- Analytics

- Market Overview

Futures point to higher US stocks openings - 12.10.2018

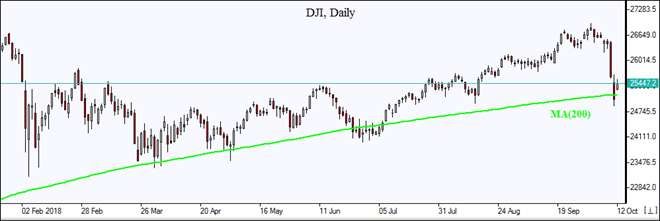

US stocks extend losses

US equities pullback slowed on Thursday after S&P 500 and Dow logged their biggest one-day drop since February. The S&P 500 fell 2.1% to 2728.37 with all of the 11 mains sectors ending lower. Dow Jones industrial average lost 2.1% to 25052.83. The Nasdaq composite slid 1.3% to 7329.06 after dipping briefly into correction territory – declining more than 10% from the most recent 52-week high. The dollar weakening accelerated after data showed lower than expected inflation for September. The live dollar index data show the ICE US Dollar index, a measure of the dollar’s strength against a basket of six rival currencies, fell 0.5% to 95.006 and is lower currently. Futures on stock indices indicate higher openings today.

DAX 30 opens higher than other European indices

European stocks selloff deepened on Thursday as US market pullback continued. The EUR/USD accelerated its gain after the ECB minutes suggested the central bank was on track to normalize its loose monetary policy this year. The GBP/USD continued climbing, both pairs are rising currently. The Stoxx Europe 600 index tumbled 2%. Germany’s DAX 30 dropped 1.5% to 11539.35. France’s CAC 40 slumped fell 1.9% and UK’s FTSE 100 lost 1.9% to 7006.93. Markets opened 0.4% - 1.2% higher today.

Hang Seng leads Asian indices recovery

Asian stock indices are rebounding today after softer than expected US inflation report gave rise to hopes the lower than expected inflation reading may give a pause to Federal Reserve’s push for rate hikes. Nikkei recovered 0.5% to 22694.66 helped also by resumed yen weakness against the dollar. Chinese stocks are rebounding after data indicated China’s September exports surged: the Shanghai Composite Index is 0.9% higher and Hong Kong’s Hang Seng Index is up 1.8%. Australia’s All Ordinaries Index recovered 0.2% while Australian dollar continued edging higher against the greenback.

Brent advances

Brent futures prices are gaining today on signs global equities are rebounding after two day selloff. Prices ended lower yesterday after a report US domestic crude inventories rose sharply last week – 6 million barrels. Brent for December settlement closed 3.4% lower at $80.26 a barrel on Thursday.

Explore our

Trading Conditions

- Spreads from 0.0 pip

- 30,000+ Trading Instruments

- Instant Execution

Ready to Trade?

Open Account