to say yet, which data will influence the market stronger and where the Euro vs. the U.S. Dollar will move at the session. The Euro is rising in the morning. In our opinion, the neutral trend may continue, as market participants await further clarification on the possible ECB monetary emission. The ECB President, Mario Draghi is going to speak in Amsterdam on Thursday. He said earlier that the excessive growth of the Euro (EURUSD) can be a trigger to start easing the monetary policy. These words provoked the Euro weakening. Now some investors expect a similar reaction of the market and they are not in a hurry to buy the single currency.

The former Japanese Deputy Minister of Finance, Eisuke Sakakibara, known as "Mr. Yen", said that the Yen is more likely to move towards 110 Yen (USDJPY) per Dollar than to 100. Tomorrow morning at 1-25 CET we will observe the speech by the Deputy Head of the Bank of Japan, Hiroshi Nakaso.

The Australian Dollar (AUDUSD) rose (growth on the chart) due to the good Leading indicator data for February, which was released early this morning. Tomorrow, at 2-30 CET, we will see the important macroeconomic inflation data from Australia for the first quarter. It is expected to grow that increases the likelihood of raising the interest rates and may contribute to further strengthening of the Australian Dollar. Recall that the Reserve Bank of Australia set a range of acceptable inflation rate at 2%-3%.

This week will bring the important economic information from Canada. Today at 13-30 CET, we will see the wholesale trade data in February and the retail trade on Wednesday. In our opinion, the preliminary forecasts are more negative (in favor of growth on the chart) for the Canadian Dollar (USDCAD).

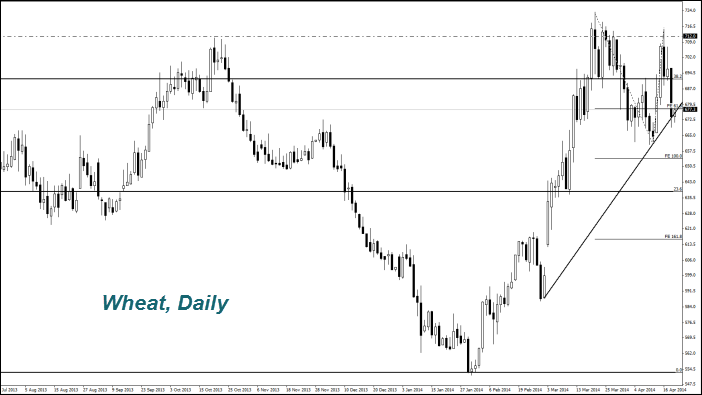

Yesterday's drop in the Wheat price appeared to be the highest since the beginning of the year. Mainly, it was due to the rainy weather in the U.S., Germany, France and Russia. Market participants expect that the rain will continue for five days. In this regard, we can count on a higher yield. The weather conditions rating (good-to-excellent) for the Wheat, which is calculated by the USDA (USDA), has not been changed for a week and stayed at 34%.

The Corn price decrease was less significant, since its planting in the U.S. has been slower than expected. According to the USDA, the 6% of the area under maize were sown on April 20th, while market participants expected 9%. There was the 14% of the area planted last year at the same date.

News

Trader Makes $410,000 Betting on Maduro’s Removal

An unknown slick trader made $410,000 in profit by betting that Venezuelan President Nicolas Maduro would be ousted (kidnapped...

Stablecoin Supercycle - A Threat to Traditional Banking

The rise of stablecoins could change how global finance works. What started as a market worth about $200 billion is expected...

The 2026 Rate Trap

The Federal Reserve just cut interest rates for the third time, bringing them to a range of 3.50% - 3.75%. However, investors...

AI That Steals Faster Than You Can Audit

The era of manual auditing in DeFi is ending. GPT-5 and Claude's can autonomously identify and exploit vulnerabilities in...

Oil Stocks and OPEC’s Credibility Problem

At the end of November, OPEC announced it would keep oil production flat through the first quarter of 2026. Historically,...

JPMorgan Data Fees And Why Europe’s PSD2 Got It Right

When Bloomberg and Reuters reported that JPMorgan Chase plans to charge fintech companies for access to customer bank-account...

Explore our

Trading Conditions

- Spreads from 0.0 pip

- 30,000+ Trading Instruments

- Stop Out Level - Only 10%

Ready to Trade?

Open AccountSee Also