- Analytics

- Market Overview

World markets kept on rising on Friday - 20.10.2014

World stock markets kept on rising on Friday. It was caused by good quarterly reports of Honeywell (its shares upped 4.3%) and General Electric (+2.4%), and also the US economic data. US New Housing Permits in September outperformed considerably the estimates. A complementary positive factor for the construction industry was the news about the largest American mortgage companies Fannie Mae and Freddie Mac: they are close to reach an agreement that may increase the mortgage loan volume. Michigan Consumer Sentiment Index (MCSI) in October jumped unexpectedly to the highest level since July 2007.

The speech given by the Fed Chair Janet Yellen did not affect financial markets, as it was focused on the widening inequality in the United States, and not on the monetary policy. Despite the positive economic data released on Thursday and Friday, following up the previous week S&P 500 still fell for the fourth consecutive time. It is the longest-running decline since August 2011. The trading volume on Friday was 8.4 billion stocks, the level of monthly average. The US important macroeconomic data is not expected for today. Futures on American stock indices are traded upwards.

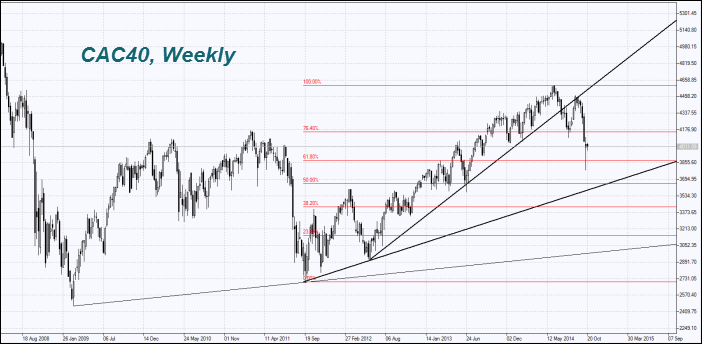

On Friday FTSEurofirst 300 added 2.8%, the highest daily increase since November 2011. Therefore, the EU exchanges reacted to positive US data, which was written about in this overview above. European stock indices have a downward retracement today. We assume that it was facilitated by the reduced estimate of the annual operating profit by 4% submitted by the German producer of business software SAP. The company’s stocks have tumbled 4.6% in the morning. There will be no important macroeconomic data in the EU today. At 11-50 СЕТ the ECB Vice President Vitor Constancio is giving his speech.

Nikkei has risen 4% today, the highest increase since June 2013. The Japanese Government Pension Investment Fund is planning to increase the shares of Japanese companies in its assets ($1.2 trillion) from 12% to 25%. At the same time it would reduce the share of Japanese bonds from 60% to 40%. Earlier, we have repeatedly emphasized that the fund is going to raise the share of local stake in the assets, but the level of 25% surpassed the expectations of market participants. This is what influenced the Nikkei’s boost. Additional positive information was the price growth of such Japanese exporters as Toyota (+5.2%), Honda (+3.5%) and Panasonic (+4.5%) due to the yen weakening (it looks like the rise from the 5-week low on the chart). NEC Corporation (+ 6.5%) published a good earnings report. We would like to note that Nikkei upped amid the domestic political crisis, which may have an impact later. The Prime Minister Shinzo Abe has dismissed several ministers of his cabinet.

Tomorrow early morning at 2-00 СЕТ the important data on the Chinese economy state will be released. This information may affect the prices of commodity futures: Q3 GDP, industrial production and Retail Sales in September. In our opinion, the tentative forecasts are moderately negative.

World oil prices ticked up slightly after the warnings of several investment banks. Moreover, according to Joint Organisations Data Initiative, oil exports from Saudi Arabia in August were cut down for the fourth month in a row to the 3-year low, and it amounted to 6.663 million barrels per day. Crude production fell to 9.597 million barrels per day, from 10.005 millions in July. In theory, Saudi Arabia can provide the production of 12.5 million barrels per day, if necessary. Currently, the country was forced to suspend the oil production (300 thousand barrels per day), due to environmental reasons on the Kuwait joint oil field Khafji.

According to the Commodity Futures Trading Commission, hedge funds increased net long gold contracts for the first time in last nine weeks. Net short silver contracts have risen to the highest level since the early June this year. Market participants are likely to expect a higher demand for gold as compared to silver.

News

JPMorgan Data Fees And Why Europe’s PSD2 Got It Right

When Bloomberg and Reuters reported that JPMorgan Chase plans to charge fintech companies for access to customer bank-account...

DOGE Shutdown

Elon Musk and Donald Trump nicely leveraged public ignorance around the Department of Government Efficiency (DOGE) and Dogecoin...

Copper Price Analysis

Copper, often referred to as the metal of civilization, plays a pivotal role in various industries, including construction,...

Soybeans Price Analysis - Trends and Drivers

Soybeans have experienced significant price fluctuations over the past decades. From the 1970s through the early 2000s, soybean...

Warren Buffett Adds $521 Million to Chevron

Berkshire Hathaway made one of its biggest stock purchases last quarter, adding nearly $521 million worth of Chevron (CVX)...

BTCUSD Analysis: Trump Walked Back Massive Tariffs on China

On Monday, Bitcoin stabilized at $115,000 after last week's sharp selloff, as Trump backed down on his threat to impose massive...

Explore our

Trading Conditions

- Spreads from 0.0 pip

- 30,000+ Trading Instruments

- Stop Out Level - Only 10%

Ready to Trade?

Open AccountSee Also