- Analytics

- Market Overview

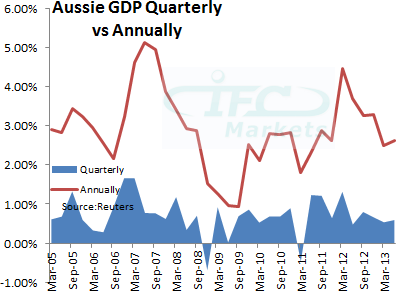

Aussie Gains on Upbeat GDP, USDJPY Capped by Syria and Key 100 Level - 4.9.2013

News

Copper Price Analysis

Copper, often referred to as the metal of civilization, plays a pivotal role in various industries, including construction,...

Soybeans Price Analysis - Trends and Drivers

Soybeans have experienced significant price fluctuations over the past decades. From the 1970s through the early 2000s, soybean...

Warren Buffett Adds $521 Million to Chevron

Berkshire Hathaway made one of its biggest stock purchases last quarter, adding nearly $521 million worth of Chevron (CVX)...

BTCUSD Analysis: Trump Walked Back Massive Tariffs on China

On Monday, Bitcoin stabilized at $115,000 after last week's sharp selloff, as Trump backed down on his threat to impose massive...

Oil Prices Stay Weak After OPEC+ Approves Modest Output Rise

Oil prices ended the week on shaky ground after OPEC+ approved a modest production increase of 137,000 bpd, signaling cautious...

Slowing U.S. Growth Put Spotlight on CPI as EURUSD

Weak PMI data, softening jobs market, and political brouhaha raise the stakes for October’s inflation print. The U.S. government...

Explore our

Trading Conditions

- Spreads from 0.0 pip

- 30,000+ Trading Instruments

- Stop Out Level - Only 10%

Ready to Trade?

Open AccountSee Also