- Analytics

- Technical Analysis

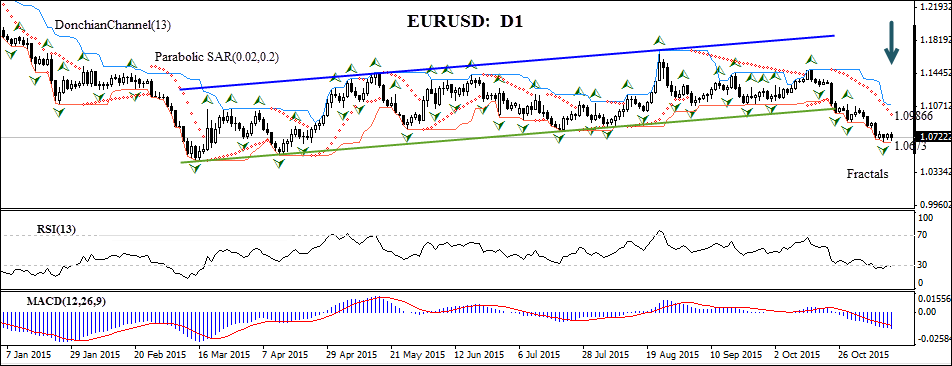

EUR/USD Technical Analysis - EUR/USD Trading: 2015-11-13

ECB monetary policy pressuring euro

Several European Central Bank policy makers recently have expressed readiness to expand the monetary stimulus program to spur inflation up to target 2% level. Euro has been trading with a negative bias as investors anticipate unveiling of additional monetary stimulus by the ECB at its December meeting. Will the euro continue weakening?

The major currency pair EUR/USD has been under pressure recently as several policymakers stated the European Central Bank is considering expanding its quantitative easing program to push inflation back towards its target of near 2%. Reuters reported on Wednesday that the ECB was considering purchasing municipal bonds as part of preparations for the next meeting on December 3. Economic data released on Wednesday provided more evidence that the slowing of emerging market economies is negatively impacting the euro-zone economy: the German exports in the third quarter fell 0.6% from the second quarter. Inflation data on Thursday indicated German consumer prices measured according to common European standards rose 0.2% on the year in October, well below the 2% target rate. And ECB President Draghi’s dovish comment at the European Parliament the same day that the ECB would re-examine its monetary easing policy at its December meeting was interpreted by investors as a hint that the central bank was considering expanding its asset purchases program. On Friday Germany’s statistics office releases preliminary GDP data: 3rd quarter GDP is expected to rise 0.3% on the quarter after 0.4% increase in the second quarter. Euro-zone third quarter GDP is expected to rise 1.7% year over year, following a 1.5% rise in the second quarter. Later in the day US October sales report will be published, with sales growth expected to accelerate to 0.3% month-on-month from 0.1% increase in September. This will support the case for interest rate hike by the Federal Reserve in December, further strengthening the US dollar and pressuring the EUR/USD .

On the daily timeframe EUR/USD fell sharply on October 22 after the ECB President Mario Draghi said the central bank was considering expanding the monetary stimulus program. It has been trading with a negative bias since then, extending declines after strong jobs report on November 6 increased the likelihood of interest rate hike by the Federal Reserve at its December meeting. The Parabolic indicator and MACD have formed a sell signal. The Donchian channel is tilted downward. The RSI oscillator is in the oversold zone. We expect the bearish momentum will continue after the price closes below the lower Donchian channel at 1.0673. A pending order to sell can be placed below that level, and risks can be limited by placing the stop loss above the last fractal high at 1.09866. After pending order placing, the stop loss is to be moved every day to the next fractal high, following Parabolic signals. Thus, we are changing the probable profit/loss ratio to the breakeven point. If the price meets the stop loss level without reaching the order, we recommend cancelling the position: the market sustains internal changes which were not considered.

| Position | Sell |

| Sell stop | below 1.0673 |

| Stop loss | above 1.09866 |

Explore our

Trading Conditions

- Spreads from 0.0 pip

- 30,000+ Trading Instruments

- Stop Out Level - Only 10%

Ready to Trade?

Open Account Note:

This overview has an informative and tutorial character and is published for free. All the data, included in the overview, are received from public sources, recognized as more or less reliable. Moreover, there is no guarantee that the indicated information is full and precise. Overviews are not updated. The whole information in each overview, including opinion, indicators, charts and anything else, is provided only for familiarization purposes and is not financial advice or а recommendation. The whole text and its any part, as well as the charts cannot be considered as an offer to make a deal with any asset. IFC Markets and its employees under any circumstances are not liable for any action taken by someone else during or after reading the overview.