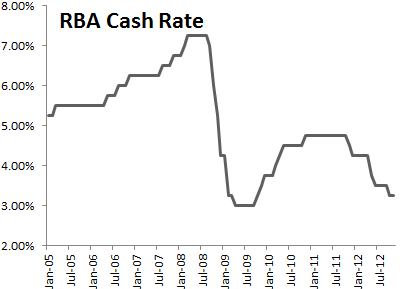

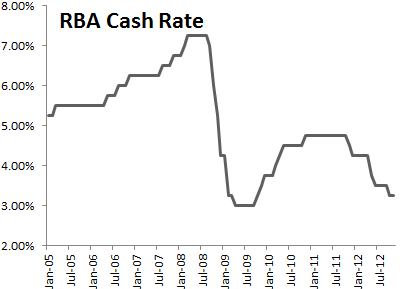

The Aussie moved sharply higher this morning against the US dollar from short-term consolidation at 1.0365 to monthly peak at 1.0436, as the RBA unexpectedly decided to maintain its cash rate at 3.25%. The RBA board saw the monetary policy as appropriate since inflation data are marginally higher than expected and latest info regarding global outlook is slightly more positive according to Glenn Stevens’, Governor’s Statement.

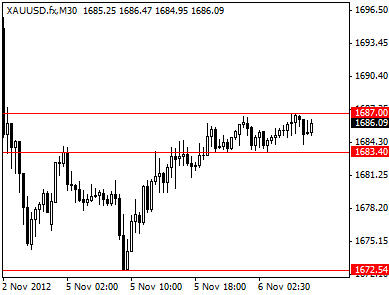

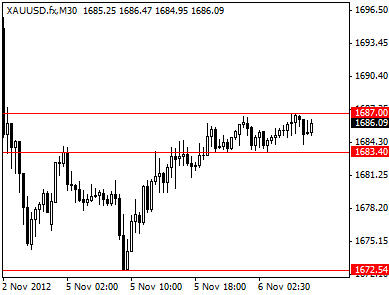

Market participants today are focused on the U.S elections. The outcome of the battle between Obama and Romney will influence regulations, financial taxes and monetary policies in the U.S. Hence, FX currency pairs are in sideways mood anticipating elections news. The USDCHF is consolidating around 0.9440, GBPUSD is trading in the 1.5997/1.5960 range and the precious metal is noticeably into a tight 1687/1683.40 range.

In addition concerns remains for Greece, should the Greek parliament approve new austerity measures tomorrow and unlock troika’s financial aid of €31.5B.