- Analytics

- Market Overview

Investors do not hurry to buy Dollars - 2.4.2014

The U.S. Dollar Index (USDIDX) fell on Tuesday. Currency market participants found the ISM Manufacturing increase not high enough because it was lower than the preliminary forecasts (54 points). Recall that the Fed chief, Janet Yellen noted that her department may extend the QE (monetary emission), unless the unemployment is decreased. Investors are reluctant to buy dollars before the U.S. labor market data release on Friday. Today at 14-15 CET we will see the preliminary U.S. employment review in March from the ADP. At 16-00 CET factory orders for February will strike out. The preliminary forecasts are positive, which can help strengthen the U.S. Dollar. The Japanese Yen (USDJPY) continued to weaken in line with our assumptions. It looks like a growth on the chart. Investors expect further easing of the monetary policy from the Bank of Japan and the negative impact of increasing the sales tax. Tomorrow night at 1-15 and 1-50 CET we will see the important data: PMI’s of business activity and investments in Japanese and foreign assets. In our opinion the projections are neutral, but it should be noted that most of market participants expect the Yen to weaken down to 104-105 vs. the U.S. Dollar at the current stage. The Euro (EURUSD) rose yesterday, as most of market participants do not expect rate cuts by the ECB meeting tomorrow despite the inflation slowdown in March to 0.5%, the lowest level during more than 4 years. An additional positive factor was a slight decrease in the number of unemployed in Germany in March and the PMI manufacturing growth in Italy and Spain. It rose in Spain to the maximum of the last 47 months. Today at 11:00 CET we will find out about the PPI in the Eurozone. We believe that the preliminary forecast is positive for the Euro. The macroeconomic data in Canada on Tuesday were better than expected. This caused the Canadian Dollar strengthening (fall on the USDCAD chart). Investors believe that the PPI growth increases the likelihood of hike in the interest rates. The PMI Manufacturing in March rose more than expected. This was an additional positive factor for the Canadian currency. Recall that the important economic data will be released in Canada tomorrow (Trade Balance) and Friday (Unemployment).

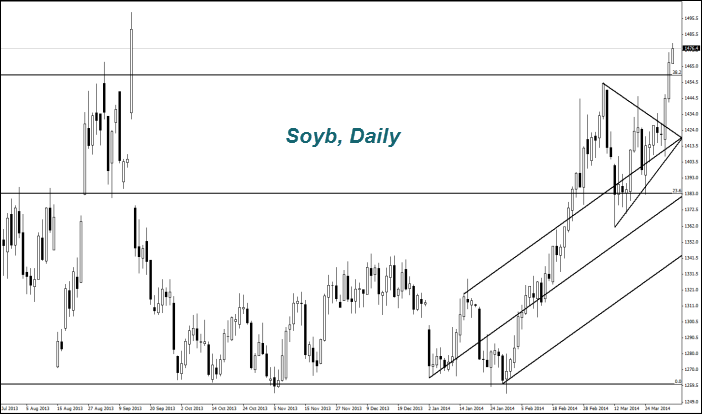

As we expected, the agricultural futures proceeded their movement according to the initial market reaction after the USDA report release. The Soyb and the Corn powerfully rose when the Wheat fell. Brazilian exports increased in March to 6.23 million tons from 2.79 million tons a month earlier, but this did not affect the quotes. But the news of the country contributed to the fall in the Sugar and Coffee prices. Brazil, had the rainy weather established, which reduces the potential crop losses of these cultures observed during the earlier drought. Note that yesterday's drop in the Sugar prices was maximal for a month. In previous reports we have already noted that it is in the medium-term downtrend.

News

GM and Ford Are Pulling Back From EVs

General Motors and Ford are quietly stepping back from the aggressive EV plans they were pushing just a few years ago. This...

PayPal Partners with OpenAI and Applies to Become a Bank

PayPal has been under a lot of pressure for a while now: there was a rising doubt if paypal can even still compete with Apple...

The Road to Hell is Paved with Good Intentions: 10% Credit Card Interest Rate Cap

As of January 2026, there is a proposal to cap credit card interest rates at 10% nationwide. The idea is to help Americans...

Iran Currency Collapse and BRICS Stress Test

So, here is what we have; Iranian Rial basically collapsed in early 2026. And it’s happening because the currency is failing,...

How Big Corporations Legally Avoid the 21% Tax

The U.S. corporate tax rate is officially 21%. In theory, that is what profitable companies are supposed to pay. But in practice,...

Trader Makes $410,000 Betting on Maduro’s Removal

An unknown slick trader made $410,000 in profit by betting that Venezuelan President Nicolas Maduro would be ousted (kidnapped...

Explore our

Trading Conditions

- Spreads from 0.0 pip

- 30,000+ Trading Instruments

- Stop Out Level - Only 10%

Ready to Trade?

Open AccountSee Also