- Analytics

- Market Overview

S&P 500 hits new historical high - 23.7.2014

World stock indices rose on Tuesday. S&P 500 hits a new historical high. The Dollar strengthened against other currencies. Positive macroeconomic data and earnings reports in the Unite States contributed to this fact, as well as the reducing political tension in Ukraine and the Middle East.

A part of the companies (115) listed in S&P 500 has already submitted their reports. Yesterday positive quarterly reports were presented by Apple, Microsoft, Verizon Communications. Their stock price growth was not so significant, but it had a positive impact on the performance of indices. Existing Home Sales for June rose 2.6% till its high since 2007 and amounted to 5.04 million units. Due to this U.S. stocks of construction companies added 1-1.5% on average. The U.S. housing average price rose 4.3% YoY to $223.3 thousand. The June CPI remained at the May level of 2.1% in annual terms. Investors decided that this value is still the best. The Consumer Price Index is almost identical to the Fed target level of 2%. Note that the index increase in June (month to month) slowed down from 0.4% to 0.3% in May. This is a positive trend. Yesterday, the turnover on U.S. stock exchanges was 10% below the average for the month and amounted to 5.05 billion stocks. No important macroeconomic data is expected today in the U.S. Before trading begins the quarterly reports will be announced by such companies, as Boeing, Delta Air Lines, Dow Chemical; and after the trade closing: Facebook.

European stock indices rose along with the American ones on Tuesday, as there was no significant macroeconomic data in the EU. Now they continue to rise due to good reporting of such European companies like Daimler, Actelion Ltd., ARM Holdings and others. No significant macroeconomic statistics is expected today in the EU and the U.S. Quarterly reports of 15 companies listed in Stoxx Europe 600 will be released.

Nikkei continues to have active fluctuations at the neutral trend under the influence of external factors. Tonight at 23-50 CET the data on Japanese foreign trade for June is coming out, and Purchasing Managers Index (PMI) for July respectively. In our opinion, their forecasts are positive for Nikkei.

Corn and soybean continued to fall in price this week, after the U.S. Department of Agriculture (USDA) raised its rating on their crops up to 76% and 73% on the category of "good-to-excellent", respectively. This is the maximum value for corn since 2004, and for soybean since 1994. Meanwhile, last week China bought unexpectedly 2 million tons of this year grain crops. In this regard, some market participants expect the rising price correction on grain futures.

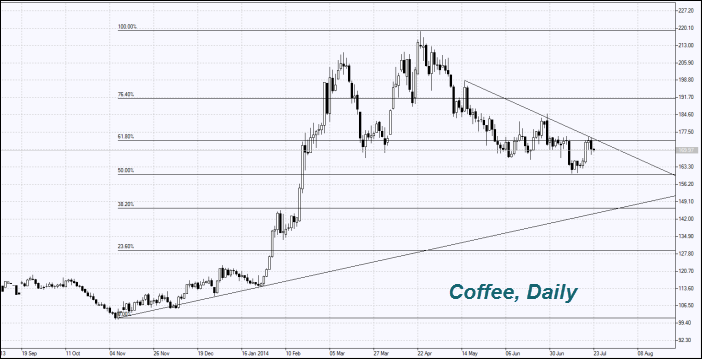

Coffee prices dropped slightly. By the mid-July 74% of the coffee harvest versus 56% last year was collected in Brazil, as reported by the Brazilian company Safras e Mercado. Thus, 30% of the total crop is already sold vs. 23% a year earlier. In theory, reduced coffee prices may be short-termed, as meteorologists expect rainy weather during which harvesting is suspended.

Beef prices increased significantly to almost recent highs. The volume of cattle slaughter in July fell 6.8% compared with the same period in 2013, according to USDA report. The number of cows in the United States is now at the lowest level since 1951. Meanwhile, it would take 22 months to raise a cow to a slaughter weight. Thereby, it is unlikely to succeed in a rapid increase of beef production. Such considerations have contributed to higher prices for different kinds of cattle meat from 26% to 32% since the beginning of 2014.

Reuters has conducted a poll, according to which this year average gold price amounts to $1277 an ounce and silver - $20.2. This is below the current market price. Note that the precious metals are not getting cheaper now, as it usually happens in terms of the dollar strengthening and the stock market growth. In our opinion, this indicates an increase in real demand for them. For this reason, the forecasts may not come true. Moreover, the gold/silver ratio looks underestimated in terms of the silver cost, according to the forecasts. This can be explained by expectations of reduction of silver use in the industry and its extraction growth this year.

News

JPMorgan Data Fees And Why Europe’s PSD2 Got It Right

When Bloomberg and Reuters reported that JPMorgan Chase plans to charge fintech companies for access to customer bank-account...

DOGE Shutdown

Elon Musk and Donald Trump nicely leveraged public ignorance around the Department of Government Efficiency (DOGE) and Dogecoin...

Copper Price Analysis

Copper, often referred to as the metal of civilization, plays a pivotal role in various industries, including construction,...

Soybeans Price Analysis - Trends and Drivers

Soybeans have experienced significant price fluctuations over the past decades. From the 1970s through the early 2000s, soybean...

Warren Buffett Adds $521 Million to Chevron

Berkshire Hathaway made one of its biggest stock purchases last quarter, adding nearly $521 million worth of Chevron (CVX)...

BTCUSD Analysis: Trump Walked Back Massive Tariffs on China

On Monday, Bitcoin stabilized at $115,000 after last week's sharp selloff, as Trump backed down on his threat to impose massive...

Explore our

Trading Conditions

- Spreads from 0.0 pip

- 30,000+ Trading Instruments

- Stop Out Level - Only 10%

Ready to Trade?

Open AccountSee Also