- Analytics

- Market Overview

Equities mixed after rout on new Covid-19 variant scare - 29.11.2021

Todays’ Market Summary

- The Dollar weakening has halted

- Futures on US equity benchmarks are rebounding

- Gold prices are edging up

Top daily news

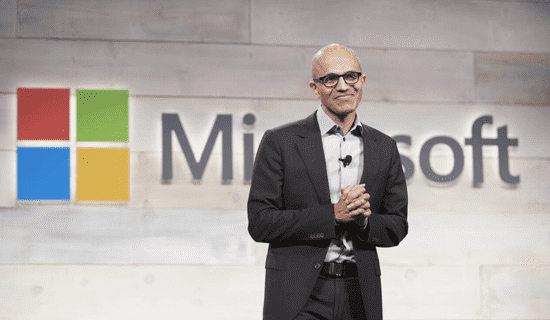

Global stocks are moving in different directions currently as Wall Street closed sharply lower Friday after South Africa announced the discovery of the B.1.1.529 variant of the virus on Thursday. Microsoft shares lost 2.44% amid reports Microsoft CEO Satya Nadella sold about 838.6 thousand shares – over half his Microsoft stock between November 22 and November 23, Tesla shares dropped 3.05% Friday underperforming market after news the EV maker withdrew its application for $1.3 billion in state subsidies support for the construction of a planned battery plant near Berlin, Germany.

Forex news

The Dollar weakening has halted currently. The live dollar index data show the ICE US Dollar index, a measure of the dollar’s strength against a basket of six rival currencies, lost 0.5% on Friday.

GBP/USD joined EUR/USD’s continued climbing Friday as the federal statistics agency Destatis reported the import prices index in Germany accelerated its increase in October when a decline was expected. Both euro and Pound are lower against the Dollar currently. Both AUD/USD and USD/JPY accelerated their retreating Friday with the Australian dollar higher against the Greenback currently and yen lower.

Stock Market news

Futures on US equity benchmarks are rebounding currently with 10-year US treasury yields up at 1.534%. The Wall Street tumbled Friday as investors sold off in shorter than normal session. Dow registered its worst loss of the year: the three main US stock benchmarks recorded daily losses ranging from 2.3% to 2.5%.

European stock indexes are up currently as concerns over tightening restrictive measures after new coronavirus variant emergence subside. Indexes plunged on Friday led by travel and leisure shares. Asian indexes are mostly down today with NIKKEI leading losses as Japan moved to bar entry of foreigners to head off the new strain named Omicron.

Commodity Market news

| Brent Crude Oil | --- | --- | --- |

| Cotton | --- | --- | --- |

Brent is recovering currently amid reports the OPEC producer group may pause output increases. OPEC+ announced it is moving two technical meetings to later this week after oil’s rout last Friday. Prices sank on Friday concerns the new virus variant could dampen fuel demand as it hurts global growth. West Texas Intermediate (WTI) futures plunged 13.1% but is higher currently. Brent crude dropped 11.6% to $72.72 a barrel on Friday.

Gold Market News

| Gold USD | --- | --- | --- |

Gold prices are edging up today. December gold slipped less than 0.1% settling at $1785.50 an ounce on Friday – logging a 3.6% loss for the week.

Crypto

| Bitcoin | --- | --- | --- |

| Ethereum - Dollar USA | --- | --- | --- |

News

JPMorgan Data Fees And Why Europe’s PSD2 Got It Right

When Bloomberg and Reuters reported that JPMorgan Chase plans to charge fintech companies for access to customer bank-account...

DOGE Shutdown

Elon Musk and Donald Trump nicely leveraged public ignorance around the Department of Government Efficiency (DOGE) and Dogecoin...

Copper Price Analysis

Copper, often referred to as the metal of civilization, plays a pivotal role in various industries, including construction,...

Soybeans Price Analysis - Trends and Drivers

Soybeans have experienced significant price fluctuations over the past decades. From the 1970s through the early 2000s, soybean...

Warren Buffett Adds $521 Million to Chevron

Berkshire Hathaway made one of its biggest stock purchases last quarter, adding nearly $521 million worth of Chevron (CVX)...

BTCUSD Analysis: Trump Walked Back Massive Tariffs on China

On Monday, Bitcoin stabilized at $115,000 after last week's sharp selloff, as Trump backed down on his threat to impose massive...

Explore our

Trading Conditions

- Spreads from 0.0 pip

- 30,000+ Trading Instruments

- Stop Out Level - Only 10%

Ready to Trade?

Open AccountSee Also