- Analytics

- Market Overview

US stocks rise posting monthly gains - 2.10.2017

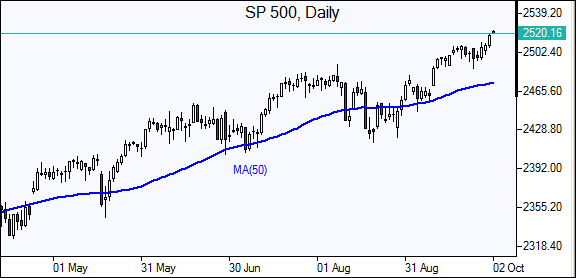

SP 500 and Nasdaq end at record highs

US stocks closed at record high on Friday with three main indexes posting monthly gains. The dollar weakened: the live dollar index data show the ICE US Dollar index, a measure of the dollar’s strength against a basket of six rival currencies, inched down 0.1% to 93.048. S&P 500 rose 0.4% to all time high 2519.36. Dow Jones industrial average finished 0.1% higher at 22405.09. The Nasdaq composite index outperformed jumping 0.7 % to record high 6495.96.

European stocks advance led by bank shares

European stocks advanced on Friday on positive data. The euro extended gains against the dollar while British Pound slipped. The Stoxx Europe 600 index ended the session up 0.5% led by bank stocks. The DAX 30 jumped 1% to 12828.86 helped by job market report showing unemployment in Germany fell to a record low 5.6% in September. France’s CAC 40 ended 0.7% higher despite unexpected 0.3% decline in consumer spending in August and UK’s FTSE 100 rose 0.7% to 7372.76 while second quarter GDP was downgraded to 1.5% from 1.7%. Indices opened 0.1% - 0.3% higher today.

Asian markets up on strong Chinese data

Asian stock indices are higher today on strong economic data from China. Nikkei added 0.2% to 20400.78 today as dollar advanced against the yen supporting exporter stocks and “tankan” survey showed big domestic manufacturers sentiment reached a decade high. Chinese industrial activity survey indicated official manufacturing purchasing managers index increased to 52.4 in September its highest level since May 2012, from 51.7 in August. Markets in China are closed for a weeklong holiday, which will likely negatively affect trading in commodity markets. Australia’s All Ordinaries Index is up 0.8% supported by a weaker Australian dollar against the greenback.

Oil lower

Oil futures prices are falling today in light of a Reuters report of higher OPEC crude oil output in September. Oil output from the Organization of Petroleum Exporting Countries rose 50 thousand barrels per day last month, according to a Reuters survey. November Brent ended 0.2% higher at $57.54 a barrel on Friday, gaining 1.1% for the week.

News

Oil Stocks and OPEC’s Credibility Problem

At the end of November, OPEC announced it would keep oil production flat through the first quarter of 2026. Historically,...

JPMorgan Data Fees And Why Europe’s PSD2 Got It Right

When Bloomberg and Reuters reported that JPMorgan Chase plans to charge fintech companies for access to customer bank-account...

DOGE Shutdown

Elon Musk and Donald Trump nicely leveraged public ignorance around the Department of Government Efficiency (DOGE) and Dogecoin...

Copper Price Analysis

Copper, often referred to as the metal of civilization, plays a pivotal role in various industries, including construction,...

Soybeans Price Analysis - Trends and Drivers

Soybeans have experienced significant price fluctuations over the past decades. From the 1970s through the early 2000s, soybean...

Warren Buffett Adds $521 Million to Chevron

Berkshire Hathaway made one of its biggest stock purchases last quarter, adding nearly $521 million worth of Chevron (CVX)...

Explore our

Trading Conditions

- Spreads from 0.0 pip

- 30,000+ Trading Instruments

- Stop Out Level - Only 10%

Ready to Trade?

Open AccountSee Also