- Analytics

- Technical Analysis

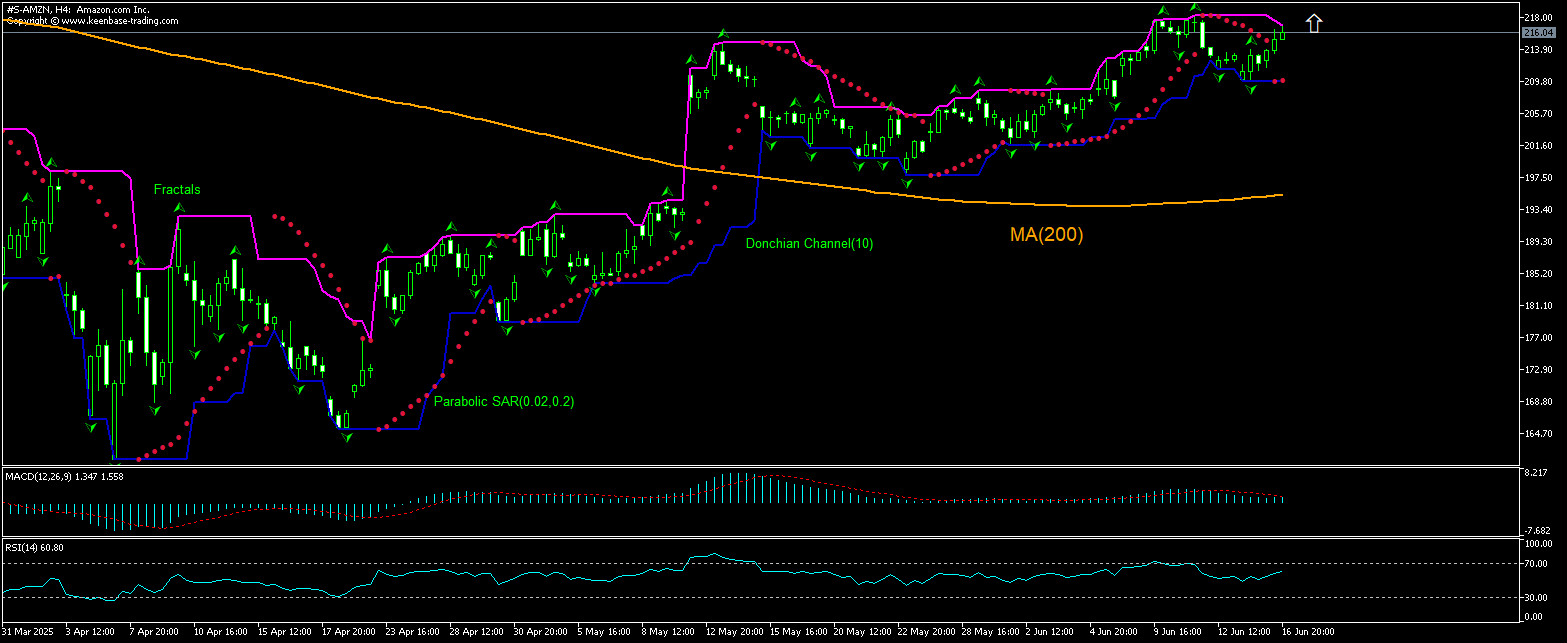

Amazon Technical Analysis - Amazon Trading: 2025-06-17

Amazon Technical Analysis Summary

Above 216.92

Buy Stop

Below 209.74

Stop Loss

| Indicator | Signal |

| RSI | Neutral |

| MACD | Buy |

| Donchian Channel | Sell |

| MA(200) | Buy |

| Fractals | Neutral |

| Parabolic SAR | Buy |

Amazon Chart Analysis

Amazon Technical Analysis

The technical analysis of the AMAZON stock price chart on 4-hour timeframe shows #S-AMZN,H4 is rebounding above the 200-period moving average MA(200) after retracing from 16-month high it hit six days ago. We believe the bullish momentum will continue after the price breaches above the upper boundary of Donchian channel at 216.92. This level can be used as an entry point for placing a pending order to buy. The stop loss can be placed below 209.74. After placing the order, the stop loss is to be moved every day to the next fractal low, following Parabolic indicator signals. Thus, we are changing the expected profit/loss ratio to the breakeven point. If the price meets the stop loss level (209.74) without reaching the order (216.92), we recommend cancelling the order: the market has undergone internal changes which were not taken into account.

Fundamental Analysis of Stocks - Amazon

AMAZON announced its biggest cloud investment. Will the AMAZON stock price advancing continue?

Amazon announced plans to invest AU$20 billion into Australia between 2025 and 2029. The investment will focus on expanding data center infrastructure in Sydney and Melbourne. Amazon also confirmed it will build three new solar farms in Victoria and Queensland to add more than 170 megawatts of clean energy to the grid to support its expanding infrastructure network. The additional capacity will supplement the eight solar and wind projects it already invests in across New South Wales, Victoria and Queensland. With all 11 sites in operation, Amazon expects to generate more than 1.4 million megawatt hours of clean energy annually. The news comes just days after Amazon Web Services (AWS) committed $20 billion to expand cloud computing infrastructure in Pennsylvania, and a further $10 billion commitment for North Carolina. Expanding data center capability enhances Amazon’s AI capabilities which is bullish for company stock price.

Explore our

Trading Conditions

- Spreads from 0.0 pip

- 30,000+ Trading Instruments

- Stop Out Level - Only 10%

Ready to Trade?

Open Account Note:

This overview has an informative and tutorial character and is published for free. All the data, included in the overview, are received from public sources, recognized as more or less reliable. Moreover, there is no guarantee that the indicated information is full and precise. Overviews are not updated. The whole information in each overview, including opinion, indicators, charts and anything else, is provided only for familiarization purposes and is not financial advice or а recommendation. The whole text and its any part, as well as the charts cannot be considered as an offer to make a deal with any asset. IFC Markets and its employees under any circumstances are not liable for any action taken by someone else during or after reading the overview.